We use cookies to understand how you use our site and to improve your experience.

This includes personalizing content and advertising.

By pressing "Accept All" or closing out of this banner, you consent to the use of all cookies and similar technologies and the sharing of information they collect with third parties.

You can reject marketing cookies by pressing "Deny Optional," but we still use essential, performance, and functional cookies.

In addition, whether you "Accept All," Deny Optional," click the X or otherwise continue to use the site, you accept our Privacy Policy and Terms of Service, revised from time to time.

You are being directed to ZacksTrade, a division of LBMZ Securities and licensed broker-dealer. ZacksTrade and Zacks.com are separate companies. The web link between the two companies is not a solicitation or offer to invest in a particular security or type of security. ZacksTrade does not endorse or adopt any particular investment strategy, any analyst opinion/rating/report or any approach to evaluating individual securities.

If you wish to go to ZacksTrade, click OK. If you do not, click Cancel.

SSR Mining is Set to Report Q2 Earnings: Here's What to Expect

Read MoreHide Full Article

Key Takeaways

SSRM is expected to post Q2 EPS of $0.23, marking a 475% increase from $0.04 in Q2 2024.

CC&V acquisition and strong Seabee and Marigold output likely boosted quarterly production.

Higher gold prices and expanded output may offset Copler-related costs in Q2 performance.

SSR Mining Inc. (SSRM - Free Report) is set to report second-quarter 2025 results on Aug. 5, after market close. SSRM is expected to deliver a solid year-over-year improvement in earnings in the quarter.

The Zacks Consensus Estimate for SSR Mining’s earnings for the quarter is pegged at 23 cents per share, indicating a significant 475% jump from the earnings of four cents reported in the second quarter of 2024. The estimate has moved up 27.78% over the past 60 days.

Image Source: Zacks Investment Research

SSR Mining’s Earnings Surprise History

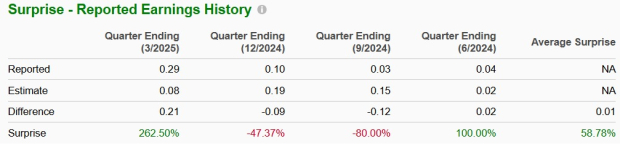

SSR Mining’s earnings beat the Zacks Consensus Estimates in two of the trailing four quarters but missed in two. The company has a trailing four-quarter earnings surprise of 58.78%, on average. The trend is shown in the chart below.

Image Source: Zacks Investment Research

What the Zacks Model Unveils for SSRM Stock

Our proven model does not conclusively predict an earnings beat for SSR Mining this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. But that is not the case here.

Earnings ESP: SSRM has an Earnings ESP of 0.00%. You can uncover the best stocks before they are reported with our Earnings ESP Filter.

Factors Likely to Have Shaped SSR Mining’s Q2 Performance

SSR Mining had reported a 2% year-over-year increase in gold equivalent production for the first quarter of 2025, totaling 103,805 ounces. The highlight of the quarter was the contribution from the recently acquired Cripple Creek & Victor (CC&V) mine, which bolstered overall output and expanded SSRM’s U.S. operations.

SSR Mining closed the CC&V acquisition on Feb. 28, 2025. Despite being integrated for only a month during the quarter, CC&V contributed 11,282 ounces of gold to SSRM’s production.

At the Marigold mine, gold production increased 11% year over year to 38,586 ounces, in line with the company’s expectations as Red Dot waste stripping continues. Full-year 2025 gold production guidance is set at 160,000-190,000, with 55-60% of production weighted to the second half of the year.

Seabee produced 26,001 ounces of gold in the first quarter, up 9% year over year, supported by high-grade ore from the Santoy 9 zone. Despite a temporary two-week suspension at Seabee in June due to power disruptions caused by nearby forest fires, SSRM maintains full-year production guidance at 70,000-80,000 ounces for the site.

The Puna mine produced 2.5 million ounces of silver (moz), which marked a 31% increase year over year. 2025 production guidance for Puna is 8.00- 8.75 moz, with production expected to be 50-55% weighted to the first half of 2025, driven largely by grades.

However, operations at the Çöpler mine in Türkiye remain suspended due to the significant slip on the heap leach pad on Feb. 13, 2024. Despite this setback, the company projects gold production between 320,000 and 380,000 ounces in 2025 across Seabee, Marigold and CC&V. It had produced 275,013 ounces of gold in 2024.

Including silver output from Puna, total gold equivalent production for the year is forecast at 410,000-480,000 ounces, marking a 10% increase over the 2024 level.

We expect the company to report higher production numbers in the second quarter of 2025, reflecting the contribution from CC&V and ongoing momentum at Seabee and Marigold.

In the April-June 2025 period, gold prices averaged around $3.301.42 per ounce, marking a 41% year-over-year increase. Tariff threats, financial uncertainty, geopolitical tensions and solid demand from central banks boosted gold prices. Prices had even reached the $3,500 per-ounce mark for the first time.

Overall, higher production levels and gold prices, somewhat offset by the care and maintenance costs related to Çöpler, will reflect on the company’s earnings in the quarter.

SSRM’s Price Performance

Year to date, SSRM shares have gained 71.2%, outpacing the industry's 12.2% growth. In comparison, the Basic Materials sector has risen 8.9%, while the S&P 500 has moved up 7.4%.

Image Source: Zacks Investment Research

Stocks to Consider

Here are some companies in the basic materials space, which according to our model, have the right combination of elements to post an earnings beat this quarter.

Hudbay Minerals Inc. (HBM - Free Report) , slated to release second-quarter 2025 earnings on Aug. 13, has an Earnings ESP of +1.12% and a Zacks Rank of 3.

The Zacks Consensus Estimate for Hudbay Minerals’ earnings for the second quarter is currently pegged at 11 cents per share. The estimate indicates a significant climb from the break-even earnings in the year-ago quarter. Hudbay Minerals has a trailing four-quarter average earnings surprise of 50%.

Triple Flag Precious Metals Corp. (TFPM - Free Report) , scheduled to release second-quarter 2025 earnings on Aug. 6, presently has an Earnings ESP of +2.80% and a Zacks Rank of 3.

Triple Flag Precious’ earnings for the second quarter are currently pegged at 21 cents per share, indicating year-over-year growth of 61.5%. Triple Flag Precious has a trailing four-quarter average earnings surprise of 6.7%.

The Mosaic Company (MOS - Free Report) , scheduled to release second-quarter 2025 earnings on Aug. 5, has an Earnings ESP of +10.45% and a Zacks Rank of 3.

The Zacks Consensus Estimate for MOS' earnings for the second quarter of 2025 is pegged at 67 cents per share, indicating an increase of 21.5% from the year-ago quarter’s reported figure.

See More Zacks Research for These Tickers

Normally $25 each - click below to receive one report FREE:

Image: Bigstock

SSR Mining is Set to Report Q2 Earnings: Here's What to Expect

Key Takeaways

SSR Mining Inc. (SSRM - Free Report) is set to report second-quarter 2025 results on Aug. 5, after market close. SSRM is expected to deliver a solid year-over-year improvement in earnings in the quarter.

The Zacks Consensus Estimate for SSR Mining’s earnings for the quarter is pegged at 23 cents per share, indicating a significant 475% jump from the earnings of four cents reported in the second quarter of 2024. The estimate has moved up 27.78% over the past 60 days.

SSR Mining’s Earnings Surprise History

SSR Mining’s earnings beat the Zacks Consensus Estimates in two of the trailing four quarters but missed in two. The company has a trailing four-quarter earnings surprise of 58.78%, on average. The trend is shown in the chart below.

Image Source: Zacks Investment Research

What the Zacks Model Unveils for SSRM Stock

Our proven model does not conclusively predict an earnings beat for SSR Mining this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. But that is not the case here.

Earnings ESP: SSRM has an Earnings ESP of 0.00%. You can uncover the best stocks before they are reported with our Earnings ESP Filter.

Zacks Rank: The company currently carries a Zacks Rank of 3. You can see the complete list of today’s Zacks #1 Rank stocks here.

Factors Likely to Have Shaped SSR Mining’s Q2 Performance

SSR Mining had reported a 2% year-over-year increase in gold equivalent production for the first quarter of 2025, totaling 103,805 ounces. The highlight of the quarter was the contribution from the recently acquired Cripple Creek & Victor (CC&V) mine, which bolstered overall output and expanded SSRM’s U.S. operations.

SSR Mining closed the CC&V acquisition on Feb. 28, 2025. Despite being integrated for only a month during the quarter, CC&V contributed 11,282 ounces of gold to SSRM’s production.

At the Marigold mine, gold production increased 11% year over year to 38,586 ounces, in line with the company’s expectations as Red Dot waste stripping continues. Full-year 2025 gold production guidance is set at 160,000-190,000, with 55-60% of production weighted to the second half of the year.

Seabee produced 26,001 ounces of gold in the first quarter, up 9% year over year, supported by high-grade ore from the Santoy 9 zone. Despite a temporary two-week suspension at Seabee in June due to power disruptions caused by nearby forest fires, SSRM maintains full-year production guidance at 70,000-80,000 ounces for the site.

The Puna mine produced 2.5 million ounces of silver (moz), which marked a 31% increase year over year. 2025 production guidance for Puna is 8.00- 8.75 moz, with production expected to be 50-55% weighted to the first half of 2025, driven largely by grades.

However, operations at the Çöpler mine in Türkiye remain suspended due to the significant slip on the heap leach pad on Feb. 13, 2024. Despite this setback, the company projects gold production between 320,000 and 380,000 ounces in 2025 across Seabee, Marigold and CC&V. It had produced 275,013 ounces of gold in 2024.

Including silver output from Puna, total gold equivalent production for the year is forecast at 410,000-480,000 ounces, marking a 10% increase over the 2024 level.

We expect the company to report higher production numbers in the second quarter of 2025, reflecting the contribution from CC&V and ongoing momentum at Seabee and Marigold.

In the April-June 2025 period, gold prices averaged around $3.301.42 per ounce, marking a 41% year-over-year increase. Tariff threats, financial uncertainty, geopolitical tensions and solid demand from central banks boosted gold prices. Prices had even reached the $3,500 per-ounce mark for the first time.

Overall, higher production levels and gold prices, somewhat offset by the care and maintenance costs related to Çöpler, will reflect on the company’s earnings in the quarter.

SSRM’s Price Performance

Year to date, SSRM shares have gained 71.2%, outpacing the industry's 12.2% growth. In comparison, the Basic Materials sector has risen 8.9%, while the S&P 500 has moved up 7.4%.

Image Source: Zacks Investment Research

Stocks to Consider

Here are some companies in the basic materials space, which according to our model, have the right combination of elements to post an earnings beat this quarter.

Hudbay Minerals Inc. (HBM - Free Report) , slated to release second-quarter 2025 earnings on Aug. 13, has an Earnings ESP of +1.12% and a Zacks Rank of 3.

The Zacks Consensus Estimate for Hudbay Minerals’ earnings for the second quarter is currently pegged at 11 cents per share. The estimate indicates a significant climb from the break-even earnings in the year-ago quarter. Hudbay Minerals has a trailing four-quarter average earnings surprise of 50%.

Triple Flag Precious Metals Corp. (TFPM - Free Report) , scheduled to release second-quarter 2025 earnings on Aug. 6, presently has an Earnings ESP of +2.80% and a Zacks Rank of 3.

Triple Flag Precious’ earnings for the second quarter are currently pegged at 21 cents per share, indicating year-over-year growth of 61.5%. Triple Flag Precious has a trailing four-quarter average earnings surprise of 6.7%.

The Mosaic Company (MOS - Free Report) , scheduled to release second-quarter 2025 earnings on Aug. 5, has an Earnings ESP of +10.45% and a Zacks Rank of 3.

The Zacks Consensus Estimate for MOS' earnings for the second quarter of 2025 is pegged at 67 cents per share, indicating an increase of 21.5% from the year-ago quarter’s reported figure.