We use cookies to understand how you use our site and to improve your experience.

This includes personalizing content and advertising.

By pressing "Accept All" or closing out of this banner, you consent to the use of all cookies and similar technologies and the sharing of information they collect with third parties.

You can reject marketing cookies by pressing "Deny Optional," but we still use essential, performance, and functional cookies.

In addition, whether you "Accept All," Deny Optional," click the X or otherwise continue to use the site, you accept our Privacy Policy and Terms of Service, revised from time to time.

You are being directed to ZacksTrade, a division of LBMZ Securities and licensed broker-dealer. ZacksTrade and Zacks.com are separate companies. The web link between the two companies is not a solicitation or offer to invest in a particular security or type of security. ZacksTrade does not endorse or adopt any particular investment strategy, any analyst opinion/rating/report or any approach to evaluating individual securities.

If you wish to go to ZacksTrade, click OK. If you do not, click Cancel.

UUUU vs. NXE: Which Uranium Stock is the Better Pick Now?

Read MoreHide Full Article

Key Takeaways

Energy Fuels is ramping uranium output and rare earths processing, but expects a loss again in 2025.

NexGen's Rook I project may triple Canada's uranium output with low costs and long-term sales contracts.

Both UUUU and NXE shares have dipped in the past year, with earnings estimates trending lower recently.

Energy Fuels Inc. (UUUU - Free Report) and NexGen Energy (NXE - Free Report) are expected to benefit from the accelerating global transition toward nuclear energy as a clean power source.

Energy Fuels, with a market capitalization of $1.28 billion, has established itself as a leading U.S. producer of natural uranium concentrate over the past several years. In contrast, Vancouver-Canada based NexGen Energy, valued at $3.86 billion, is an exploration and development stage company, which engages in the acquisition, exploration, evaluation and advancement of uranium properties in Canada.

After facing pressure earlier this year due to oversupply and uncertain demand, uranium prices have recently rebounded. The recovery was fueled by news that the Sprott Physical Uranium Trust plans to purchase approximately $200 million worth of physical uranium. Additionally, the U.S. government’s initiative to quadruple domestic nuclear energy capacity by 2050, along with rising energy needs from AI data centers, has boosted long-term demand expectations.

In this context, we evaluate the fundamentals, growth potential and risks associated with UUUU and NXE to identify which company presents a more compelling investment in the uranium sector.

The Case for Energy Fuels

Energy Fuels has produced two-thirds of all uranium in the United States since 2017, and continues to ramp its production further, backed by its debt-free balance sheet. Taking current production levels and its development pipeline into account, the company has the potential to produce 6 million pounds of uranium per year.

UUUU owns the White Mesa Mill in Utah—the only operating and licensed conventional uranium mill in the country. In addition to uranium, the facility processes rare earth elements (REEs) and vanadium oxide, and is evaluating the recovery of medical isotopes used in cancer treatment.

The 2024 acquisition of Base Resources gave Energy Fuels access to the Toliara Mineral Sands Project in Madagascar, boosting its potential in titanium, zirconium and REEs. However, Energy Fuels’ efforts to grow its REE business have been perceived as risky due to China’s dominance in the market. In the first quarter of 2025, Energy Fuels reported a 33.5% year-over-year revenue decline to $16.9 million. This reflected the company’s decision to defer uranium sales due to lower prices. Instead, revenues came from its Heavy Mineral Sands segment, pertaining to rutile, ilmenite and zircon sales. Energy Fuels incurred a loss of 13 cents per share against earnings of two cents in the year-ago quarter.

This was attributed to the lack of uranium sales and the ongoing ramp-up at its mines. Higher costs, associated with the increased headcount of retained Base Resources employees, the Kwale mine reclamation and the lower grade of HMS produced, also impacted results.

Energy Fuels expects to mine 55,000-80,000 tons of ore containing approximately 875,000-1,435,000 pounds of uranium from its three mines during 2025, a 22% increase from the previously provided guidance. UUUU aims to process up to 1 million pounds of uranium this year—four times its earlier forecast. Despite these upbeat expectations, uranium sales for 2025 are projected at 220,000 pounds, way lower than the 450,000 pounds sold in 2024.

The company has been reporting yearly losses since it started trading on the NYSE in December 2013. It seems to be headed for a loss this year as well, due to the expected lower uranium sales and costs.

The Case for NexGen Energy

NexGen Energy holds a 100% interest in the Rook I project that consists of 32 contiguous mineral claims totaling an area of approximately 35,065 hectares located in the southwestern Athabasca Basin of Saskatchewan.

The Rook I Project is being developed into the largest source of low-cost uranium globally. It is expected to deliver up to 30 million pounds of high-grade uranium per year, at the lowest quartile of the cost curve of C$13.86 over generations to come. This massive output could triple Canada’s uranium production, elevating NexGen to a dominant position in the nuclear fuel market.

The Arrow Deposit is the focus of the Rook I Project and was discovered in February 2014. The Arrow Deposit has measured and indicated mineral resources totaling 3.75 million tons, at a grade of 3.10%, containing 257 million pounds of uranium. The company has intersected numerous other mineralized zones on trend from Arrow along the Patterson Corridor on the Rook I property, which are subject to further exploration before economic potential can be assessed.

In December 2024, NexGen Energy announced that it had entered into uranium sales contracts with major U.S. utilities committing to supply 1 million pounds of uranium annually from 2029 to 2033. These contracts, incorporating market-based pricing, validate confidence in the Rook I Project and provide financial stability while allowing the company to benefit from rising uranium prices.

As an exploration and development stage company, NXE does not have revenues and historically has reported recurring operating losses. In the first quarter of 2025, the company reported an adjusted loss of four cents per share compared with the year-ago quarter’s loss of one cent.

NXE’s results are likely to continue to reflect the impact of salaries, office, administrative and travel costs as well as costs consistent with the expansion of operations. However, once it starts production, there remains strong margin potential due to the Rook I’s low-cost position.

How do Estimates Compare for Energy Fuels & NexGen Energy?

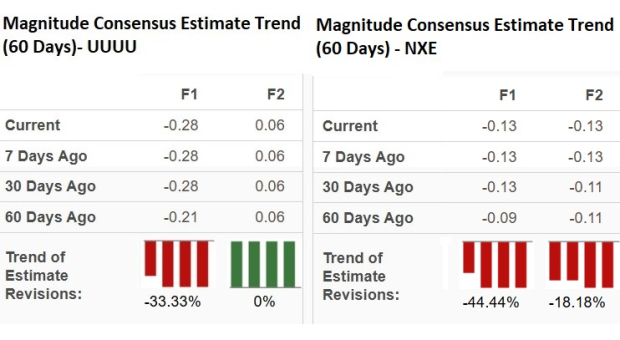

The Zacks Consensus Estimate for Energy Fuel’s 2025 earnings is currently at a loss of 28 cents per share, in line with 2024. Estimates for 2026, however, depict a better picture. The consensus estimate for UUUU’s revenues implies a year-over-year surge of 232.4%, with earnings per share pegged at six cents, marking the first year of expected profits for it.

The EPS estimate for 2025 for Energy Fuels has been trending south over the past 60 days, while the same has remained unchanged for 2026.

The Zacks Consensus Estimate for NexGen Energy’s earnings for 2025 is at a loss of 13 cents per share, wider than the loss of 10 cents in 2024. The estimate for 2026 is also at a loss of 13 cents per share.

Both the estimates for NexGen Energy for 2025 and 2026 have moved down in the past 60 days.

Image Source: Zacks Investment Research

(Find the latest earnings estimates and surprises on Zacks Earnings Calendar.)

UUUU & NXE: Price Performance & Valuation

Over the past year, UUUU shares have lost 3.4%, while NexGen Energy’s shares have dipped 1.2%.

Image Source: Zacks Investment Research

Energy Fuels is trading at a forward price-to-book multiple of 2.07X, below its median of 5.54X over the last three years. NXE forward price-to-book multiple sits at 5.02X, below its median of 5.54X over the last three years.

Image Source: Zacks Investment Research

Conclusion

With global nuclear energy expansion boosting uranium demand, both Energy Fuels and NexGen Energy are positioned to support Western efforts to reduce reliance on Russian supply. UUUU has branched into rare earth elements and vanadium, but these ventures remain in early development. Given China’s dominance in the REE market, it may take time for UUUU to establish a competitive presence. UUUU’s reliance on spot uranium sales also contributes to revenue volatility.

Although NXE is still in the development phase, it offers exposure to a high-grade, long-life asset with strong margin potential. NexGen’s Zacks Rank #3 (Hold) reflects a balanced risk-reward outlook, whereas UUUU’s Zacks Rank #4 (Sell) highlights the abovementioned concerns and limited near-term earnings visibility.

Image: Bigstock

UUUU vs. NXE: Which Uranium Stock is the Better Pick Now?

Key Takeaways

Energy Fuels Inc. (UUUU - Free Report) and NexGen Energy (NXE - Free Report) are expected to benefit from the accelerating global transition toward nuclear energy as a clean power source.

Energy Fuels, with a market capitalization of $1.28 billion, has established itself as a leading U.S. producer of natural uranium concentrate over the past several years. In contrast, Vancouver-Canada based NexGen Energy, valued at $3.86 billion, is an exploration and development stage company, which engages in the acquisition, exploration, evaluation and advancement of uranium properties in Canada.

After facing pressure earlier this year due to oversupply and uncertain demand, uranium prices have recently rebounded. The recovery was fueled by news that the Sprott Physical Uranium Trust plans to purchase approximately $200 million worth of physical uranium. Additionally, the U.S. government’s initiative to quadruple domestic nuclear energy capacity by 2050, along with rising energy needs from AI data centers, has boosted long-term demand expectations.

In this context, we evaluate the fundamentals, growth potential and risks associated with UUUU and NXE to identify which company presents a more compelling investment in the uranium sector.

The Case for Energy Fuels

Energy Fuels has produced two-thirds of all uranium in the United States since 2017, and continues to ramp its production further, backed by its debt-free balance sheet. Taking current production levels and its development pipeline into account, the company has the potential to produce 6 million pounds of uranium per year.

UUUU owns the White Mesa Mill in Utah—the only operating and licensed conventional uranium mill in the country. In addition to uranium, the facility processes rare earth elements (REEs) and vanadium oxide, and is evaluating the recovery of medical isotopes used in cancer treatment.

The 2024 acquisition of Base Resources gave Energy Fuels access to the Toliara Mineral Sands Project in Madagascar, boosting its potential in titanium, zirconium and REEs. However, Energy Fuels’ efforts to grow its REE business have been perceived as risky due to China’s dominance in the market.

In the first quarter of 2025, Energy Fuels reported a 33.5% year-over-year revenue decline to $16.9 million. This reflected the company’s decision to defer uranium sales due to lower prices. Instead, revenues came from its Heavy Mineral Sands segment, pertaining to rutile, ilmenite and zircon sales. Energy Fuels incurred a loss of 13 cents per share against earnings of two cents in the year-ago quarter.

This was attributed to the lack of uranium sales and the ongoing ramp-up at its mines. Higher costs, associated with the increased headcount of retained Base Resources employees, the Kwale mine reclamation and the lower grade of HMS produced, also impacted results.

Energy Fuels expects to mine 55,000-80,000 tons of ore containing approximately 875,000-1,435,000 pounds of uranium from its three mines during 2025, a 22% increase from the previously provided guidance. UUUU aims to process up to 1 million pounds of uranium this year—four times its earlier forecast. Despite these upbeat expectations, uranium sales for 2025 are projected at 220,000 pounds, way lower than the 450,000 pounds sold in 2024.

The company has been reporting yearly losses since it started trading on the NYSE in December 2013. It seems to be headed for a loss this year as well, due to the expected lower uranium sales and costs.

The Case for NexGen Energy

NexGen Energy holds a 100% interest in the Rook I project that consists of 32 contiguous mineral claims totaling an area of approximately 35,065 hectares located in the southwestern Athabasca Basin of Saskatchewan.

The Rook I Project is being developed into the largest source of low-cost uranium globally. It is expected to deliver up to 30 million pounds of high-grade uranium per year, at the lowest quartile of the cost curve of C$13.86 over generations to come. This massive output could triple Canada’s uranium production, elevating NexGen to a dominant position in the nuclear fuel market.

The Arrow Deposit is the focus of the Rook I Project and was discovered in February 2014. The Arrow Deposit has measured and indicated mineral resources totaling 3.75 million tons, at a grade of 3.10%, containing 257 million pounds of uranium. The company has intersected numerous other mineralized zones on trend from Arrow along the Patterson Corridor on the Rook I property, which are subject to further exploration before economic potential can be assessed.

In December 2024, NexGen Energy announced that it had entered into uranium sales contracts with major U.S. utilities committing to supply 1 million pounds of uranium annually from 2029 to 2033. These contracts, incorporating market-based pricing, validate confidence in the Rook I Project and provide financial stability while allowing the company to benefit from rising uranium prices.

As an exploration and development stage company, NXE does not have revenues and historically has reported recurring operating losses. In the first quarter of 2025, the company reported an adjusted loss of four cents per share compared with the year-ago quarter’s loss of one cent.

NXE’s results are likely to continue to reflect the impact of salaries, office, administrative and travel costs as well as costs consistent with the expansion of operations. However, once it starts production, there remains strong margin potential due to the Rook I’s low-cost position.

How do Estimates Compare for Energy Fuels & NexGen Energy?

The Zacks Consensus Estimate for Energy Fuel’s 2025 earnings is currently at a loss of 28 cents per share, in line with 2024. Estimates for 2026, however, depict a better picture. The consensus estimate for UUUU’s revenues implies a year-over-year surge of 232.4%, with earnings per share pegged at six cents, marking the first year of expected profits for it.

The EPS estimate for 2025 for Energy Fuels has been trending south over the past 60 days, while the same has remained unchanged for 2026.

The Zacks Consensus Estimate for NexGen Energy’s earnings for 2025 is at a loss of 13 cents per share, wider than the loss of 10 cents in 2024. The estimate for 2026 is also at a loss of 13 cents per share.

Both the estimates for NexGen Energy for 2025 and 2026 have moved down in the past 60 days.

Image Source: Zacks Investment Research

(Find the latest earnings estimates and surprises on Zacks Earnings Calendar.)

UUUU & NXE: Price Performance & Valuation

Over the past year, UUUU shares have lost 3.4%, while NexGen Energy’s shares have dipped 1.2%.

Image Source: Zacks Investment Research

Energy Fuels is trading at a forward price-to-book multiple of 2.07X, below its median of 5.54X over the last three years. NXE forward price-to-book multiple sits at 5.02X, below its median of 5.54X over the last three years.

Image Source: Zacks Investment Research

Conclusion

With global nuclear energy expansion boosting uranium demand, both Energy Fuels and NexGen Energy are positioned to support Western efforts to reduce reliance on Russian supply. UUUU has branched into rare earth elements and vanadium, but these ventures remain in early development. Given China’s dominance in the REE market, it may take time for UUUU to establish a competitive presence. UUUU’s reliance on spot uranium sales also contributes to revenue volatility.

Although NXE is still in the development phase, it offers exposure to a high-grade, long-life asset with strong margin potential. NexGen’s Zacks Rank #3 (Hold) reflects a balanced risk-reward outlook, whereas UUUU’s Zacks Rank #4 (Sell) highlights the abovementioned concerns and limited near-term earnings visibility.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.