Costco Wholesale (COST)

(Real Time Quote from BATS)

$901.54 USD

-15.54 (-1.70%)

Updated Sep 24, 2024 03:55 PM ET

After-Market: $901.00 -0.54 (-0.06%) 4:10 PM ET

3-Hold of 5 3

B Value B Growth A Momentum A VGM

Company Summary

Based in Issaquah, Washington, Costco Wholesale Corporation sells high volumes of foods and general merchandise (including household products and appliances) at discounted prices through membership warehouses. It is one of the largest warehouse club operators in the United States. The company also operates e-commerce sites in the United States, Canada, the United Kingdom, Mexico, Korea, Taiwan, Japan and Australia.

The company’s warehouses offer an array of low-priced nationally branded and select private labeled products in a wide range of merchandise categories. Costco offers three types of memberships to its customers: Business, Gold ...

Company Summary

Based in Issaquah, Washington, Costco Wholesale Corporation sells high volumes of foods and general merchandise (including household products and appliances) at discounted prices through membership warehouses. It is one of the largest warehouse club operators in the United States. The company also operates e-commerce sites in the United States, Canada, the United Kingdom, Mexico, Korea, Taiwan, Japan and Australia.

The company’s warehouses offer an array of low-priced nationally branded and select private labeled products in a wide range of merchandise categories. Costco offers three types of memberships to its customers: Business, Gold Star (individual), and Executive.

As of Sep 5, 2024, Costco operates 890 warehouses, including 614 in the United States and Puerto Rico, 108 in Canada, 40 in Mexico, 35 in Japan, 29 in the United Kingdom, 19 in Korea, 15 in Australia, 14 in Taiwan, seven in China, four in Spain, two in France, and one each in Iceland, New Zealand and Sweden.

Costco generates revenue from two sources: 1) Store sales (Net sales; 98% of fiscal 2022 total revenue) and 2) Membership fees (MFI; 2% of fiscal 2022 total revenue).

Costco offers a myriad of food products as well as a vast range of household and lifestyle products, stationeries and appliances. The company also sells gasoline to customers at cheap prices. It offers merchandise in the following categories:

Food and Sundries (including dry foods, packaged foods, groceries, snack foods, candy, alcoholic and nonalcoholic beverages, and

cleaning supplies)

Hardlines (including major appliances, electronics, health and beauty aids, hardware, and garden and patio)

Fresh Foods (including meat, produce, deli, and bakery)

Softlines (including apparel and small appliances)

Ancillary (including gasoline and pharmacy businesses).

General Information

Costco Wholesale Corporation

999 LAKE DRIVE

ISSAQUAH, WA 98027

Phone: 425-313-8100

Fax: 425-313-6593

Email: investor@costco.com

| Industry | Retail - Discount Stores |

| Sector | Retail-Wholesale |

| Fiscal Year End | August |

| Last Reported Quarter | 8/31/2024 |

| Earnings Date | 9/26/2024 |

EPS Information

| Current Quarter EPS Consensus Estimate | 5.05 |

| Current Year EPS Consensus Estimate | 16.22 |

| Estimated Long-Term EPS Growth Rate | 9.30 |

| Earnings Date | 9/26/2024 |

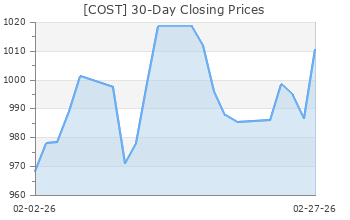

Price and Volume Information

| Zacks Rank | |

| Yesterday's Close | 917.08 |

| 52 Week High | 923.83 |

| 52 Week Low | 540.23 |

| Beta | 0.80 |

| 20 Day Moving Average | 1,774,498.00 |

| Target Price Consensus | 898.07 |

| 4 Week | 2.75 |

| 12 Week | 8.44 |

| YTD | 38.94 |

| 4 Week | 0.93 |

| 12 Week | 3.83 |

| YTD | 15.89 |

| Shares Outstanding (millions) | 443.33 |

| Market Capitalization (millions) | 406,573.72 |

| Short Ratio | NA |

| Last Split Date | 1/14/2000 |

| Dividend Yield | 0.51% |

| Annual Dividend | $4.64 |

| Payout Ratio | 0.29 |

| Change in Payout Ratio | 0.00 |

| Last Dividend Payout / Amount | 7/26/2024 / $1.16 |

Fundamental Ratios

| P/E (F1) | 51.96 |

| Trailing 12 Months | 57.93 |

| PEG Ratio | 5.57 |

| vs. Previous Year | 10.20% |

| vs. Previous Quarter | 1.89% |

| vs. Previous Year | 9.07% |

| vs. Previous Quarter | 0.12% |

| Price/Book | 18.67 |

| Price/Cash Flow | 47.23 |

| Price / Sales | 1.60 |

| 8/31/24 | Pending Next EPS Report |

| 5/31/24 | 30.02 |

| 2/29/24 | 28.80 |

| 8/31/24 | Pending Next EPS Report |

| 5/31/24 | 10.16 |

| 2/29/24 | 9.98 |

| 8/31/24 | Pending Next EPS Report |

| 5/31/24 | 0.94 |

| 2/29/24 | 0.93 |

| 8/31/24 | Pending Next EPS Report |

| 5/31/24 | 0.45 |

| 2/29/24 | 0.43 |

| 8/31/24 | Pending Next EPS Report |

| 5/31/24 | 2.77 |

| 2/29/24 | 2.76 |

| 8/31/24 | Pending Next EPS Report |

| 5/31/24 | 2.83 |

| 2/29/24 | 2.73 |

| 8/31/24 | Pending Next EPS Report |

| 5/31/24 | 3.78 |

| 2/29/24 | 3.65 |

| 8/31/24 | Pending Next EPS Report |

| 5/31/24 | 49.11 |

| 2/29/24 | 46.81 |

| 8/31/24 | Pending Next EPS Report |

| 5/31/24 | 12.84 |

| 2/29/24 | 12.81 |

| 8/31/24 | Pending Next EPS Report |

| 5/31/24 | 0.27 |

| 2/29/24 | 0.28 |

| 8/31/24 | Pending Next EPS Report |

| 5/31/24 | 21.13 |

| 2/29/24 | 22.03 |