Zacks Industry Rank: Your Best Stocks Will Be Found in the Best Industries

We've all heard the old adage that 50% of a stock's price movement can be attributed to the group it's in.

In fact, studies have shown that just getting into an average stock in a strong industry is likely to outperform a great stock in a poor industry.

"Studies have shown that 50% of a stock's price movement can be attributed to its industry. In fact, an average stock in a strong group is likely to outperform a great stock in a poor group."

Of course, this does not mean that you can just pick any stock in a top group and expect to make money. But, it does underscore the importance of sticking with the best industries.

If your last losing stock was in a poorly performing industry, the odds of success were against you the entire time.

But identifying the best stocks in the best industries is easy to do. And the Zacks Industry Rank is the ideal way to do that so you can put the odds of success in your favor on your very next trade.

Zacks Industry Rank

Since 1988, the Zacks Rank #1 stocks have generated an average annual return of +23.86% per year. That's more than 2 times the S&P 500. And it has beaten the market in 26 of the last 31 years. Learn more about the Zacks Rank.

Zacks Rank #1 stocks more than double the S&P 500

+11.43%

S&P 500

+23.86%

Zacks Rank #1 Stocks

Average Annual Returns

That's because the Zacks Rank is based on the most powerful force impacting stocks prices which is earnings estimate revisions.

The Zacks Rank is also one of the best ways to rank industries. And this is done with the Zacks Industry Rank. After all, since an industry is nothing more than a group of stocks in a similar business, this is the perfect way to size up an industry.

The Zacks Industry Rank is determined by calculating the average Zacks Rank for all of the stocks in the industry and then assigning an ordinal rank to it. For example, an industry with an average Zacks Rank of 1.6 is better than an industry with an average Zacks Rank of 2.3. So the industry with the better average Zacks Rank would get a better Zacks Industry Rank.

Zacks classifies all stocks into one of 265 expanded (aka "X") Industries. The average Zacks Rank is calculated for every industry every day. So, if an industry has the best average Zacks Rank, it would be considered the top industry (1 out of 265), which would place it in the top 1% of Zacks Rank Industries.

The top 132 Zacks Ranked industries would be in the top 50% of industries, whereas the bottom 133 Zacks Ranked Industries would be in the bottom 50% of industries.

If an industry had a poor average Zacks Rank, it might be, for example, ranked 220th out of 265 industries, thus placing it in the bottom 17% of Zacks Rank Industries.

Putting the Zacks Industry Rank to the Test

To further illustrate the importance of picking stocks in the best industries, and how the Zacks Industry Rank is one of the best ways to do this, take a look at the test results and chart below.

We put our X industries (all 265 of them) into two groups: the top half (i.e., industries with the best average Zacks Rank) and the bottom half (the industries with the worst average Zacks Rank).

Over the last 10 years, using a one week rebalance, the top half beat the bottom half by a factor of more than 2 to 1. The top blue line is the performance of the top 50% of Zacks Ranked Industries. The maroon line is the S&P 500. And the orange line is the performance for the bottom 50% of Zacks Ranked Industries.

Keep in mind that even the worst industries had some Zacks Rank #1's in them. And even the best industries had some Zacks Rank #5's in them. That goes to show the power of simply being in the best group.

The next chart shows what would happen if only the Zacks Rank #1s were applied to the top Zacks Ranked Industries.

The results were even better, adding to the already impressive returns by an additional factor of 2X. The top green line is the performance of the top 50% of Zacks Ranked Industries with just the Zacks Rank #1's. The blue line below is the performance for the top 50% of Zacks Ranked Industries with all Zacks Ranks included. Once again, the maroon line is the S&P.

It's clear that selecting the best stocks in the best groups can give your stock picking a decided advantage, increasing your portfolio's returns like never before.

Where to Find the Zacks Industry Rank

You'll find references to the Zacks Industry Rank all throughout Zacks.com.

-

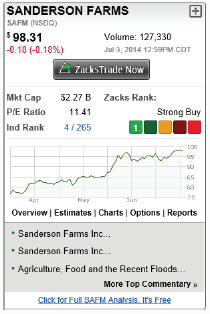

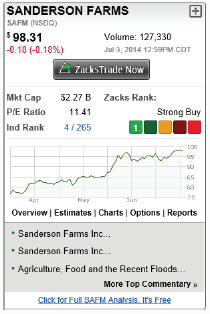

Hover-Quote: Every time you hover over a ticker, virtually anywhere on Zacks.com, the Zacks hover-quote box pops up. In addition to pricing information, a quick-view chart, and other salient information, you'll find the Zacks Rank and the Zacks Industry Rank (its placement within all of the industries), to quickly identify whether the stocks you're looking at is a top stock in a top group or not.

-

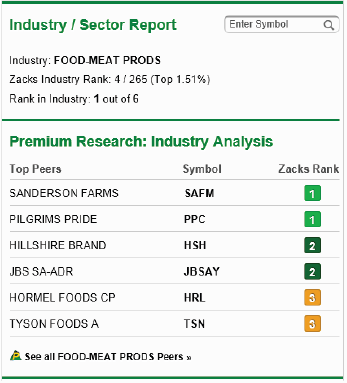

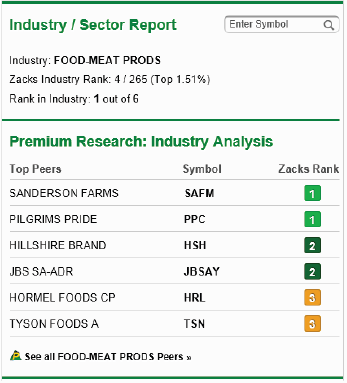

Quote Overview / Premium Research box: Type in any stock symbol within the ticker search box, and you'll be taken to the Quote Overview page. Once there, you'll find the Premium Research box. Within that box, you'll find the Zacks Rank (and whether its Zacks Rank has been upgraded or downgraded within the last 30 days), Zacks Equity Research reports, and of course, the Zacks Industry Rank, which includes its placement within all of the industries and whether it's in the top percentile or bottom percentile of Zacks Ranked Industries.

(Note: underneath this box, you'll find a short-list of the stock's top peers in the Premium Research: Industry Analysis table.) You'll also find the Premium Research box on the Detailed Estimates page as well.

-

Comparison to Industry page: When you click on the Comparison to Industry link (on the left margin of any stock page), you'll see the Industry information germane to that stock prominently displayed. This includes the Industry Name, the Zacks Industry Rank (placement and percentile), as well as the position of your selected stock within that industry (Rank in Industry), and a list of its closest peers in the Industry Analysis table, which also displays the Zacks Rank for all of the stocks shown.

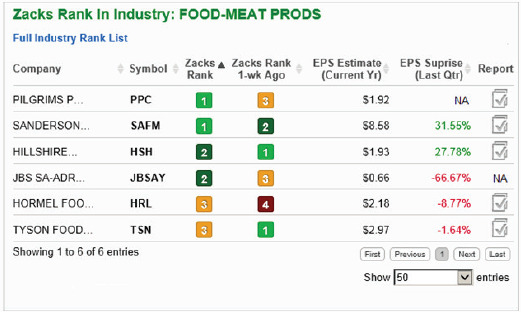

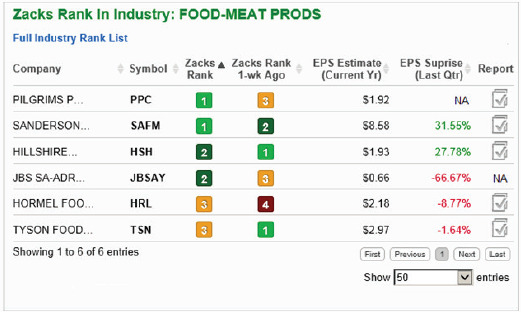

At the bottom of the Industry Analysis table, you'll see a link where you can see a complete list of all of the stocks' industry peers. When you click it, you'll be taken to the Zacks Rank in Industry page. It will show every stock within that industry, what the Zacks Rank is (and what it was 1 week ago), its Current Year EPS Estimate, its last Quarter's EPS Surprise percentage, and access to more reports.

-

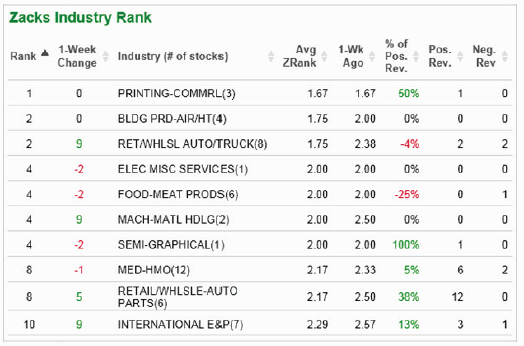

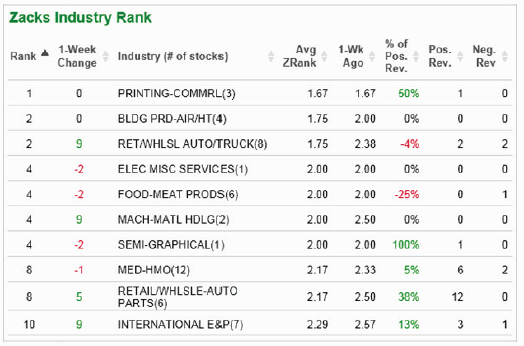

Zacks Industry Rank page: You can access the Zacks Industry Rank page from the Zacks Rank in Industry page (described above), or you can quickly and easily access it by going to Stocks on the Menu bar, and selecting the Zacks Industry Rank from the choices.

On that page, you'll see the complete list of ALL of the industries (and how many stocks are within each respective group), sorted from the top Zacks Ranked Industry down to the bottom Zacks Ranked Industry. Moreover, it will display its current Industry Rank (position), its Zacks Rank from 1 week ago (so you can see whether it's gotten better or worse), what the Industry's average Zacks Rank is (and what it was 1 week ago), the % of Positive Revisions the stocks in the industry have received, along with the number of Positive and Negative Revisions for the stocks in the industry as well.

Once you find an industry you want to do further analysis on, just click the industry's name, and it'll take you back to the Rank in Industry page/table where you can once again drill down on that specific group.

Using the Zacks Industry Rank

Once again, the Zacks Industry Rank is calculated by averaging the Zacks Rank for all stocks within a specific industry. The industry with the lowest (best) average Zacks Rank will be considered the top Zacks Ranked Industry (1 out of 265) while the industry with the highest (worst) average Zacks Rank will be ranked at the bottom of the Zacks Ranked Industries (265 out of 265).

Remember, the Zacks Rank is a score of 1 thru 5 with a Zacks Rank #1 (Strong Buy) being the best, and a Zacks Rank #5 (Strong Sell) being the worst.

If there were 10 stocks in an industry and five had a Zacks Rank #1, and the other five a Zacks Rank #2, the average Zacks Rank would be 1.5. That industry would receive a top Zacks Industry Rank.

An industry that had five stocks with a Zacks Rank #4 (Sell), and the other five a Zacks Rank #5 (Strong Sell), would have an average Zacks Rank of 4.5. That industry would receive a low Zacks Industry Rank.

Since you always want a diversified portfolio, don't select all of your stocks from just one top Zacks Ranked Industry. You should populate your portfolio with stocks from several groups in the top 50% of Zacks Rank Industries (top 133 industries).

Summary

We said it before, but it's worth saying it again; 50% of a stock's price movement can be attributed to the group that it's in. So it's of the utmost importance to make sure your stocks are within the top industries specifically the top Zacks Ranked industries.

"Your most profitable stocks will be found in the top Zacks Ranked Industries. The more stocks you have from the top industries, the better."

If you find yourself considering a stock that happens to be in one of the bottom 50% of Zacks Ranked Industries, move on. Sure, it may still go up, in spite of the drag the low industry rank has placed on it. But, why put yourself in a position where the odds are against you? And if you get in, against your better judgment, and it does go down, you'll be wondering why you ever did that in the first place. Instead, put the odds of success in your favor.

Remember, a top Zacks Industry Rank means more stocks within that group are receiving upward earnings estimate revisions. That means something positive is happening to that group. Not just that stock, but for the bulk of those stocks within that industry's business. If it has a poor Industry Rank, that means more companies within that industry are receiving downward earnings estimate revisions. In other words, conditions are tough for that industry's business right now, causing the analysts following that group to lower their estimates.

Simply put, your most profitable stocks will be those with upward earnings estimate revisions in the industries enjoying the same.

And there's no better way to increase your odds of success than by combining the Zacks Rank and the Zacks Industry Rank together.

The links below go over each one of the four main trading and investment styles and their unique characteristics. Please click the links below to learn more about each style.

Learn more about:

How Are Industry Groups Determined - Zacks uses a proprietary industry classification system that groups companies together according to their business models. Expanded industry groups are used for calculating the Zacks Industry Rank. But companies can also be classified by Sector or medium Industry groups.

"I can honestly say that I have never felt as confident in my trading. Nor have I been as profitable as I have by using Zacks."

- Kurt Petrich of Norfolk, VA