The Zacks Retail and Wholesale sector has sailed through rough conditions in 2022, facing high inflation, down more than 20% and lagging behind the S&P 500.

A name that many are familiar with residing in the realm, Hibbett Sports , is slated to unveil Q3 earnings on November 29th, before the market open.

Hibbett Sports, Inc, has evolved its offerings from sports goods. The company emphasizes on providing a compelling collection of athletic-inspired fashion footwear, apparel, and accessories.

Currently, the retailer carries a favorable Zacks Rank #2 (Buy) paired with an overall VGM Score of a D.

How does everything else stack up heading into the print? Let’s take a closer look.

Share Performance & Valuation

Year-to-date, HIBB shares have weathered a dark fiscal cloud better than most, down a marginal 2% and outperforming the general market by a fair margin.

Image Source: Zacks Investment Research

Over the last month, HIBB shares have tacked on a stellar 22% in value, crushing the S&P 500 again in this timeframe as well.

Image Source: Zacks Investment Research

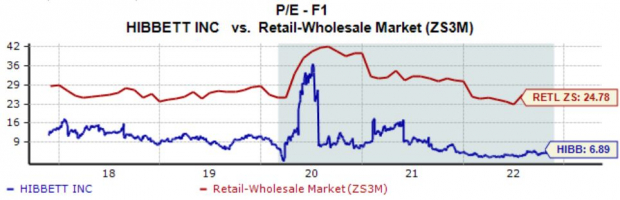

The company’s shares aren’t expensive by any stretch; HIBB’s current forward earnings multiple of 6.9X is well below its 10.2X five-year median and reflects a 72% discount relative to the Zacks Retail and Wholesale sector.

Image Source: Zacks Investment Research

HIBB carries a Value Style Score of an A.

Quarterly Estimates

A singular analyst has upped their earnings outlook over the last several months, with the Zacks Consensus EPS Estimate of $2.58 suggesting a substantial 53% Y/Y uptick in quarterly earnings.

Image Source: Zacks Investment Research

The company’s top-line also looks to expand; the Zacks Consensus Sales Estimate of $437.8 million suggests an uptick of nearly 15% from year-ago quarterly sales of $381.7 million.

Quarterly Performance

HIBB has posted weak bottom-line results as of late, falling short of the Zacks Consensus EPS Estimate in back-to-back prints. In its latest quarter, the company fell short of earnings expectations by 17.7%.

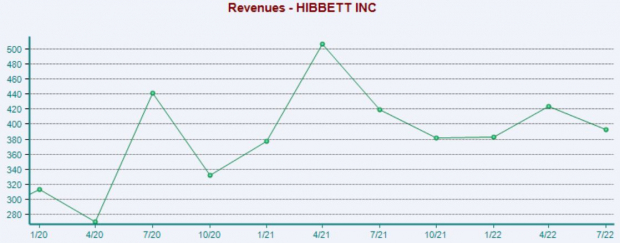

Sales results have been more positive; HIBB has exceeded revenue estimates in four of its last five quarters. Below is a chart illustrating the company’s revenue on a quarterly basis.

Image Source: Zacks Investment Research

Putting Everything Together

HIBB shares have outperformed the general market across several timeframes YTD, indicating that buyers have been busy.

The company’s forward earnings multiple sits well beneath its five-year median value and the Zacks Retail and Wholesale sector average.

One analyst has upped their earnings outlook for the quarter to be reported, with estimates indicating Y/Y upticks in both revenue and earnings.

Further, HIBB has posted weak bottom-line results as of late, but revenue results have been mainly positive.

Heading into the release, Hibbett, Inc. carries a Zacks Rank #2 (Buy) with an Earnings ESP Score of -8.4%.

Image: Bigstock

Hibbett, Inc. Q3 Preview: Double-Digit Earnings Growth Inbound?

The Zacks Retail and Wholesale sector has sailed through rough conditions in 2022, facing high inflation, down more than 20% and lagging behind the S&P 500.

A name that many are familiar with residing in the realm, Hibbett Sports , is slated to unveil Q3 earnings on November 29th, before the market open.

Hibbett Sports, Inc, has evolved its offerings from sports goods. The company emphasizes on providing a compelling collection of athletic-inspired fashion footwear, apparel, and accessories.

Currently, the retailer carries a favorable Zacks Rank #2 (Buy) paired with an overall VGM Score of a D.

How does everything else stack up heading into the print? Let’s take a closer look.

Share Performance & Valuation

Year-to-date, HIBB shares have weathered a dark fiscal cloud better than most, down a marginal 2% and outperforming the general market by a fair margin.

Image Source: Zacks Investment Research

Over the last month, HIBB shares have tacked on a stellar 22% in value, crushing the S&P 500 again in this timeframe as well.

Image Source: Zacks Investment Research

The company’s shares aren’t expensive by any stretch; HIBB’s current forward earnings multiple of 6.9X is well below its 10.2X five-year median and reflects a 72% discount relative to the Zacks Retail and Wholesale sector.

Image Source: Zacks Investment Research

HIBB carries a Value Style Score of an A.

Quarterly Estimates

A singular analyst has upped their earnings outlook over the last several months, with the Zacks Consensus EPS Estimate of $2.58 suggesting a substantial 53% Y/Y uptick in quarterly earnings.

Image Source: Zacks Investment Research

The company’s top-line also looks to expand; the Zacks Consensus Sales Estimate of $437.8 million suggests an uptick of nearly 15% from year-ago quarterly sales of $381.7 million.

Quarterly Performance

HIBB has posted weak bottom-line results as of late, falling short of the Zacks Consensus EPS Estimate in back-to-back prints. In its latest quarter, the company fell short of earnings expectations by 17.7%.

Sales results have been more positive; HIBB has exceeded revenue estimates in four of its last five quarters. Below is a chart illustrating the company’s revenue on a quarterly basis.

Image Source: Zacks Investment Research

Putting Everything Together

HIBB shares have outperformed the general market across several timeframes YTD, indicating that buyers have been busy.

The company’s forward earnings multiple sits well beneath its five-year median value and the Zacks Retail and Wholesale sector average.

One analyst has upped their earnings outlook for the quarter to be reported, with estimates indicating Y/Y upticks in both revenue and earnings.

Further, HIBB has posted weak bottom-line results as of late, but revenue results have been mainly positive.

Heading into the release, Hibbett, Inc. carries a Zacks Rank #2 (Buy) with an Earnings ESP Score of -8.4%.