-

AAPL

Apple

-

#1

-

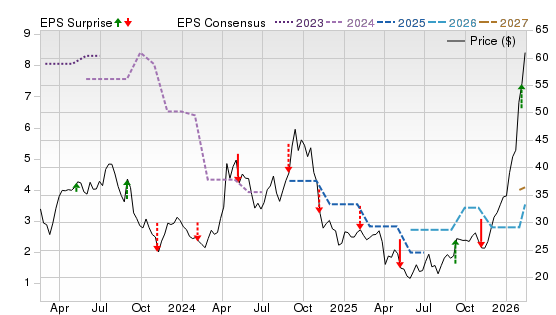

NVDA

NVIDIA

-

#2

-

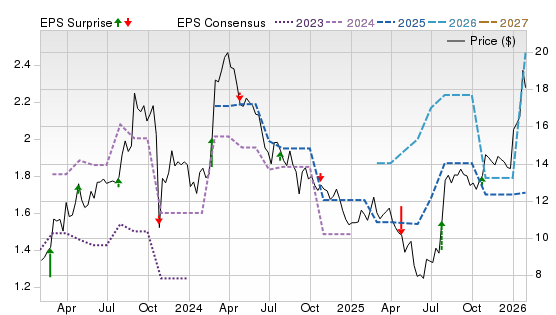

MU

Micron Technology

-

#3

-

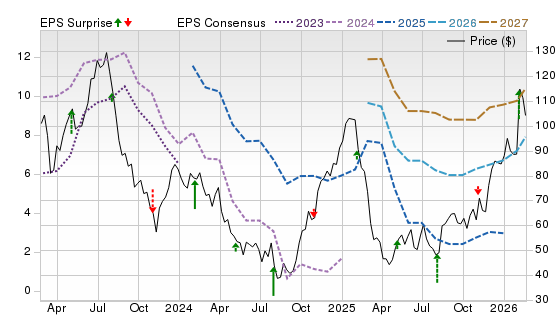

AVGO

Broadcom

-

#4

-

PLTR

Palantir Technologies

-

#5

-

MSFT

Microsoft

-

#6

-

AMZN

Amazon.com

-

#7

Strong Buy

Strong Buy