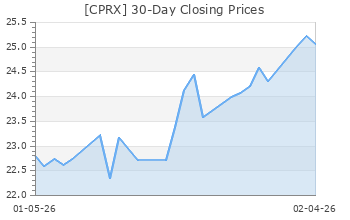

Catalyst Pharmaceuticals (CPRX)

(Delayed Data from NSDQ)

$17.59 USD

+0.22 (1.27%)

Updated Jul 26, 2024 04:00 PM ET

After-Market: $17.41 -0.18 (-1.02%) 7:58 PM ET

5-Strong Sell of 5 5

C Value A Growth C Momentum B VGM

Company Summary

Coral Gables, FL-based Catalyst Pharmaceuticals, Inc. is a commercial-stage biopharmaceutical company, focused on the development and commercialization of therapies targeting rare and difficult-to-treat diseases.

In October 2012, Catalyst in-licensed rights to Firdapse (amifampridine phosphate) from BioMarin Pharmaceutical Inc. to develop and commercialize the product in the United States. Firdapse is currently approved in the European Union as well as in the United States for the symptomatic treatment of LEMS in adults.

The company is also strengthening the commercial portfolio of Firdapse. It already received multiple patents that cover the treatment of ...

Company Summary

Coral Gables, FL-based Catalyst Pharmaceuticals, Inc. is a commercial-stage biopharmaceutical company, focused on the development and commercialization of therapies targeting rare and difficult-to-treat diseases.

In October 2012, Catalyst in-licensed rights to Firdapse (amifampridine phosphate) from BioMarin Pharmaceutical Inc. to develop and commercialize the product in the United States. Firdapse is currently approved in the European Union as well as in the United States for the symptomatic treatment of LEMS in adults.

The company is also strengthening the commercial portfolio of Firdapse. It already received multiple patents that cover the treatment of all amifampridine metabolizer types within the LEMS patient population. As a result, these patents will now provide intellectual property protection to Firdapse through 2034.

Catalyst also received FDA approval in September 2022 for its supplemental new drug application (sNDA) for Firdapse (amifampridine) tablets in 10 mg dosage to include pediatric patients (six years and older) for treating LEMS. In May, the FDA approved the company’s sNDA seeking to increase the maximum dosage strength of Firdapsefrom 80 mg to 100 mg for LEMS.

On Jan 25, Catalyst announced the successful acquisition of the U.S. rights for Fycompa (perampanel) CIII, from Eisai Co., Ltd. This has now diversified Catalyst’s portfolio with the addition of a commercial-stage epilepsy asset. Catalyst began marketing the product through its own sales organization in May 2023. In July 2023, the company also acquired North American rights to Santhera’s vamorolone, an investigational dissociative steroid, which has been approved by the FDA and consequently launched for the treatment of Duchenne Muscular Dystrophy (DMD), under the brand name Agamree.

Catalyst currently expects to attribute its future development costs, principally toward the continued development of Firdapse, Fycompa and Agamree. However, the company is currently focusing on acquiring the rights to late-stage products to treat rare central nervous system and adjacent rare diseases, as part of its efforts to diversify its business, as well as invest in innovative opportunities.

Catalyst recorded total revenues worth $398.2 million in 2023, reflecting an increase of 85.3% year over year.

General Information

Catalyst Pharmaceuticals, Inc

355 ALHAMBRA CIRCLE SUITE 801

CORAL GABLES, FL 33134

Phone: 305-420-3200

Fax: 305-529-0933

Web: http://www.catalystpharma.com

Email: mcoleman@catalystpharma.com

| Industry | Medical - Drugs |

| Sector | Medical |

| Fiscal Year End | December |

| Last Reported Quarter | 6/30/2024 |

| Earnings Date | 8/7/2024 |

EPS Information

| Current Quarter EPS Consensus Estimate | 0.42 |

| Current Year EPS Consensus Estimate | 1.75 |

| Estimated Long-Term EPS Growth Rate | NA |

| Earnings Date | 8/7/2024 |

Price and Volume Information

| Zacks Rank | |

| Yesterday's Close | 17.37 |

| 52 Week High | 17.99 |

| 52 Week Low | 11.55 |

| Beta | 0.71 |

| 20 Day Moving Average | 790,607.44 |

| Target Price Consensus | 27.29 |

| 4 Week | 15.49 |

| 12 Week | 15.65 |

| YTD | 3.33 |

| 4 Week | 17.28 |

| 12 Week | 8.47 |

| YTD | -8.71 |

| Shares Outstanding (millions) | 118.11 |

| Market Capitalization (millions) | 2,051.66 |

| Short Ratio | NA |

| Last Split Date | NA |

| Dividend Yield | 0.00% |

| Annual Dividend | $0.00 |

| Payout Ratio | 0.00 |

| Change in Payout Ratio | 0.00 |

| Last Dividend Payout / Amount | NA / $0.00 |

Fundamental Ratios

| P/E (F1) | 9.95 |

| Trailing 12 Months | 17.37 |

| PEG Ratio | NA |

| vs. Previous Year | 19.23% |

| vs. Previous Quarter | -36.73% |

| vs. Previous Year | 15.40% |

| vs. Previous Quarter | -10.91% |

| Price/Book | 3.65 |

| Price/Cash Flow | 8.45 |

| Price / Sales | 4.99 |

| 6/30/24 | NA |

| 3/31/24 | 25.08 |

| 12/31/23 | 26.56 |

| 6/30/24 | NA |

| 3/31/24 | 21.26 |

| 12/31/23 | 22.13 |

| 6/30/24 | NA |

| 3/31/24 | 5.09 |

| 12/31/23 | 2.88 |

| 6/30/24 | NA |

| 3/31/24 | 4.83 |

| 12/31/23 | 2.68 |

| 6/30/24 | NA |

| 3/31/24 | 25.50 |

| 12/31/23 | 24.10 |

| 6/30/24 | NA |

| 3/31/24 | 15.83 |

| 12/31/23 | 17.93 |

| 6/30/24 | NA |

| 3/31/24 | 20.98 |

| 12/31/23 | 23.73 |

| 6/30/24 | NA |

| 3/31/24 | 4.76 |

| 12/31/23 | 3.30 |

| 6/30/24 | NA |

| 3/31/24 | 3.94 |

| 12/31/23 | 4.54 |

| 6/30/24 | NA |

| 3/31/24 | 0.00 |

| 12/31/23 | 0.00 |

| 6/30/24 | NA |

| 3/31/24 | 0.00 |

| 12/31/23 | 0.00 |