We use cookies to understand how you use our site and to improve your experience. This includes personalizing content and advertising. To learn more, click here. By continuing to use our site, you accept our use of cookies, revised Privacy Policy and Terms of Service.

You are being directed to ZacksTrade, a division of LBMZ Securities and licensed broker-dealer. ZacksTrade and Zacks.com are separate companies. The web link between the two companies is not a solicitation or offer to invest in a particular security or type of security. ZacksTrade does not endorse or adopt any particular investment strategy, any analyst opinion/rating/report or any approach to evaluating individual securities.

If you wish to go to ZacksTrade, click OK. If you do not, click Cancel.

What Happens This Week Will Lead the Market for 2023

Read MoreHide Full Article

From big tech earnings to employment data and interest rate decisions, this is an extremely significant week for Wall Street. Markets are at a possible precipice and depending on the results of this week’s data deluge we may have a case to help determine where the market will trade going forward.

Monday was a light day for data, but not the market. Besides a few earnings releases there wasn’t much news on the day, but that didn’t stop the stock market indexes from selling off. On Tuesday morning the bulls stepped up though and have bid the market back to where it was yesterday. Not surprising that the market is chopping up traders before the big day, Wednesday.

Tuesday

Tuesday morning has been busy with several big earnings calls, and economic data releases. On the earnings side Exxon Mobil (XOM - Free Report) reported an historic year. Exxon Mobil took home $56 billion in earnings in 2022, which is the most profitable year in Exxon’s history.

Other big reports came from Pfizer (PFE - Free Report) and McDonald’s (MCD - Free Report) . The big news from Pfizer was 2023 sales were guided down 33% to $67-$71 billion. This is following a historically successful 2022 for PFE with $100.3 billion in revenue reported driven by $50 billion from Covid vaccine and antiviral sales.

McDonald’s beat on both the top and bottom line and showed increasing visits from consumers. CEO Chris Kempczinski did note that he expects “short-term inflationary pressures to continue in 2023.”

On the economic data front, the big news today came from the Employment Cost Index (ECI). The ECI, a figure Federal Reserve officials watch closely for cues on inflation, was up less than. Wages and salaries increased just 1%, less than the expected 1.1%, and down from the Q3 number of 1.3%. This is good news for team soft landing, and plays favorably to the Federal Reserve, whose FOMC meeting, and press conference Wednesday are the most anticipated event of the week.

Economic data released Tuesday also included:

Case-Schiller home prices – showed a decrease of -3.1%, previously 2.8%

FHFA home price index – a decrease of -1.6%, previously 0%

Chicago business barometer – 44.3, estimated 45.3, previously 45.1.

Also reporting earnings on Tuesday: AMD, CAT, AMGN, MDLZ, UBS, UPS, MCO, GM, PSX, MSCI

Wednesday

While Meta Platforms (META - Free Report) reports earnings Wednesday February 1 after the close the real big news will be coming from the Fed. According to the federal funds futures curve, it is a near certainty that the Fed will be raising interest rates just 25 basis points at the conclusion of its meeting.

This will be the first 25 bps hike for this cycle, and marks a dovish pivot from the Fed. The soft-landing narrative has become extremely loud, and it seems the Fed believes they are close to success as well. This is a delicate balancing act though. Any upside surprise from inflation can really throw a wrench in the central bank’s plan.

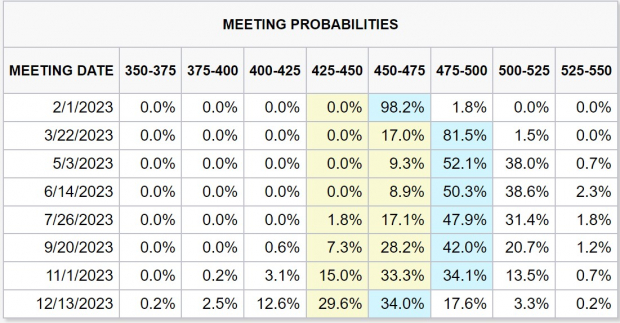

Even more important will be the press conference and the rhetoric from Fed Chair Jerome Powell. There is no doubt that the rate of inflation is slowing, but how will that affect future rate hikes? Fed funds futures currently indicate the likeliest path is that March meeting will mark the final rate hike for the cycle. Followed by several meetings of maintaining the rate of 475-500 bps, and an eventual cut during the December meeting.

Image Source: CME

Meta’s Q4 and FY22 earnings results should be very interesting as well. Estimates from Zacks project Q4 sales of $31 billion, a -7% YoY decrease, and FY sales of $115 billion, a YoY decrease of -1.8%. Earnings have been revised lower by analysts for the current quarter, next quarter, and the current year, but next year’s estimates are slowly ticking up. Additionally, Zacks is expecting a positive earnings surprise of 6.9%. META currently holds a Zacks Rank #3 (Hold)

Image Source: Zacks Investment Research

Wednesday morning will also bring some important economic data:

ADP employment report – Median forecast 190,000, previous report 235,000

PMI manufacturing – Median forecast 46.6, previous report 46.8

ISM manufacturing – Median forecast 48%, previous report 48.4%

Job openings – Median forecast 10.3 million, previous report 10.5 million

Quits – Median forecast n/a, previous report 4.2 million

Also reporting earnings on Wednesday: MO, TMUS, NVO, GSK, WM, AFl

Thursday

Thursday after the market closes, we will see the big dogs Apple (AAPL - Free Report) , Amazon (AMZN - Free Report) , and Alphabet (GOOGL - Free Report) report earnings. All three are currently Zack Rank #3 (Hold) stocks.

Apple’s Q1 FY23 sales are expected to decrease -2.2% YoY to $121 billion according to Zacks estimates. Earnings are expected to be lower as well, down -8.1% to $1.93 per share. Key data will come in the form of iPhone sales, Apple Services revenue, and guidance.

Amazon Q4 sales are expected to be $145.4 billion, which would be a 5.8% YoY increase, and FY sales are projected to be $510 billion an 8.6% increase YoY. Sales growth numbers from AMZN are an important indicator of the state of the consumer now. Also keep an eye on AWS numbers as growth rates have been slowing, and Amazon is losing cloud market share quarterly.

Alphabet, Google’s parent company, will provide insight on how the digital ads industry is faring. According to the analysts, the expectations are not great. GOOGL has had earnings revised lower on nearly all time frames, and the new antitrust case from the Department of Justice doesn’t help. Keep an eye on total ads revenue growth, and cloud growth.

Image Source: Zacks Investment Research

Also reporting earnings on Thursday: LLY, MRK, SHEL, COP QCOM, HON, SBUX GILD, ICE, F

Friday

Earnings will slow down a bit by Friday, but more important economic data will be coming out. In the morning there will be data released for Nonfarm payroll, Unemployment, Average hourly earnings, Labor force participation, PMI, and ISM services.

Earnings will include, SNY, CI, VCISY, REGN, AON, CHD and others.

Review

The importance of this week, especially Wednesday and Thursday, can’t be understated. Of course, nobody knows for certain what the future will bring, but the data coming out this week should provide some extremely valuable insights.

Earnings from big tech companies will tell us how consumers and leading businesses are managing in the current economy. The Fed will let us know what we can expect from interest rates, inflation, and employment. After a strong start for equities in 2023, and an easing of interest rates, this week may inform us about whether these trends will continue, or reverse.

See More Zacks Research for These Tickers

Normally $25 each - click below to receive one report FREE:

Image: Bigstock

What Happens This Week Will Lead the Market for 2023

From big tech earnings to employment data and interest rate decisions, this is an extremely significant week for Wall Street. Markets are at a possible precipice and depending on the results of this week’s data deluge we may have a case to help determine where the market will trade going forward.

Monday was a light day for data, but not the market. Besides a few earnings releases there wasn’t much news on the day, but that didn’t stop the stock market indexes from selling off. On Tuesday morning the bulls stepped up though and have bid the market back to where it was yesterday. Not surprising that the market is chopping up traders before the big day, Wednesday.

Tuesday

Tuesday morning has been busy with several big earnings calls, and economic data releases. On the earnings side Exxon Mobil (XOM - Free Report) reported an historic year. Exxon Mobil took home $56 billion in earnings in 2022, which is the most profitable year in Exxon’s history.

Other big reports came from Pfizer (PFE - Free Report) and McDonald’s (MCD - Free Report) . The big news from Pfizer was 2023 sales were guided down 33% to $67-$71 billion. This is following a historically successful 2022 for PFE with $100.3 billion in revenue reported driven by $50 billion from Covid vaccine and antiviral sales.

McDonald’s beat on both the top and bottom line and showed increasing visits from consumers. CEO Chris Kempczinski did note that he expects “short-term inflationary pressures to continue in 2023.”

On the economic data front, the big news today came from the Employment Cost Index (ECI). The ECI, a figure Federal Reserve officials watch closely for cues on inflation, was up less than. Wages and salaries increased just 1%, less than the expected 1.1%, and down from the Q3 number of 1.3%. This is good news for team soft landing, and plays favorably to the Federal Reserve, whose FOMC meeting, and press conference Wednesday are the most anticipated event of the week.

Economic data released Tuesday also included:

Also reporting earnings on Tuesday: AMD, CAT, AMGN, MDLZ, UBS, UPS, MCO, GM, PSX, MSCI

Wednesday

While Meta Platforms (META - Free Report) reports earnings Wednesday February 1 after the close the real big news will be coming from the Fed. According to the federal funds futures curve, it is a near certainty that the Fed will be raising interest rates just 25 basis points at the conclusion of its meeting.

This will be the first 25 bps hike for this cycle, and marks a dovish pivot from the Fed. The soft-landing narrative has become extremely loud, and it seems the Fed believes they are close to success as well. This is a delicate balancing act though. Any upside surprise from inflation can really throw a wrench in the central bank’s plan.

Even more important will be the press conference and the rhetoric from Fed Chair Jerome Powell. There is no doubt that the rate of inflation is slowing, but how will that affect future rate hikes? Fed funds futures currently indicate the likeliest path is that March meeting will mark the final rate hike for the cycle. Followed by several meetings of maintaining the rate of 475-500 bps, and an eventual cut during the December meeting.

Image Source: CME

Meta’s Q4 and FY22 earnings results should be very interesting as well. Estimates from Zacks project Q4 sales of $31 billion, a -7% YoY decrease, and FY sales of $115 billion, a YoY decrease of -1.8%. Earnings have been revised lower by analysts for the current quarter, next quarter, and the current year, but next year’s estimates are slowly ticking up. Additionally, Zacks is expecting a positive earnings surprise of 6.9%. META currently holds a Zacks Rank #3 (Hold)

Image Source: Zacks Investment Research

Wednesday morning will also bring some important economic data:

Also reporting earnings on Wednesday: MO, TMUS, NVO, GSK, WM, AFl

Thursday

Thursday after the market closes, we will see the big dogs Apple (AAPL - Free Report) , Amazon (AMZN - Free Report) , and Alphabet (GOOGL - Free Report) report earnings. All three are currently Zack Rank #3 (Hold) stocks.

Apple’s Q1 FY23 sales are expected to decrease -2.2% YoY to $121 billion according to Zacks estimates. Earnings are expected to be lower as well, down -8.1% to $1.93 per share. Key data will come in the form of iPhone sales, Apple Services revenue, and guidance.

Amazon Q4 sales are expected to be $145.4 billion, which would be a 5.8% YoY increase, and FY sales are projected to be $510 billion an 8.6% increase YoY. Sales growth numbers from AMZN are an important indicator of the state of the consumer now. Also keep an eye on AWS numbers as growth rates have been slowing, and Amazon is losing cloud market share quarterly.

Alphabet, Google’s parent company, will provide insight on how the digital ads industry is faring. According to the analysts, the expectations are not great. GOOGL has had earnings revised lower on nearly all time frames, and the new antitrust case from the Department of Justice doesn’t help. Keep an eye on total ads revenue growth, and cloud growth.

Image Source: Zacks Investment Research

Also reporting earnings on Thursday: LLY, MRK, SHEL, COP QCOM, HON, SBUX GILD, ICE, F

Friday

Earnings will slow down a bit by Friday, but more important economic data will be coming out. In the morning there will be data released for Nonfarm payroll, Unemployment, Average hourly earnings, Labor force participation, PMI, and ISM services.

Earnings will include, SNY, CI, VCISY, REGN, AON, CHD and others.

Review

The importance of this week, especially Wednesday and Thursday, can’t be understated. Of course, nobody knows for certain what the future will bring, but the data coming out this week should provide some extremely valuable insights.

Earnings from big tech companies will tell us how consumers and leading businesses are managing in the current economy. The Fed will let us know what we can expect from interest rates, inflation, and employment. After a strong start for equities in 2023, and an easing of interest rates, this week may inform us about whether these trends will continue, or reverse.