We use cookies to understand how you use our site and to improve your experience. This includes personalizing content and advertising. To learn more, click here. By continuing to use our site, you accept our use of cookies, revised Privacy Policy and Terms of Service.

You are being directed to ZacksTrade, a division of LBMZ Securities and licensed broker-dealer. ZacksTrade and Zacks.com are separate companies. The web link between the two companies is not a solicitation or offer to invest in a particular security or type of security. ZacksTrade does not endorse or adopt any particular investment strategy, any analyst opinion/rating/report or any approach to evaluating individual securities.

If you wish to go to ZacksTrade, click OK. If you do not, click Cancel.

The market may have gotten a bit choppy over the past couple of weeks, but that’s just giving investors a chance to catch their breath and prepare for the next upswing. You don’t go through five straight weeks of record setting advances in the so-so month of October just to hit a brick wall in two of the most positive months of the year (November and December).

Fortunately, we’ve got a screen that can help you get ready for the next move higher. It’s called the Zacks #1 Rank Uptrends, which seeks out Zacks Rank #1s (Strong Buys) with upward price momentum and market-beating relative price strength. These stocks are also trading in the top third of their 52-week price range… and have even further to go.

Below are three names that were recently on the list, but make sure to check the screen daily for new stocks that pass the criteria.

Being stuck at home during this pandemic reinforced the benefits of buying in bulk, which was a boon for leading warehouse club operator Costco Wholesale (COST - Free Report) . But even in more “normal” times, the efficiency and savings of shopping at a store like COST is apparent. Why buy just a few bags of potato chips for the game when you can spend a little bit more and get 14 bags?

Oh, and if you need a 75” QLED TV and sectional sofa to watch the game, that can be arranged as well. COST can provide everything but the house itself, including big containers of headache pills and antacids for the day after.

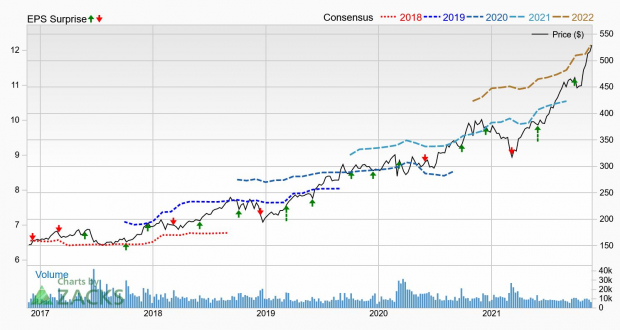

Costco is one of the largest warehouse club operators in the country with nearly 570 stores here in the U.S. and dozens more around the world (820 warehouses in total). Shares are up more than 40% so far this year.

October sales results remained robust with net sales jumping 19.2% to $16.47 billion, exceeding the September print of 15.8%. Same-store sales were up 17.5%, while e-commerce same-store sales accelerated 16.5% as part of the company’s omni-channel adoption.

COST has now beaten the Zacks Consensus Estimate in four of the past five quarters. Earnings per share came to $3.90 in its fiscal fourth quarter, which eclipsed expectations by nearly 10%. Revenue jumped 17.4% to $62.7 billion, while same-store sales were up 15.5%. Importantly, e-commerce same-store sales rose 11.2%.

These strong results were due to the company’s growth strategies, improved price management, membership gains and e-commerce penetration. These same factors should keep COST moving in the right direction as life returns to some kind of new normal. As a result, analysts boosted expectations over the past two months.

The Zacks Consensus Estimate for this fiscal year (ending August 2022) and next fiscal year (ending August 2023) are now at $12.15 and $13.30, respectively. Those results are each up by about 5% in the past 60 days, but analysts see year-over-year profit growth of about 9.5%.

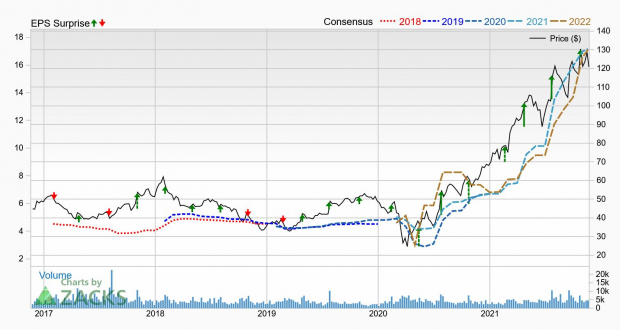

When you mix surging consumer demand with manufacturing supply chain disruptions, you can do crazy things like put together six straight record quarters right through an unprecedented pandemic. That’s what AutoNation (AN - Free Report) did in its third-quarter report, as people have been looking for ways to travel safely and avoid that coughing guy on the bus.

AN is the largest automotive retailer in the country with 315 new vehicle franchises from 230 stores (as of Dec 31, 2020). The company’s diversified product mix and multiple streams of income help to reduce risk and generate more earnings and sales growth.

Its business has been divided into three operating segments: Domestic (33% of revenues in 2020); Import (30.4%) and Premium Luxury (36.6%). As part of the Automotive – Retail & Whole Sales space, its in the top 11% of the Zacks Industry Rank. Shares are up nearly 70% so far this year.

In late October, AN earned $5.12 per share in the third quarter, which topped our expectation by 17.7%. That makes 11 straight quarters of outperformance. Revenue of $6.4 billion jumped 18% year over year. The domestic segment increased 33%, while import was up 63% and premium luxury advance 43%.

Historically low new vehicle inventories and the shift toward personal transportation are two factors that drove this growth in the past and should continue to do so in the future. As a result, earnings estimates for this year and next have improved significantly over the past 60 days.

The Zacks Consensus Estimate for this year is now $17.17, which has jumped 12% in that time. Expectations for next year currently suggest a year-over-year decline to $17.12, but that estimate has surged 27% over the past two months… and 2022 hasn’t even started yet.

Now what kind of an ‘uptrends’ article would this be without taking a look at the chips? There are several different industries to choose from that are doing well at this time high demand and low supply. Let’s take a look at semiconductor – analog & mixed since it’s in the Top 10% of the Zacks Industry Rank.

MaxLinear (MXL - Free Report) is one of only two names from this area with a Zacks Rank #1 (Strong Buy). The company is a leading provider of RF, analog, digital and mixed-signal integrated circuits. Its current products enable the display of broadband video in a wide range of electronic devices, including cable and terrestrial set top boxes, digital televisions, mobile handsets, personal computers, netbooks, and in-vehicle entertainment devices.

Shares of MXL have jumped over 83% so far this year after beating the Zacks Consensus Estimate for six straight quarters. Most recently, it reported third quarter earnings per share of 75 cents, which beat the Zacks Consensus Estimate by 10.3%.

Revenue of $229.8 million marked an impressive improvement of 47% year over year while also topping the Zacks Consensus Estimate by 1%. The company enjoyed strong demand for its broadband access and connectivity and high-performance analog products.

The company is dealing admirably with the global supply chain constraints that are impacting the entire economy. Analysts like how MXL’s future looks, so they’ve raised estimates over the past two months.

The Zacks Consensus Estimate for this year is up to $2.68, which marks an advance of 13% in 60 days. Next year is now at $3.15, or more than 14% better in the timeframe. Most importantly though, analysts expect year over year improvement of 17.5%.

Image Source: Zacks Investment Research

See More Zacks Research for These Tickers

Normally $25 each - click below to receive one report FREE:

Image: Bigstock

3 Zacks Rank #1s With Upward Price Momentum

The market may have gotten a bit choppy over the past couple of weeks, but that’s just giving investors a chance to catch their breath and prepare for the next upswing. You don’t go through five straight weeks of record setting advances in the so-so month of October just to hit a brick wall in two of the most positive months of the year (November and December).

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Fortunately, we’ve got a screen that can help you get ready for the next move higher. It’s called the Zacks #1 Rank Uptrends, which seeks out Zacks Rank #1s (Strong Buys) with upward price momentum and market-beating relative price strength. These stocks are also trading in the top third of their 52-week price range… and have even further to go.

Below are three names that were recently on the list, but make sure to check the screen daily for new stocks that pass the criteria.

Costco Wholesale (COST - Free Report)

Being stuck at home during this pandemic reinforced the benefits of buying in bulk, which was a boon for leading warehouse club operator Costco Wholesale (COST - Free Report) . But even in more “normal” times, the efficiency and savings of shopping at a store like COST is apparent. Why buy just a few bags of potato chips for the game when you can spend a little bit more and get 14 bags?

Oh, and if you need a 75” QLED TV and sectional sofa to watch the game, that can be arranged as well. COST can provide everything but the house itself, including big containers of headache pills and antacids for the day after.

Costco is one of the largest warehouse club operators in the country with nearly 570 stores here in the U.S. and dozens more around the world (820 warehouses in total). Shares are up more than 40% so far this year.

October sales results remained robust with net sales jumping 19.2% to $16.47 billion, exceeding the September print of 15.8%. Same-store sales were up 17.5%, while e-commerce same-store sales accelerated 16.5% as part of the company’s omni-channel adoption.

COST has now beaten the Zacks Consensus Estimate in four of the past five quarters. Earnings per share came to $3.90 in its fiscal fourth quarter, which eclipsed expectations by nearly 10%. Revenue jumped 17.4% to $62.7 billion, while same-store sales were up 15.5%. Importantly, e-commerce same-store sales rose 11.2%.

These strong results were due to the company’s growth strategies, improved price management, membership gains and e-commerce penetration. These same factors should keep COST moving in the right direction as life returns to some kind of new normal. As a result, analysts boosted expectations over the past two months.

The Zacks Consensus Estimate for this fiscal year (ending August 2022) and next fiscal year (ending August 2023) are now at $12.15 and $13.30, respectively. Those results are each up by about 5% in the past 60 days, but analysts see year-over-year profit growth of about 9.5%.

AutoNation (AN - Free Report)

When you mix surging consumer demand with manufacturing supply chain disruptions, you can do crazy things like put together six straight record quarters right through an unprecedented pandemic. That’s what AutoNation (AN - Free Report) did in its third-quarter report, as people have been looking for ways to travel safely and avoid that coughing guy on the bus.

AN is the largest automotive retailer in the country with 315 new vehicle franchises from 230 stores (as of Dec 31, 2020). The company’s diversified product mix and multiple streams of income help to reduce risk and generate more earnings and sales growth.

Its business has been divided into three operating segments: Domestic (33% of revenues in 2020); Import (30.4%) and Premium Luxury (36.6%). As part of the Automotive – Retail & Whole Sales space, its in the top 11% of the Zacks Industry Rank. Shares are up nearly 70% so far this year.

In late October, AN earned $5.12 per share in the third quarter, which topped our expectation by 17.7%. That makes 11 straight quarters of outperformance. Revenue of $6.4 billion jumped 18% year over year. The domestic segment increased 33%, while import was up 63% and premium luxury advance 43%.

Historically low new vehicle inventories and the shift toward personal transportation are two factors that drove this growth in the past and should continue to do so in the future. As a result, earnings estimates for this year and next have improved significantly over the past 60 days.

The Zacks Consensus Estimate for this year is now $17.17, which has jumped 12% in that time. Expectations for next year currently suggest a year-over-year decline to $17.12, but that estimate has surged 27% over the past two months… and 2022 hasn’t even started yet.

MaxLinear (MXL - Free Report)

Now what kind of an ‘uptrends’ article would this be without taking a look at the chips? There are several different industries to choose from that are doing well at this time high demand and low supply. Let’s take a look at semiconductor – analog & mixed since it’s in the Top 10% of the Zacks Industry Rank.

MaxLinear (MXL - Free Report) is one of only two names from this area with a Zacks Rank #1 (Strong Buy). The company is a leading provider of RF, analog, digital and mixed-signal integrated circuits. Its current products enable the display of broadband video in a wide range of electronic devices, including cable and terrestrial set top boxes, digital televisions, mobile handsets, personal computers, netbooks, and in-vehicle entertainment devices.

Shares of MXL have jumped over 83% so far this year after beating the Zacks Consensus Estimate for six straight quarters. Most recently, it reported third quarter earnings per share of 75 cents, which beat the Zacks Consensus Estimate by 10.3%.

Revenue of $229.8 million marked an impressive improvement of 47% year over year while also topping the Zacks Consensus Estimate by 1%. The company enjoyed strong demand for its broadband access and connectivity and high-performance analog products.

The company is dealing admirably with the global supply chain constraints that are impacting the entire economy. Analysts like how MXL’s future looks, so they’ve raised estimates over the past two months.

The Zacks Consensus Estimate for this year is up to $2.68, which marks an advance of 13% in 60 days. Next year is now at $3.15, or more than 14% better in the timeframe. Most importantly though, analysts expect year over year improvement of 17.5%.