5 Best Cheap Stocks to Buy Today

| Company (Ticker) | 12 Week Price Change | Forward PE | Price | Proj EPS Growth (1 Year) | Projected Sales Growth (1Y) |

|---|---|---|---|---|---|

| Skillsoft (SKIL) | -27.57% | 2.15 | $9.00 | -3.70% | -3.55% |

| Ironwood Pharmaceuticals (IRWD) | 174.87% | 6.76 | $4.79 | 375.00% | 22.66% |

| Drilling Tools International Corp. (DTI) | 78.08% | 26.00 | $3.75 | 650.00% | 0.59% |

| Designer Brands (DBI) | 94.10% | NA | $6.51 | -107.41% | -4.03% |

| Vince Holding (VNCE) | -6.81% | 10.83 | $2.69 | 26.32% | 2.11% |

*Updated on January 28, 2026.

Skillsoft (SKIL)

$9.00 USD +0.04 (0.45%)

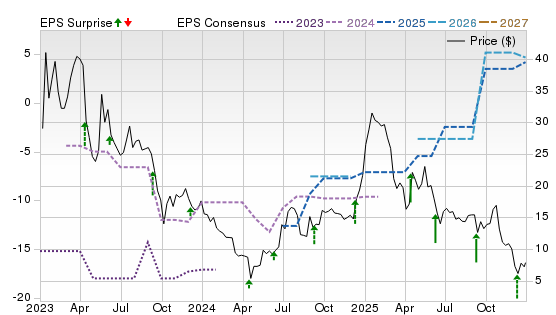

3-Year Stock Price Performance

Premium Research for SKIL

- Zacks Rank

- Strong Buy 1

- Style Scores

A Value B Growth F Momentum A VGM

- Market Cap:$77.78 M (Micro Cap)

- Projected EPS Growth:-3.70%

- Last Quarter EPS Growth:172.34%

- Last EPS Surprise:30.95%

- Next EPS Report date: April 13, 2026

Our Take:

Skillsoft is a corporate learning company focused on digital content and its Percipio skills intelligence platform. Its market cap is $77.8 million. The Zacks Rank #1 (Strong Buy) reflects positive estimate revisions, and Style scores of A for Value and B for Growth argue that subdued expectations are resetting as fundamentals stabilize despite a weak Momentum score of F.

In Q3 fiscal 2026, Skillsoft began onboarding large enterprises to its next-generation Percipio platform, with AI now driving over half of content production. Despite macro-driven revenue pressure, adjusted EBITDA remained resilient, and management reaffirmed expectations for positive free cash flow for fiscal 2026.

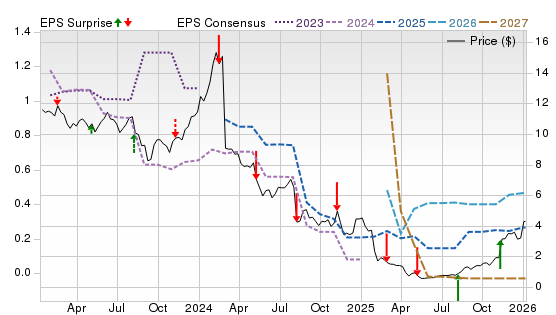

On the Price, Consensus & EPS Surprise chart, the 2026–2027 consensus lines have begun to tick up after a long slide, while the stock has bottomed and started to recover, an emerging setup of rising out-year estimates against a depressed valuation that supports a contrarian entry.

See more from Zacks Research for This Ticker

Normally $25 each - click below to receive one report FREE:

Ironwood Pharmaceuticals (IRWD)

$4.79 USD -0.35 (-6.81%)

3-Year Stock Price Performance

Premium Research for IRWD

- Zacks Rank

Strong Buy 1

Strong Buy 1

- Style Scores

A Value B Growth C Momentum A VGM

- Market Cap:$842.67 M (Small Cap)

- Projected EPS Growth:300.00%

- Last Quarter EPS Growth:71.43%

- Last EPS Surprise:166.67%

- Next EPS Report date:Feb. 26, 2026

Our Take:

Ironwood is a GI-focused biopharma best known for LINZESS. Its market cap is $842.7 million. A Zacks Rank #1 with Style scores of A for Value and B for Growth and Momentum indicates favorable revisions alongside reasonable valuation and improving sentiment.

The company closed 2025 on track to meet the low end of its LINZESS U.S. net sales and revenue targets and exited the year with more than $200 million in cash, reflecting solid profitability and liquidity. Looking ahead, management introduced 2026 guidance calling for higher LINZESS U.S. net sales and adjusted EBITDA exceeding $300 million, supported by pricing actions, steady demand growth, and continued cost discipline.

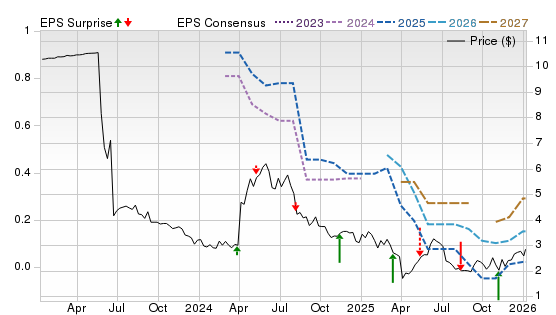

On the chart, out-year consensus estimates have stabilized and edged higher after a prolonged downturn, and the share price has begun to follow, an alignment that suggests the reset may be behind the stock.

See more from Zacks Research for This Ticker

Normally $25 each - click below to receive one report FREE:

Drilling Tools International Corp. (DTI)

$3.75 USD -0.15 (-3.85%)

3-Year Stock Price Performance

Premium Research for DTI

- Zacks Rank

- Strong Buy 1

- Style Scores

B Value C Growth C Momentum A VGM

- Market Cap:$146.07 M (Micro Cap)

- Projected EPS Growth:-93.55%

- Last Quarter EPS Growth:200.00%

- Last EPS Surprise:300.00%

- Next EPS Report date:March 12, 2026

Our Take:

Drilling Tools International rents specialized tools for horizontal and directional drilling. Its market cap is $146.1 million. A Zacks Rank #1 with a Value score of B and Growth score of C points to estimate support at a still-reasonable valuation, while a Momentum score of F shows recent trading momentum remains weak.

The company operates a predominantly North America–centric platform, with approximately 85% of revenue generated in the Western Hemisphere and a growing 15% contribution from the Eastern Hemisphere following multiple international acquisitions. Its integrated model, anchored by a large rental fleet, in-house manufacturing and repair, and disciplined capital allocation, drives fleet utilization while avoiding speculative newbuild risk.

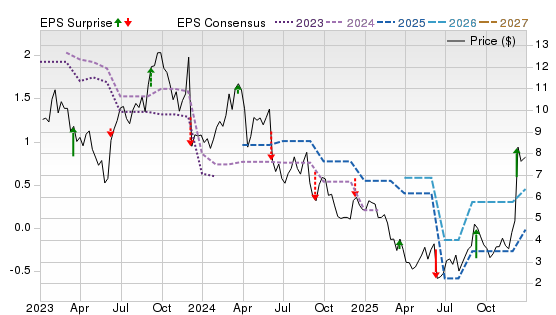

On the chart, 2026–2027 estimates have stopped falling and are curling higher as shares base, a constructive setup consistent with the Rank. For investors seeking energy services at a discount, the improving revisions trend is the near-term driver.

See more from Zacks Research for This Ticker

Normally $25 each - click below to receive one report FREE:

Designer Brands (DBI)

$6.51 USD -0.40 (-5.79%)

3-Year Stock Price Performance

Premium Research for DBI

- Zacks Rank

- Strong Buy 1

- Style Scores

A Value C Growth D Momentum B VGM

- Market Cap:$366.31 M (Small Cap)

- Projected EPS Growth:-107.41%

- Last Quarter EPS Growth:11.76%

- Last EPS Surprise:111.11%

- Next EPS Report date:March 19, 2026

Our Take:

Designer Brands designs, produces, and sells footwear and accessories through retail stores, e-commerce platforms, and wholesale distribution. Its market cap is about $366.3 million. Despite earlier volatility, the Zacks Rank #1 with a Value score of A, a Growth Score of C, and a Momentum Score of D points to strengthening estimates at an attractive, undemanding valuation.

Looking ahead, Designer Brands’ improved margins and profitability may enhance resilience in a choppy demand backdrop. Continued restraint in promotions, greater contribution from non-product revenue, and tighter cost control could help protect gross margin. Although logistics costs remain elevated, inventory discipline and expense management may support operating performance amid ongoing macroeconomic and trade uncertainty.

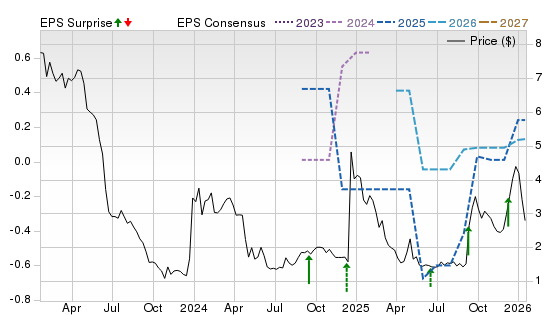

On the chart, consensus for 2026 has lifted from mid-year lows as price forms a bottoming pattern. That emerging convergence of rising estimates and basing price action supports the case for multiple recovery.

See more from Zacks Research for This Ticker

Normally $25 each - click below to receive one report FREE:

Vince Holding (VNCE)

$2.69 USD +0.09 (3.46%)

3-Year Stock Price Performance

Premium Research for VNCE

- Zacks Rank

- Strong Buy 1

- Style Scores

A Value D Growth D Momentum C VGM

- Market Cap:$35.08 M (Micro Cap)

- Projected EPS Growth:26.32%

- Last Quarter EPS Growth:-44.74%

- Last EPS Surprise:90.91%

- Next EPS Report date:May 1, 2026

Our Take:

Vince operates a global retail platform for a luxury women’s and men’s ready-to-wear brand. Its market cap is roughly $35.1 million. A Zacks Rank #1 alongside a Style Score of A for Value points to favorable revisions and a depressed valuation, while a weaker Growth and Momentum score of D reflects tariff and direct sales challenges.

The company’s holiday performance reinforces a positive near-term outlook, with total net sales up 5.3% year over year, driven by strong 9.7% growth in direct-to-consumer, underscoring continued momentum in its strategic focus areas. Management indicated results are tracking in line with prior guidance, with adjusted EBITDA and adjusted operating income margins trending toward the high end of expectations for Q4 and full-year 2025, supported by disciplined pricing, promotional balance, and cost management.

On the chart, after a steep decline, the 2026–2027 consensus lines have inflected higher as the stock rebounds from lows.

See more from Zacks Research for This Ticker

Normally $25 each - click below to receive one report FREE:

Methodology

The Zacks Rank is a proprietary stock-rating model that uses trends in earnings estimate revisions and earnings-per-share (EPS) surprises to classify stocks into five groups: #1 (Strong Buy), #2 (Buy), #3 (Hold), #4 (Sell) and #5 (Strong Sell). The Zacks Rank is calculated through four primary factors related to earnings estimates: analysts' consensus on earnings estimate revisions, the magnitude of revision change, the upside potential and estimate surprise (or the degree in which earnings per share deviated from the previous quarter).

Zacks builds the data from 3,000 analysts at over 150 different brokerage firms. The average yearly gain for Zacks Rank #1 (Strong Buy) stocks is +23.62% per year from January, 1988, through June 2, 2025.

Selections for Best Cheap Stocks Under $10 are based on the current top ranking stocks based on Zacks Indicator Score, Style Scores and fundamentals. For this list, only companies that have average daily trading volumes of 100,000 shares or more were considered, as well as companies from the top 50% of all industries. All information is current as of market open, Jan. 28, 2026.

General Questions About Cheap Stocks

What are the Benefits of Buying Cheap Stocks?

Cheap stocks can make investing more accessible, especially for investors who don’t want to commit large sums to a single position. Because these stocks trade at lower prices, investors can spread their capital across multiple companies, sectors, or strategies, helping improve diversification.

In addition, many stocks fall below $10 not because the underlying business is broken, but because of temporary challenges such as economic slowdowns, industry cycles, earnings volatility, or broader market sell-offs. When conditions improve, these stocks may rebound sharply, offering attractive upside potential. Cheap stocks can also provide exposure to undervalued or overlooked sectors that are out of favor but poised for recovery.

Learn more about Cheap Stocks Under $10 from Zacks.

What are the Risks of Buying Cheap Stocks?

The primary risk with cheap stocks is that their low price may reflect genuine business problems rather than temporary setbacks. These companies often experience higher volatility, meaning prices can swing sharply in either direction. Many also have weaker balance sheets, higher debt loads, or limited cash reserves, making them more vulnerable during economic downturns.

Additionally, cheap stocks may face challenges raising capital, maintaining profitability, or competing with larger rivals. Without careful analysis, investors risk buying into so-called “value traps” — stocks that appear inexpensive but continue to decline because fundamentals fail to improve.

Can Cheap Stocks Actually Make Money?

Yes, cheap stocks can generate meaningful returns when purchased at the right time and for the right reasons. Numerous well-known companies have traded below $10 during periods of market stress, corporate restructuring, or industry downturns before eventually recovering.

That said, success is far from guaranteed. Cheap stocks tend to require patience, a willingness to tolerate volatility, and a focus on long-term business trends rather than short-term price movements.

Are Cheap Stocks a Good Investment for Beginners?

Cheap stocks can be suitable for beginners if approached cautiously. Their lower price points allow new investors to learn portfolio management, diversification, and risk control without committing excessive capital.

However, beginners should avoid concentrating too much money in a single cheap stock or chasing speculative names purely because they look inexpensive. Focusing on established companies, clear business models, and basic fundamentals can help reduce risk while building investing experience.

What is the Difference Between Cheap Stocks and Penny Stocks?

Cheap stocks generally trade under $10 but are listed on major exchanges like the NYSE or Nasdaq and are required to meet stricter regulatory and reporting standards. Penny stocks, by contrast, often trade under $5 — and frequently under $1 — and are commonly found on over-the-counter (OTC) markets.

Penny stocks typically carry far higher risk due to low liquidity, limited transparency, and greater susceptibility to manipulation. While some cheap stocks are speculative, they usually offer better disclosure and stability than penny stocks.

How to Select Fundamentally Strong Cheap Stocks

How can I Analyze a Cheap Stock's Potential?

Analyzing a cheap stock starts with examining its financial health and business model. Key areas to review include revenue growth trends, profitability or progress toward profitability, debt levels, and cash flow generation. Investors should also evaluate the company’s competitive position within its industry, the durability of its products or services, and management’s long-term strategy.

Beyond the numbers, it’s important to consider industry tailwinds, upcoming catalysts such as new products or restructuring efforts, and whether the company has a credible path to improving performance.

How do I Know if a Stock is Cheap or Just Bad?

A truly cheap stock trades at a low valuation relative to its future earnings potential, assets, or cash flow, often due to temporary challenges. These companies usually have a realistic plan for recovery, cost control, or growth.

A bad stock, on the other hand, lacks earnings visibility, suffers from persistent losses, carries excessive debt, or operates in a declining or obsolete industry. If management cannot articulate a clear strategy for improvement, or if fundamentals continue to deteriorate, the stock may remain cheap for the wrong reasons.

Strategy and Portfolio Building with Cheap Stocks

Is it Better to Buy 100 Shares of a Cheap Stock, or 1 Share of an Expensive Stock?

The number of shares owned is largely irrelevant. What matters is the percentage return on investment and the level of risk taken. A single share of a high-quality company can outperform hundreds of shares of a struggling business. Investors should focus on expected returns, downside risk, and how each position fits within the broader portfolio.

How do I Build a Diversified Portfolio Using Cheap Stocks?

Diversification with cheap stocks involves spreading investments across multiple sectors, industries, and business models. Combining growth-oriented names with income or value stocks can help balance risk and reward. Limiting position sizes — especially for more speculative companies — helps prevent any single stock from dominating portfolio performance.

How can I Screen for Cheap Stocks with Growth Potential?

Investors can use stock screeners to identify candidates by filtering for price, market capitalization, revenue growth, manageable debt levels, and improving margins. Additional filters such as analyst earnings revisions, insider buying, or strong free cash flow can further refine results. Screening helps narrow the field, but deeper research is still essential before investing.

Cheap Stock Investing Through ETFs

What are Some Good ETFs that Hold Cheap or Value Stocks?

Investors who prefer diversification over picking individual stocks may consider value-focused ETFs. Examples include:

- Vanguard Value ETF (VTV).

- iShares Russell 2000 Value ETF (IWN).

- SPDR Portfolio S&P 600 Small Cap Value ETF (SLYV).

These funds hold baskets of undervalued stocks across multiple sectors and market capitalizations. ETFs can reduce single-stock risk while still providing exposure to companies trading at attractive valuations.