We use cookies to understand how you use our site and to improve your experience. This includes personalizing content and advertising. To learn more, click here. By continuing to use our site, you accept our use of cookies, revised Privacy Policy and Terms of Service.

You are being directed to ZacksTrade, a division of LBMZ Securities and licensed broker-dealer. ZacksTrade and Zacks.com are separate companies. The web link between the two companies is not a solicitation or offer to invest in a particular security or type of security. ZacksTrade does not endorse or adopt any particular investment strategy, any analyst opinion/rating/report or any approach to evaluating individual securities.

If you wish to go to ZacksTrade, click OK. If you do not, click Cancel.

Nordstrom (JWN) Buys a Minority Stake in ASOS's Four Brands

Read MoreHide Full Article

Nordstrom, Inc. (JWN - Free Report) has bought a minority stake in the Topshop, Topman, Miss Selfridge and HIIT brands owned by ASOS, a UK-based online fashion company. By investing in these apparel brands, the Seattle-based retailer looks to target younger customers.

Apart from bolstering growth for the brands globally, the department store chain with more than 350 physical outlets will be sole brick-and-mortar presence worldwide for these brands. This strategic collaboration redefines the traditional retail/wholesale model. However, financial terms of the deal were under wraps.

Per the latest strategic agreement, Nordstrom will boast the exclusive multi-channel retail rights for Topshop and Topman brands across North America including Canada and also own a minority stake, globally. In fact, the fashion retailer has been the exclusive distributor of Topshop and Topman labels in the United States since 2012. Meanwhile, ASOS will continue to retain the operational and creative control of the Topshop brands.

Through the aforesaid alliance, Nordstrom and ASOS aim at leveraging the complementary retail models to boost shoppers’ confidence in becoming whoever they want to be. Shoppers will be able to receive Asos.com orders at Nordstrom and Nordstrom Rack stores this fall.

Moving ahead, the companies look to build a multi-channel showcase for a handful of ASOS brands for customers. Thus, management at Nordstrom remains quite impressed with the investment in such iconic brands, through which it expects to innovate for enriching shoppers’ experience.

What’s More?

Nordstrom is focused on fueling growth in the technology space by enhancing e-commerce and digital networks, and improving supply-chain network and marketing efforts. The Nordstrom and Nordstrom Rack apps remain key drivers of customer engagement.

During first-quarter fiscal 2021, digital sales advanced 23% year over year and 28% from the number recorded in the first quarter of fiscal 2019. Digital sales represented nearly 46% of net sales in the same quarter while digital penetration improved 15 percentage points on a two-year basis. Mobile customers including app users constituted about 75% of the total digital traffic and two-thirds of total digital sales in the fiscal first quarter.

Nordstrom’s customer-based strategy focusing on leveraging its brand strength, providing excellent services and offering compelling products to customers looks appealing. The company concentrates on developing its market strategy to cash in on its digital-first platform to better serve customers and gain a decent market share to deliver profits.

Deepened focus on distribution capabilities along with improved connectivity of physical and digital inventory are likely to constantly aid Nordstrom Rack sales. Management envisions the company’s digital unit to account for 50% of its total sales.

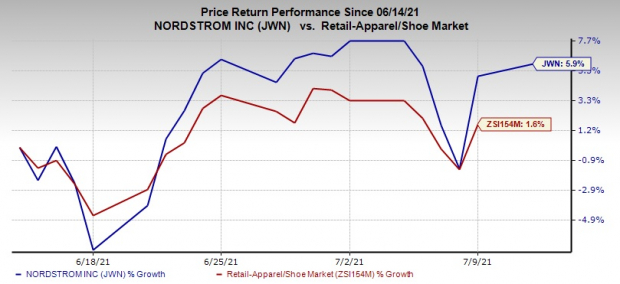

Image Source: Zacks Investment Research

Over the past month, this currently Zacks Rank #3 (Hold) company’s shares have gained 5.9% while the industry has merely inched up 1.6%.

Image: Bigstock

Nordstrom (JWN) Buys a Minority Stake in ASOS's Four Brands

Nordstrom, Inc. (JWN - Free Report) has bought a minority stake in the Topshop, Topman, Miss Selfridge and HIIT brands owned by ASOS, a UK-based online fashion company. By investing in these apparel brands, the Seattle-based retailer looks to target younger customers.

Apart from bolstering growth for the brands globally, the department store chain with more than 350 physical outlets will be sole brick-and-mortar presence worldwide for these brands. This strategic collaboration redefines the traditional retail/wholesale model. However, financial terms of the deal were under wraps.

Per the latest strategic agreement, Nordstrom will boast the exclusive multi-channel retail rights for Topshop and Topman brands across North America including Canada and also own a minority stake, globally. In fact, the fashion retailer has been the exclusive distributor of Topshop and Topman labels in the United States since 2012. Meanwhile, ASOS will continue to retain the operational and creative control of the Topshop brands.

Through the aforesaid alliance, Nordstrom and ASOS aim at leveraging the complementary retail models to boost shoppers’ confidence in becoming whoever they want to be. Shoppers will be able to receive Asos.com orders at Nordstrom and Nordstrom Rack stores this fall.

Moving ahead, the companies look to build a multi-channel showcase for a handful of ASOS brands for customers. Thus, management at Nordstrom remains quite impressed with the investment in such iconic brands, through which it expects to innovate for enriching shoppers’ experience.

What’s More?

Nordstrom is focused on fueling growth in the technology space by enhancing e-commerce and digital networks, and improving supply-chain network and marketing efforts. The Nordstrom and Nordstrom Rack apps remain key drivers of customer engagement.

During first-quarter fiscal 2021, digital sales advanced 23% year over year and 28% from the number recorded in the first quarter of fiscal 2019. Digital sales represented nearly 46% of net sales in the same quarter while digital penetration improved 15 percentage points on a two-year basis. Mobile customers including app users constituted about 75% of the total digital traffic and two-thirds of total digital sales in the fiscal first quarter.

Nordstrom’s customer-based strategy focusing on leveraging its brand strength, providing excellent services and offering compelling products to customers looks appealing. The company concentrates on developing its market strategy to cash in on its digital-first platform to better serve customers and gain a decent market share to deliver profits.

Deepened focus on distribution capabilities along with improved connectivity of physical and digital inventory are likely to constantly aid Nordstrom Rack sales. Management envisions the company’s digital unit to account for 50% of its total sales.

Image Source: Zacks Investment Research

Over the past month, this currently Zacks Rank #3 (Hold) company’s shares have gained 5.9% while the industry has merely inched up 1.6%.

Hot Retail Stocks to Consider

Abercrombie & Fitch (ANF - Free Report) has a long-term earnings growth rate of 18% and a Zacks Rank #1 (Strong Buy), currently. You can see the complete list of today’s Zacks #1 Rank stocks here.

Boot Barn (BOOT - Free Report) , presently a Zacks #1 Ranked stock, has a trailing four-quarter earnings surprise of 51.7%, on average.

L Brands has a long-term earnings growth rate of 13% and a Zacks Rank of 1, presently.