There are dozens of reasons why the stock market should be trading lower than it is. There are soft economic numbers showing up all the time, valuations are stretched well beyond what is “normal,” and the Fed is still tightening and raising rates. For the bears out there, this can be very frustrating as the market continues to climb. But remember my bearish friends, markets can stay irrational longer than you can remain solvent.

The market is a colossal amalgamation of billions of data points. Intangibles like emotions and expectations can have just as large of an impact on prices as earnings. That is why it is so hard to forecast the future in the stock market. Not only are there nearly innumerable variables, but these are all constantly changing. There is always a bear case to be made in any stock market. And in a market like this one, the bear case is even easier to make. Even so, the market has been soldiering on.

Bear Case One: Soft Economic Data

Manufacturing data has been coming in weaker than expected. The ISM Purchasing Managers Index fell to 46.9 in May 2023. That was the seventh consecutive month of contraction. The Chair of the ISM Manufacturing Business Survey Committee said that companies “manage outputs to better align with demand in the first half of 2023 and prepare for growth in the late summer/early fall period.” That points to a soft spot right now which has recently been getting worse.

Image Source: TradingView

The Caveat: At the surface, slowing manufacturing data seems like a bad thing. It’s difficult to argue that a contraction in the manufacturing industry is bullish over the intermediate term. However, you must take this in context. COVID caused massive supply chain disruptions globally. These caused shortages throughout the economy. For instance, I remember having to wait nine months for a basic refrigerator. These kinds of backlogs were present throughout the world.

After this catchup period waned, things got back to normal. Only that normal is at a much lower baseline than the activity manufacturing saw while it was catching up. That means that, yes, the manufacturing sector is slowing down compared to the levels it was at post-COVID. But overall, the growth is still there when you zoom out a bit.

Continued . . .

------------------------------------------------------------------------------------------------------

5 Stocks Set to Double: Sunday Deadline

This is a great time to take a longer view and download Zacks Special Report, 5 Stocks Set to Double. Each pick was pinpointed by a Zacks expert to have the best chance to gain +100% and more in the months ahead.

Previous editions have racked up gains of +143.0%, +175.9%, +498.3%, and even +673.0%.¹ Deadline to download the latest report is midnight Sunday, June 11.

See Stocks Now >>

------------------------------------------------------------------------------------------------------

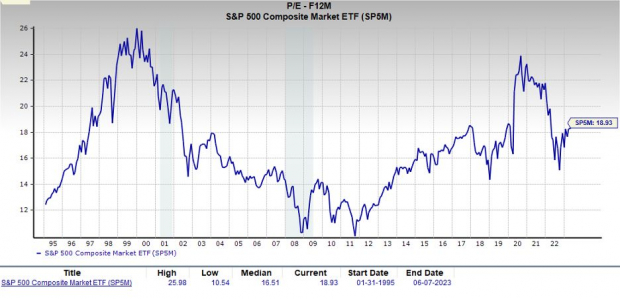

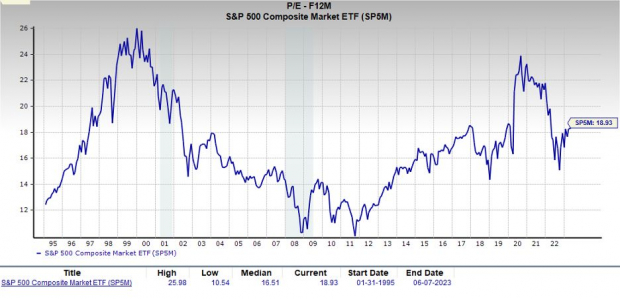

Bear Case Two: Insane Valuations

Valuations are stretched by nearly any metric you choose. The most common, price-to-earnings, is elevated not only for the broad market, but for many individual sectors. Take technology for example. The tech sector is currently trading at 34.3x earnings. But when you start to look at individual names, you forget about it! NVIDIA trades at 194x earnings and 36x sales. And NVIDIA isn’t some fly-by-night operation. It is a trillion-dollar company.

The forward 12-month earnings on the S&P 500 is nearly 19x. That is well above the range the market saw in the period between 2002 and 2018.

Image Source: ZRS

The Caveat: It’s not all over-valued. There are always opportunities in downtrodden stocks and oversold sectors. It’s easy to point out the madness in NVIDIA and some other tech stocks, but take a look at energy. Only 5.86x earnings for the energy sector. Though you’re not going to get the 10% EPS growth over the next 5 years for energy, there are several names in that space that pay monster dividends.

While 19x earnings looks rich when compared to that period between 2002 and 2018, why are we comparing it to a lost decade for stocks? Because that period started in the wake of the Dot Com bubble and included the Great Recession. Looking back at that Dot Com bubble, S&P 500 earnings spent two years above 24x.

Bear Case Three: The Fed Continues to Tighten

The downturn in the market last year was sparked in part by the Fed ratcheting up interest rates. This latest aggressive hiking cycle sought to snuff out inflation. The Fed has been adamant about its intent to continue to keep rates high until inflation cools significantly. Looking at the Fed Funds Futures data, there is a 27.5% chance of a rate hike next week. If you look out to December, there is a 16.2% chance that rates will be a quarter-point higher than they are today, and a 2.7% chance that they are 50-bps higher than today. Even if there is a pause in the rate-hike cycle, the Fed is reserving the rate to hike at future meetings.

Image Source: TradingView

The Caveat: The stock market is less concerned about whether a pause in hikes comes this month or next, than it is about seeing an end to the hikes. When the market was really under pressure, it was because the market felt a sense of despair. Almost like the hikes would just never end and the Fed would continue to snuff out the economy. For a while there, it seemed like any time there was news about inflation cooling, the Fed would do cooling of its own, dumping a bucket of cold water on any stock market rally.

Bottom Line

In any market, you are going to have debates. It is never clear cut what might happen in the future. The bulls and the bears have been at each other’s throats and pocketbooks for decades. Here, I have addressed a few of the bearish arguments for the market moving forward, meeting them with bullish counterparts. Who will win this latest battle? Me, of course. And you.

5 Stocks to Buy & Hold in Any Market

Zacks has released a Special Report to fill you in on our 5 picks to gain +100% or more in the months ahead.

It names and explains 5 Stocks Set to Double >>

Stock #1: After 15 years of under-investing, one global oil and gas giant is poised to lead a wave of exploration. This stock was singled out by our Director of Research as his favorite for triple-digit growth.

Stock #2: “Groundbreaking!” “Unorthodox!” The stock price of this search-and-social-media advertiser has already doubled – but its move may have only just begun.

Stock #3: In 4 years, an ambitious cybersecurity firm has gobbled up 10 rivals, blasted through earnings estimates and achieved staggering EPS growth. And there's no end in sight.

Stock #4: This undervalued online internet-commerce provider has boosted revenues nearly fourfold over the past two years. And Wall Street will inevitably catch on.

Stock #5: Rejuvenated by a major acquisition, this century-old electronics company is trading at an estimated 40% discount. Right now is the time to get aboard.

These picks are worth noting. Previous editions have racked up gains of +143.0%, +175.9%, +498.3%, and even +673.0%.¹

You may be surprised at what it costs to download this Special Report and also gain 30 days access to the Zacks Investor Collection, including all the picks from ALL Zacks long-term services…

Only $1.

And there’s not a cent of additional obligation.

So go ahead and get our best buy and hold recommendations for $1.

Click for 5 Stocks to Double and 30-day access to Zacks Investor Collection >>

All the Best,

Dave

Dave Bartosiak is the Editor of Zacks Surprise Trader and Zacks Blockchain Innovators.

¹ The results listed above are not (or may not be) representative of the performance of all selections made by Zacks Investment Research's newsletter editors and may represent the partial close of a position.

Image: Bigstock

Debunking the Bear Market Myth

There are dozens of reasons why the stock market should be trading lower than it is. There are soft economic numbers showing up all the time, valuations are stretched well beyond what is “normal,” and the Fed is still tightening and raising rates. For the bears out there, this can be very frustrating as the market continues to climb. But remember my bearish friends, markets can stay irrational longer than you can remain solvent.

The market is a colossal amalgamation of billions of data points. Intangibles like emotions and expectations can have just as large of an impact on prices as earnings. That is why it is so hard to forecast the future in the stock market. Not only are there nearly innumerable variables, but these are all constantly changing. There is always a bear case to be made in any stock market. And in a market like this one, the bear case is even easier to make. Even so, the market has been soldiering on.

Bear Case One: Soft Economic Data

Manufacturing data has been coming in weaker than expected. The ISM Purchasing Managers Index fell to 46.9 in May 2023. That was the seventh consecutive month of contraction. The Chair of the ISM Manufacturing Business Survey Committee said that companies “manage outputs to better align with demand in the first half of 2023 and prepare for growth in the late summer/early fall period.” That points to a soft spot right now which has recently been getting worse.

Image Source: TradingView

The Caveat: At the surface, slowing manufacturing data seems like a bad thing. It’s difficult to argue that a contraction in the manufacturing industry is bullish over the intermediate term. However, you must take this in context. COVID caused massive supply chain disruptions globally. These caused shortages throughout the economy. For instance, I remember having to wait nine months for a basic refrigerator. These kinds of backlogs were present throughout the world.

After this catchup period waned, things got back to normal. Only that normal is at a much lower baseline than the activity manufacturing saw while it was catching up. That means that, yes, the manufacturing sector is slowing down compared to the levels it was at post-COVID. But overall, the growth is still there when you zoom out a bit.

Continued . . .

------------------------------------------------------------------------------------------------------

5 Stocks Set to Double: Sunday Deadline

This is a great time to take a longer view and download Zacks Special Report, 5 Stocks Set to Double. Each pick was pinpointed by a Zacks expert to have the best chance to gain +100% and more in the months ahead.

Previous editions have racked up gains of +143.0%, +175.9%, +498.3%, and even +673.0%.¹ Deadline to download the latest report is midnight Sunday, June 11.

See Stocks Now >>

------------------------------------------------------------------------------------------------------

Bear Case Two: Insane Valuations

Valuations are stretched by nearly any metric you choose. The most common, price-to-earnings, is elevated not only for the broad market, but for many individual sectors. Take technology for example. The tech sector is currently trading at 34.3x earnings. But when you start to look at individual names, you forget about it! NVIDIA trades at 194x earnings and 36x sales. And NVIDIA isn’t some fly-by-night operation. It is a trillion-dollar company.

The forward 12-month earnings on the S&P 500 is nearly 19x. That is well above the range the market saw in the period between 2002 and 2018.

Image Source: ZRS

The Caveat: It’s not all over-valued. There are always opportunities in downtrodden stocks and oversold sectors. It’s easy to point out the madness in NVIDIA and some other tech stocks, but take a look at energy. Only 5.86x earnings for the energy sector. Though you’re not going to get the 10% EPS growth over the next 5 years for energy, there are several names in that space that pay monster dividends.

While 19x earnings looks rich when compared to that period between 2002 and 2018, why are we comparing it to a lost decade for stocks? Because that period started in the wake of the Dot Com bubble and included the Great Recession. Looking back at that Dot Com bubble, S&P 500 earnings spent two years above 24x.

Bear Case Three: The Fed Continues to Tighten

The downturn in the market last year was sparked in part by the Fed ratcheting up interest rates. This latest aggressive hiking cycle sought to snuff out inflation. The Fed has been adamant about its intent to continue to keep rates high until inflation cools significantly. Looking at the Fed Funds Futures data, there is a 27.5% chance of a rate hike next week. If you look out to December, there is a 16.2% chance that rates will be a quarter-point higher than they are today, and a 2.7% chance that they are 50-bps higher than today. Even if there is a pause in the rate-hike cycle, the Fed is reserving the rate to hike at future meetings.

Image Source: TradingView

The Caveat: The stock market is less concerned about whether a pause in hikes comes this month or next, than it is about seeing an end to the hikes. When the market was really under pressure, it was because the market felt a sense of despair. Almost like the hikes would just never end and the Fed would continue to snuff out the economy. For a while there, it seemed like any time there was news about inflation cooling, the Fed would do cooling of its own, dumping a bucket of cold water on any stock market rally.

Bottom Line

In any market, you are going to have debates. It is never clear cut what might happen in the future. The bulls and the bears have been at each other’s throats and pocketbooks for decades. Here, I have addressed a few of the bearish arguments for the market moving forward, meeting them with bullish counterparts. Who will win this latest battle? Me, of course. And you.

5 Stocks to Buy & Hold in Any Market

Zacks has released a Special Report to fill you in on our 5 picks to gain +100% or more in the months ahead.

It names and explains 5 Stocks Set to Double >>

Stock #1: After 15 years of under-investing, one global oil and gas giant is poised to lead a wave of exploration. This stock was singled out by our Director of Research as his favorite for triple-digit growth.

Stock #2: “Groundbreaking!” “Unorthodox!” The stock price of this search-and-social-media advertiser has already doubled – but its move may have only just begun.

Stock #3: In 4 years, an ambitious cybersecurity firm has gobbled up 10 rivals, blasted through earnings estimates and achieved staggering EPS growth. And there's no end in sight.

Stock #4: This undervalued online internet-commerce provider has boosted revenues nearly fourfold over the past two years. And Wall Street will inevitably catch on.

Stock #5: Rejuvenated by a major acquisition, this century-old electronics company is trading at an estimated 40% discount. Right now is the time to get aboard.

These picks are worth noting. Previous editions have racked up gains of +143.0%, +175.9%, +498.3%, and even +673.0%.¹

You may be surprised at what it costs to download this Special Report and also gain 30 days access to the Zacks Investor Collection, including all the picks from ALL Zacks long-term services…

Only $1.

And there’s not a cent of additional obligation.

So go ahead and get our best buy and hold recommendations for $1.

Click for 5 Stocks to Double and 30-day access to Zacks Investor Collection >>

All the Best,

Dave

Dave Bartosiak is the Editor of Zacks Surprise Trader and Zacks Blockchain Innovators.

¹ The results listed above are not (or may not be) representative of the performance of all selections made by Zacks Investment Research's newsletter editors and may represent the partial close of a position.