The Zacks Retail and Wholesale Sector has fallen on tough times in 2022 as costs soar, down nearly 30% and widely lagging behind the general market.

Image Source: Zacks Investment Research

A stock that gained widespread popularity this year during the meme-stock resurgence, Bed Bath & Beyond , is on deck to unveil Q2 earnings on September 29th before the market open.

Bed Bath & Beyond is a leading omnichannel retailer offering top-quality and differentiated products, services, and solutions.

Currently, the company carries a Zacks Rank #3 (Hold) with an overall VGM Score of a D.

How does everything stack up heading into the print? Let’s take a closer look.

Share Performance & Valuation

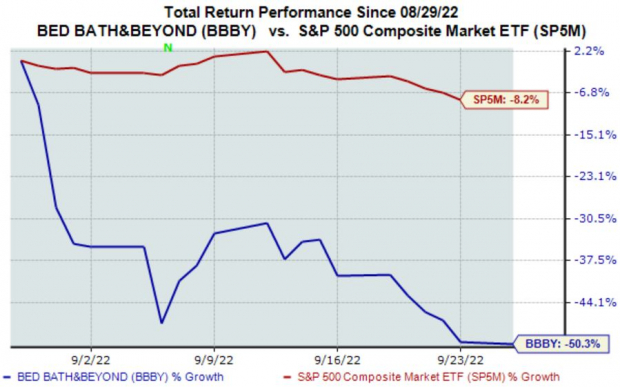

It’s been a wild ride for BBBY shares in 2022, as shown in the chart below. Still, shares have lost more than 50% in value and have widely underperformed the general market overall.

Image Source: Zacks Investment Research

Over the last month, the adverse price action of BBBY shares is undeniable – down 50%, the share performance doesn’t even come close to the S&P 500’s performance.

Image Source: Zacks Investment Research

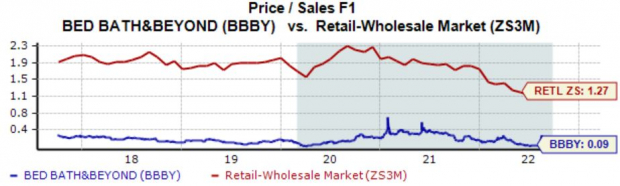

The company’s forward price-to-sales ratio resides at 0.09X, well beneath its Zacks Retail and Wholesale Sector average. Still, the company carries a Style Score of a D for Value.

Image Source: Zacks Investment Research

Quarterly Estimates

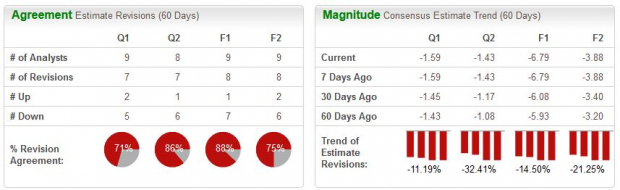

Analysts have been bearish for the quarter to be reported, with five downwards earnings estimate revisions hitting the tape over the last 60 days. The Zacks Consensus EPS Estimate of -$1.59 pencils in a quad-digit percentage drop-off in quarterly earnings Y/Y.

Image Source: Zacks Investment Research

The company’s top line is also undergoing turbulence – the Zacks Consensus Sales estimate of $1.4 billion indicates a Y/Y revenue decline of nearly 30%.

Quarterly Performance & Market Reactions

BBBY’s earnings track record leaves much to be desired – the company has posted back-to-back bottom-line misses, both in excess of 110%.

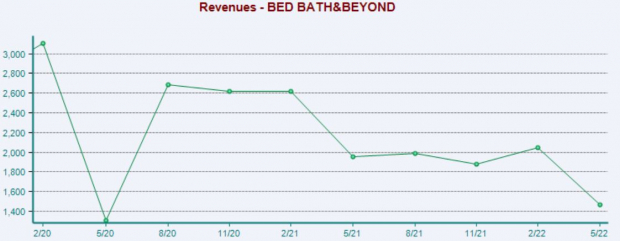

Revenue has also primarily missed expectations; BBBY has missed on the top line in four consecutive quarters. Below is a chart illustrating the company’s revenue on a quarterly basis.

Image Source: Zacks Investment Research

Day traders should be aware that shares have moved downwards following back-to-back quarterly releases.

Putting Everything Together

The meme-stock resurgence put BBBY shares in the full spotlight, but that has since ended. Down more than 50% YTD, the adverse price action of shares tells us how tight of grip sellers have had.

Shares could be considered overvalued, further bolstered by its Style Score of a D for Value.

Analysts have been bearish in their quarterly earnings outlook, and estimates indicate a steep Y/Y decline in both revenue and earnings.

The company has struggled to exceed quarterly estimates as of late, and the market hasn’t reacted favorably following its last two prints.

Heading into the release, Bed Bath & Beyond carries a Zacks Rank #3 (Hold) with an Earnings ESP Score of -4.8%.

Image: Bigstock

Bed Bath & Beyond Q2 Preview: Rebound Quarter Inbound?

The Zacks Retail and Wholesale Sector has fallen on tough times in 2022 as costs soar, down nearly 30% and widely lagging behind the general market.

Image Source: Zacks Investment Research

A stock that gained widespread popularity this year during the meme-stock resurgence, Bed Bath & Beyond , is on deck to unveil Q2 earnings on September 29th before the market open.

Bed Bath & Beyond is a leading omnichannel retailer offering top-quality and differentiated products, services, and solutions.

Currently, the company carries a Zacks Rank #3 (Hold) with an overall VGM Score of a D.

How does everything stack up heading into the print? Let’s take a closer look.

Share Performance & Valuation

It’s been a wild ride for BBBY shares in 2022, as shown in the chart below. Still, shares have lost more than 50% in value and have widely underperformed the general market overall.

Image Source: Zacks Investment Research

Over the last month, the adverse price action of BBBY shares is undeniable – down 50%, the share performance doesn’t even come close to the S&P 500’s performance.

Image Source: Zacks Investment Research

The company’s forward price-to-sales ratio resides at 0.09X, well beneath its Zacks Retail and Wholesale Sector average. Still, the company carries a Style Score of a D for Value.

Image Source: Zacks Investment Research

Quarterly Estimates

Analysts have been bearish for the quarter to be reported, with five downwards earnings estimate revisions hitting the tape over the last 60 days. The Zacks Consensus EPS Estimate of -$1.59 pencils in a quad-digit percentage drop-off in quarterly earnings Y/Y.

Image Source: Zacks Investment Research

The company’s top line is also undergoing turbulence – the Zacks Consensus Sales estimate of $1.4 billion indicates a Y/Y revenue decline of nearly 30%.

Quarterly Performance & Market Reactions

BBBY’s earnings track record leaves much to be desired – the company has posted back-to-back bottom-line misses, both in excess of 110%.

Revenue has also primarily missed expectations; BBBY has missed on the top line in four consecutive quarters. Below is a chart illustrating the company’s revenue on a quarterly basis.

Image Source: Zacks Investment Research

Day traders should be aware that shares have moved downwards following back-to-back quarterly releases.

Putting Everything Together

The meme-stock resurgence put BBBY shares in the full spotlight, but that has since ended. Down more than 50% YTD, the adverse price action of shares tells us how tight of grip sellers have had.

Shares could be considered overvalued, further bolstered by its Style Score of a D for Value.

Analysts have been bearish in their quarterly earnings outlook, and estimates indicate a steep Y/Y decline in both revenue and earnings.

The company has struggled to exceed quarterly estimates as of late, and the market hasn’t reacted favorably following its last two prints.

Heading into the release, Bed Bath & Beyond carries a Zacks Rank #3 (Hold) with an Earnings ESP Score of -4.8%.