The Zacks Retail and Wholesale has struggled in 2022, facing high inflation, down more than 20% and underperforming the general market by a fair margin.

A famous company in the arena, The Gap , is slated to unveil Q3 results on November 17th, after the market close.

With more than 3,800 stores worldwide, The Gap is a premier international specialty retailer offering a diverse range of clothing, accessories, and personal care products.

As it stands, the company carries a Zacks Rank #3 (Hold) paired with an overall VGM Score of a B.

How does the retailer stack up heading into the release? Let’s take a closer look.

Share Performance & Valuation

GPS shares have undergone adverse price action year-to-date, down more than 25% and lagging behind the S&P 500 by a notable margin.

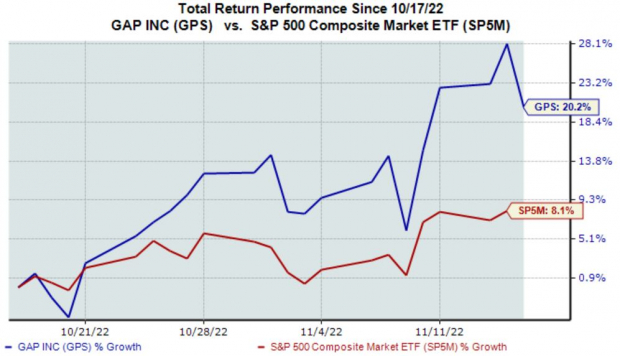

Image Source: Zacks Investment Research

However, the story has visibly changed over the last month; GPS shares have tacked on more than 20% in value, widely outperforming the S&P 500’s 8% gain.

Image Source: Zacks Investment Research

The company’s forward price-to-sales ratio currently comes in at a small 0.3X, below its 0.5X five-year median and representing a sizable 78% discount relative to the Zacks Retail and Wholesale sector.

The Gap sports a Style Score of a B for Value.

Image Source: Zacks Investment Research

Quarterly Estimates

Analysts have been silent for the quarter to be reported over the last several months, with no earnings estimate revisions coming in. The Zacks Consensus EPS Estimate of $0.01 indicates a 96% Y/Y drop in quarterly earnings.

Image Source: Zacks Investment Research

The company’s top-line appears to be undergoing a bit of turbulence as well; the Zacks Consensus Sales Estimate of $3.8 billion suggests a decline of 3.6% from year-ago quarterly sales of $3.9 billion.

Quarterly Performance

GPS has primarily posted mixed bottom-line results as of late, exceeding the Zacks Consensus EPS Estimate in two of its last four quarters. In its latest print, the retailer registered a steep 300% EPS beat.

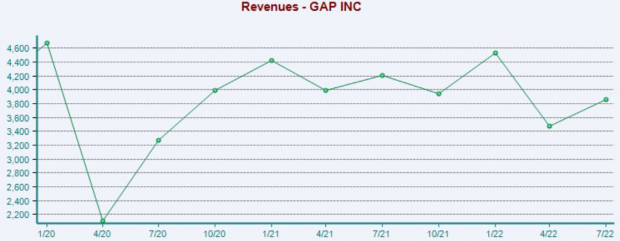

Sales results have been more positive, with the company exceeding the Zacks Consensus Sales Estimate in three consecutive quarters. Below is a chart illustrating the company’s revenue on a quarterly basis.

Image Source: Zacks Investment Research

Putting Everything Together

The Gap shares are in the red year-to-date but have handily outperformed the S&P 500 over the last month, indicating that buyers have stepped up heavily as of late.

The company’s forward price-to-sales ratio sits on the lower end of the spectrum and well below its Zacks sector average.

Analysts have been silent for the quarter to be reported, with estimates indicating a Y/Y decline in both earnings and revenue.

The company’s bottom-line results have been mixed as of late, but revenue has consistently come in above expectations.

Heading into the release, The Gap carries a Zacks Rank #3 (Hold) paired with an overall VGM Score of a B.

Image: Bigstock

The Gap Q3 Preview: Can Shares Remain Hot?

The Zacks Retail and Wholesale has struggled in 2022, facing high inflation, down more than 20% and underperforming the general market by a fair margin.

A famous company in the arena, The Gap , is slated to unveil Q3 results on November 17th, after the market close.

With more than 3,800 stores worldwide, The Gap is a premier international specialty retailer offering a diverse range of clothing, accessories, and personal care products.

As it stands, the company carries a Zacks Rank #3 (Hold) paired with an overall VGM Score of a B.

How does the retailer stack up heading into the release? Let’s take a closer look.

Share Performance & Valuation

GPS shares have undergone adverse price action year-to-date, down more than 25% and lagging behind the S&P 500 by a notable margin.

Image Source: Zacks Investment Research

However, the story has visibly changed over the last month; GPS shares have tacked on more than 20% in value, widely outperforming the S&P 500’s 8% gain.

Image Source: Zacks Investment Research

The company’s forward price-to-sales ratio currently comes in at a small 0.3X, below its 0.5X five-year median and representing a sizable 78% discount relative to the Zacks Retail and Wholesale sector.

The Gap sports a Style Score of a B for Value.

Image Source: Zacks Investment Research

Quarterly Estimates

Analysts have been silent for the quarter to be reported over the last several months, with no earnings estimate revisions coming in. The Zacks Consensus EPS Estimate of $0.01 indicates a 96% Y/Y drop in quarterly earnings.

Image Source: Zacks Investment Research

The company’s top-line appears to be undergoing a bit of turbulence as well; the Zacks Consensus Sales Estimate of $3.8 billion suggests a decline of 3.6% from year-ago quarterly sales of $3.9 billion.

Quarterly Performance

GPS has primarily posted mixed bottom-line results as of late, exceeding the Zacks Consensus EPS Estimate in two of its last four quarters. In its latest print, the retailer registered a steep 300% EPS beat.

Sales results have been more positive, with the company exceeding the Zacks Consensus Sales Estimate in three consecutive quarters. Below is a chart illustrating the company’s revenue on a quarterly basis.

Image Source: Zacks Investment Research

Putting Everything Together

The Gap shares are in the red year-to-date but have handily outperformed the S&P 500 over the last month, indicating that buyers have stepped up heavily as of late.

The company’s forward price-to-sales ratio sits on the lower end of the spectrum and well below its Zacks sector average.

Analysts have been silent for the quarter to be reported, with estimates indicating a Y/Y decline in both earnings and revenue.

The company’s bottom-line results have been mixed as of late, but revenue has consistently come in above expectations.

Heading into the release, The Gap carries a Zacks Rank #3 (Hold) paired with an overall VGM Score of a B.