We use cookies to understand how you use our site and to improve your experience. This includes personalizing content and advertising. To learn more, click here. By continuing to use our site, you accept our use of cookies, revised Privacy Policy and Terms of Service.

You are being directed to ZacksTrade, a division of LBMZ Securities and licensed broker-dealer. ZacksTrade and Zacks.com are separate companies. The web link between the two companies is not a solicitation or offer to invest in a particular security or type of security. ZacksTrade does not endorse or adopt any particular investment strategy, any analyst opinion/rating/report or any approach to evaluating individual securities.

If you wish to go to ZacksTrade, click OK. If you do not, click Cancel.

Revenue Growth Supports U.S. Bancorp (USB) Amid High Cost

Read MoreHide Full Article

U.S. Bancorp’s (USB - Free Report) key strengths involve diverse revenue sources and balance-sheet growth. Also, its inorganic growth moves support expansion into new geographic footprints. However, rising cost is likely to hinder bottom-line improvement. Also, lack of diversification in loan portfolio and legal hassles are likely to act as headwinds.

U.S. Bancorp’s revenues witnessed a rising trend over the last few years and in first-quarter 2023. Revenues benefit from higher NII and USB’s efforts to enhance its range of products, services and capabilities. Management expects total revenues to reach $28.5-$30.5 billion in 2023.

The company’s NII has been higher due to the rising interest rates and balance-sheet growth. USB’s loan and deposit balances have been rising over the years as it continues to expand and deepen relationships with current customers, acquire new ones and expand market share. For second-quarter and full-year 2023, management expects average earning assets in the range of $600-$605 billion and $600-$610 billion, respectively.

U.S. Bancorp has opened new markets for itself and fortified existing markets through a number of strategic acquisitions in the past years. In December 2022, it completed the acquisition of MUFG Union Bank’s core regional banking franchise to expand its branch network and have greater access to digital banking tools.

USB has a strong balance sheet. At first quarter end, the company’s cash and due from banks of $67.23 billion exceeded its long-term debt of $42.05 billion, reflecting manageable debt levels. Also, given its strong liquidity and impressive earnings strength, its capital deployment activities seem sustainable and is likely to boost investors’ confidence in the stock.

However, rising costs remain a concern for U.S. Bancorp. Its non-interest expenses saw a positive compound annual growth rate over the last four years. The increasing trend continued in first-quarter 2023 as well.

Management estimates to incur total expenses of $1.4 billion for Union Bank integration. Further, it forecasts non-interest expenses (excluding merger and integration charges) of $17-$17.5 billion in 2023. Hence, USB’s cost base remains relatively high which is likely to hinder bottom-line growth.

Apart from increasing costs, lack of diversification in loan portfolio amid an uncertain economy and legal hassles are likely to act as headwinds. Around 49.6% of USB’s loan portfolio comprises of commercial loans (commercial and commercial real estate lending) as of Mar 31. Further, U.S. Bancorp continues to encounter investigations and lawsuits from the investors and regulators, leading to increased legal expenses and provisions in the near term.

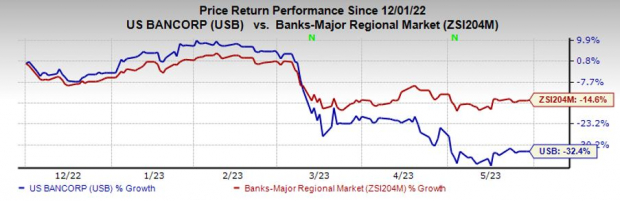

Shares of this Zacks Rank #3 (Hold) company have lost 32.4% compared with a decline of 14.6% recorded by its industry over the past six months.

Earnings estimates for BHB have remained flat for 2023 over the past 30 days. The stock has declined 21.1% over the past six months.

The consensus estimate for CASH’s fiscal 2023 earnings has been revised 1.8% upward over the past 60 days. Over the past six months, the company’s share price has increased 6%.

Unique Zacks Analysis of Your Chosen Ticker

Pick one free report - opportunity may be withdrawn at any time

Image: Bigstock

Revenue Growth Supports U.S. Bancorp (USB) Amid High Cost

U.S. Bancorp’s (USB - Free Report) key strengths involve diverse revenue sources and balance-sheet growth. Also, its inorganic growth moves support expansion into new geographic footprints. However, rising cost is likely to hinder bottom-line improvement. Also, lack of diversification in loan portfolio and legal hassles are likely to act as headwinds.

U.S. Bancorp’s revenues witnessed a rising trend over the last few years and in first-quarter 2023. Revenues benefit from higher NII and USB’s efforts to enhance its range of products, services and capabilities. Management expects total revenues to reach $28.5-$30.5 billion in 2023.

The company’s NII has been higher due to the rising interest rates and balance-sheet growth. USB’s loan and deposit balances have been rising over the years as it continues to expand and deepen relationships with current customers, acquire new ones and expand market share. For second-quarter and full-year 2023, management expects average earning assets in the range of $600-$605 billion and $600-$610 billion, respectively.

U.S. Bancorp has opened new markets for itself and fortified existing markets through a number of strategic acquisitions in the past years. In December 2022, it completed the acquisition of MUFG Union Bank’s core regional banking franchise to expand its branch network and have greater access to digital banking tools.

USB has a strong balance sheet. At first quarter end, the company’s cash and due from banks of $67.23 billion exceeded its long-term debt of $42.05 billion, reflecting manageable debt levels. Also, given its strong liquidity and impressive earnings strength, its capital deployment activities seem sustainable and is likely to boost investors’ confidence in the stock.

However, rising costs remain a concern for U.S. Bancorp. Its non-interest expenses saw a positive compound annual growth rate over the last four years. The increasing trend continued in first-quarter 2023 as well.

Management estimates to incur total expenses of $1.4 billion for Union Bank integration. Further, it forecasts non-interest expenses (excluding merger and integration charges) of $17-$17.5 billion in 2023. Hence, USB’s cost base remains relatively high which is likely to hinder bottom-line growth.

Apart from increasing costs, lack of diversification in loan portfolio amid an uncertain economy and legal hassles are likely to act as headwinds. Around 49.6% of USB’s loan portfolio comprises of commercial loans (commercial and commercial real estate lending) as of Mar 31. Further, U.S. Bancorp continues to encounter investigations and lawsuits from the investors and regulators, leading to increased legal expenses and provisions in the near term.

Shares of this Zacks Rank #3 (Hold) company have lost 32.4% compared with a decline of 14.6% recorded by its industry over the past six months.

.

Image Source: Zacks Investment Research

Finance Stocks Worth Considering

A couple of better-ranked stocks from the finance sector are Bar Harbor Bankshares (BHB - Free Report) and Pathward Financial Inc. (CASH - Free Report) , each currently carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Earnings estimates for BHB have remained flat for 2023 over the past 30 days. The stock has declined 21.1% over the past six months.

The consensus estimate for CASH’s fiscal 2023 earnings has been revised 1.8% upward over the past 60 days. Over the past six months, the company’s share price has increased 6%.