IRobot makes robotic vacuums and more. The company has also entered into a totally different and potentially important market. Still, IRBT shares have been on a wild up and down ride over the last five years and things have been just as crazy during the past 12 months.

The Short Story

Bedford, Massachusetts-based iRobot makes and sells small household robot cleaners that glide around the floor to help tidy up. The Roomba robotic vacuum drove sales for years. Today, iRobot’s Roomba portfolio includes multiple vacuum models that range in price from around $275 to over $1,000.

The company also sells various Braava robot mops and it entered the handheld vacuum space. Outside of cleaning, iRobot now sells educational robots designed to help children learn how to code. Its Root coding robots start at $129.99 and could turn into hits as parents look to help their kids get a leg up on the future.

IRobot’s revenue growth has been strong over the past decade. But Wall Street has never really been convinced of its long-term business model, with IRBT stock up only 18% in the last five years. This lags way behind the S&P 500’s 120% run and the tech sector’s 163%.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Bottom Line

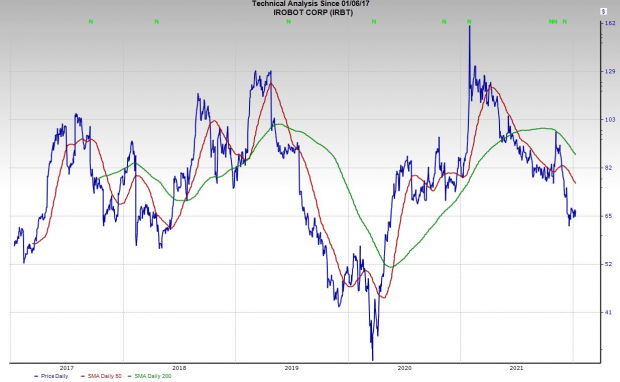

IRBT stock is also heavily shorted (26% of shares outstanding). This contributes to its wild swings and helped it get caught up in the meme-stock mania of early 2021. IRobot shares are down 20% in the last year and 30% since early November. And IRBT shares are currently hovering far below both their 50-day and 200-day moving averages.

Zacks estimates call for iRobot’s adjusted FY21 earnings to sink 65% from the last year on 10% higher sales. It is projected to post solid growth next year. However, its earnings estimates have tumbled since its Q3 report amid global supply chain setbacks, rising costs, and other headwinds.

IRobot’s FY22 consensus EPS figure is down 30% compared to where it was 30 days ago. IRBT’s overall earnings revisions activity helps it land a Zacks Rank #5 (Strong Sell) right now. The stock also lands an overall “F” VGM score and iRobot is part of an industry that sits in the bottom 6% of over 250 Zacks industries right now.

Bear of the Day: iRobot Corp. (IRBT)

IRobot makes robotic vacuums and more. The company has also entered into a totally different and potentially important market. Still, IRBT shares have been on a wild up and down ride over the last five years and things have been just as crazy during the past 12 months.

The Short Story

Bedford, Massachusetts-based iRobot makes and sells small household robot cleaners that glide around the floor to help tidy up. The Roomba robotic vacuum drove sales for years. Today, iRobot’s Roomba portfolio includes multiple vacuum models that range in price from around $275 to over $1,000.

The company also sells various Braava robot mops and it entered the handheld vacuum space. Outside of cleaning, iRobot now sells educational robots designed to help children learn how to code. Its Root coding robots start at $129.99 and could turn into hits as parents look to help their kids get a leg up on the future.

IRobot’s revenue growth has been strong over the past decade. But Wall Street has never really been convinced of its long-term business model, with IRBT stock up only 18% in the last five years. This lags way behind the S&P 500’s 120% run and the tech sector’s 163%.

Bottom Line

IRBT stock is also heavily shorted (26% of shares outstanding). This contributes to its wild swings and helped it get caught up in the meme-stock mania of early 2021. IRobot shares are down 20% in the last year and 30% since early November. And IRBT shares are currently hovering far below both their 50-day and 200-day moving averages.

Zacks estimates call for iRobot’s adjusted FY21 earnings to sink 65% from the last year on 10% higher sales. It is projected to post solid growth next year. However, its earnings estimates have tumbled since its Q3 report amid global supply chain setbacks, rising costs, and other headwinds.

IRobot’s FY22 consensus EPS figure is down 30% compared to where it was 30 days ago. IRBT’s overall earnings revisions activity helps it land a Zacks Rank #5 (Strong Sell) right now. The stock also lands an overall “F” VGM score and iRobot is part of an industry that sits in the bottom 6% of over 250 Zacks industries right now.