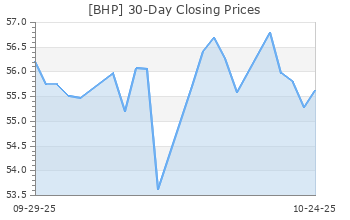

BHP Group Limited (BHP)

(Delayed Data from NYSE)

$56.43 USD

-0.78 (-1.36%)

Updated Apr 26, 2024 04:00 PM ET

After-Market: $56.43 0.00 (0.00%) 7:58 PM ET

3-Hold of 5 3

B Value B Growth D Momentum B VGM

Company Summary

BHP Group Limited is one of the world's largest diversified resource companies with operations across several continents with a market capitalization of around $146 billion. It earlier operated under a Dual Listed Company structure with two parent companies with separate legal structures and share registers — BHP Group Limited, incorporated in Australia and BHP Group Plc, incorporated in the U.K. It has unified its dual listed company structure under its existing Australian parent company, BHP Group Limited.

BHP Group owns and operates large, long-life, low-cost and expandable assets worldwide. Its asset portfolio is ...

Company Summary

BHP Group Limited is one of the world's largest diversified resource companies with operations across several continents with a market capitalization of around $146 billion. It earlier operated under a Dual Listed Company structure with two parent companies with separate legal structures and share registers — BHP Group Limited, incorporated in Australia and BHP Group Plc, incorporated in the U.K. It has unified its dual listed company structure under its existing Australian parent company, BHP Group Limited.

BHP Group owns and operates large, long-life, low-cost and expandable assets worldwide. Its asset portfolio is well diversified – by commodity, geography and market. A diversified portfolio, lower costs and continued focus on technology and innovation provides it an edge over peers. Population growth and rising living standards are expected to continue generating demand for energy, metals and fertilizers for years to come, which will drive BHP Group’s growth.

The company has more than 72,000 employees and contractors, who work in over 90 locations worldwide. It engages in exploration, development, and production of oil and gas properties; and mining of copper, silver, lead, zinc, molybdenum, uranium, gold, and iron ores, as well as metallurgical and energy coal. It also engages in the mining, smelting, and refining of nickel and potash development activities. Its products are sold worldwide, with sales and marketing led through Singapore and Houston, United States. It manages product distribution through global logistics chain, including freight and pipeline transportation. It sells products through direct supply agreements with customers and on global commodity exchanges.

Its segments are-

The Iron Ore segment (around 52% of the company’s revenues) is engaged in mining of iron ore.

The Copper segment (around 28% of the company’s revenues) is engaged in mining of copper, silver, lead, zinc, molybdenum, uranium and gold.

The Coal segment (around 18% of the company’s revenues) is engaged in mining of metallurgic and thermal coal.

The company completed the merger of its Petroleum business with Woodside Petroleum Ltd, which created a global top 10 independent energy company by production.

General Information

BHP Group Limited Sponsored ADR

16/171 COLLINS STREET MELBOURNE

VICTORIA, C3 3000

Phone: 011611300554757

Fax: 61-3-9609-3015

Web: http://www.bhp.com

Email: citibank@shareholders-online.com

| Industry | Mining - Miscellaneous |

| Sector | Basic Materials |

| Fiscal Year End | June |

| Last Reported Quarter | 3/31/2024 |

| Exp Earnings Date | NA |

EPS Information

| Current Quarter EPS Consensus Estimate | NA |

| Current Year EPS Consensus Estimate | 5.41 |

| Estimated Long-Term EPS Growth Rate | 3.00 |

| Exp Earnings Date | NA |

Price and Volume Information

| Zacks Rank | |

| Yesterday's Close | 57.21 |

| 52 Week High | 69.11 |

| 52 Week Low | 54.28 |

| Beta | 0.96 |

| 20 Day Moving Average | 2,768,603.50 |

| Target Price Consensus | 63.67 |

| 4 Week | -0.83 |

| 12 Week | -7.67 |

| YTD | -16.25 |

| 4 Week | 3.21 |

| 12 Week | -10.27 |

| YTD | -20.87 |

| Shares Outstanding (millions) | 2,532.91 |

| Market Capitalization (millions) | 144,907.80 |

| Short Ratio | NA |

| Last Split Date | 7/13/2001 |

| Dividend Yield | 4.98% |

| Annual Dividend | $2.85 |

| Payout Ratio | NA |

| Change in Payout Ratio | NA |

| Last Dividend Payout / Amount | 3/7/2024 / $1.42 |

Fundamental Ratios

| P/E (F1) | 10.59 |

| Trailing 12 Months | NA |

| PEG Ratio | 3.53 |

| vs. Previous Year | NA |

| vs. Previous Quarter | NA |

| vs. Previous Year | NA% |

| vs. Previous Quarter | NA% |

| Price/Book | 3.18 |

| Price/Cash Flow | 8.04 |

| Price / Sales | NA |

| 3/31/24 | NA |

| 12/31/23 | NA |

| 9/30/23 | NA |

| 3/31/24 | NA |

| 12/31/23 | NA |

| 9/30/23 | NA |

| 3/31/24 | NA |

| 12/31/23 | 1.57 |

| 9/30/23 | NA |

| 3/31/24 | NA |

| 12/31/23 | 1.22 |

| 9/30/23 | NA |

| 3/31/24 | NA |

| 12/31/23 | NA |

| 9/30/23 | NA |

| 3/31/24 | NA |

| 12/31/23 | NA |

| 9/30/23 | NA |

| 3/31/24 | NA |

| 12/31/23 | NA |

| 9/30/23 | NA |

| 3/31/24 | NA |

| 12/31/23 | 18.00 |

| 9/30/23 | NA |

| 3/31/24 | NA |

| 12/31/23 | NA |

| 9/30/23 | NA |

| 3/31/24 | NA |

| 12/31/23 | 0.43 |

| 9/30/23 | NA |

| 3/31/24 | NA |

| 12/31/23 | 30.03 |

| 9/30/23 | NA |