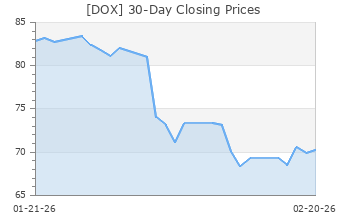

Amdocs (DOX)

(Real Time Quote from BATS)

$86.40 USD

+0.19 (0.22%)

Updated Sep 23, 2024 03:06 PM ET

4-Sell of 5 4

B Value D Growth A Momentum B VGM

Company Summary

Amdocs Limited is one of the leading providers of customer care, billing and order management systems for communications and Internet services.

The company offers amdocsONE, a line of services designed for various stages of a service provider's lifecycle. Moreover, it provides advertising and media services for media publishers, TV networks, video streaming providers, advertising agencies and service providers.

It also provides managed, quality engineering, data and intelligence, cloud enablement, digital business operation, autonomous network service assurance and advisory services. Additionally, Amdocs offers mobile financial services to service providers and financial institutions; ...

Company Summary

Amdocs Limited is one of the leading providers of customer care, billing and order management systems for communications and Internet services.

The company offers amdocsONE, a line of services designed for various stages of a service provider's lifecycle. Moreover, it provides advertising and media services for media publishers, TV networks, video streaming providers, advertising agencies and service providers.

It also provides managed, quality engineering, data and intelligence, cloud enablement, digital business operation, autonomous network service assurance and advisory services. Additionally, Amdocs offers mobile financial services to service providers and financial institutions; and the BriteBill — a multi-channel bill presentment platform — focused on contextual and personalized customer engagements.

The company’s technology is built on the following principles:

Design-led, API-enabled, Cloud flexibility, Microservices, Scalability, Reliability, Modularity, Upgradability and Backwards Compatibility, Virtualization, and Open-Source software.

In fiscal 2023, the company generated revenues of $4.89 billion. Region wise, the company generated 68% of revenues from North America, 14% from Europe and 18% from Rest of the World.

Amdocs has its registered office in St. Peter Port, Guernsey with operating subsidiaries in Canada, Cyprus, India, Ireland, Israel, Switzerland, the United Kingdom and the United States.

The company faces competition from business and operational support systems (BSS/OSS) providers like Oracle, Salesforce and SAP; system integrators and providers of IT services, such as Accenture, Cognizant, HPE, IBM Global Services, Infosys, Tata Consultancy Services, Tech Mahindra and Wipro. Network equipment providers such as Cisco, Ericsson, Huawei and Nokia Networks, among others, also pose significant threat.

General Information

Amdocs Limited

625 Maryville Centre Drive Suite 200

Saint Louis, MO 63141

Phone: 314-212-7000

Fax: 1 314 212 7500

Email: dox_info@amdocs.com

| Industry | Computers - IT Services |

| Sector | Computer and Technology |

| Fiscal Year End | September |

| Last Reported Quarter | 6/30/2024 |

| Exp Earnings Date | 11/5/2024 |

EPS Information

| Current Quarter EPS Consensus Estimate | 1.70 |

| Current Year EPS Consensus Estimate | 6.44 |

| Estimated Long-Term EPS Growth Rate | 9.90 |

| Exp Earnings Date | 11/5/2024 |

Price and Volume Information

| Zacks Rank | |

| Yesterday's Close | 86.21 |

| 52 Week High | 94.04 |

| 52 Week Low | 74.41 |

| Beta | 0.74 |

| 20 Day Moving Average | 612,138.88 |

| Target Price Consensus | 100.50 |

| 4 Week | 0.91 |

| 12 Week | 9.24 |

| YTD | -1.91 |

| 4 Week | -0.29 |

| 12 Week | 4.60 |

| YTD | -17.95 |

| Shares Outstanding (millions) | 117.54 |

| Market Capitalization (millions) | 10,132.78 |

| Short Ratio | NA |

| Last Split Date | NA |

| Dividend Yield | 2.22% |

| Annual Dividend | $1.92 |

| Payout Ratio | 0.35 |

| Change in Payout Ratio | 0.03 |

| Last Dividend Payout / Amount | 6/28/2024 / $0.48 |

Fundamental Ratios

| P/E (F1) | 13.38 |

| Trailing 12 Months | 13.99 |

| PEG Ratio | 1.35 |

| vs. Previous Year | 2.13% |

| vs. Previous Quarter | 4.35% |

| vs. Previous Year | 1.14% |

| vs. Previous Quarter | 0.34% |

| Price/Book | 2.86 |

| Price/Cash Flow | 12.08 |

| Price / Sales | 2.03 |

| 6/30/24 | 17.89 |

| 3/31/24 | 17.85 |

| 12/31/23 | 17.79 |

| 6/30/24 | 9.96 |

| 3/31/24 | 9.95 |

| 12/31/23 | 9.93 |

| 6/30/24 | 1.24 |

| 3/31/24 | 1.32 |

| 12/31/23 | 1.29 |

| 6/30/24 | 1.24 |

| 3/31/24 | 1.32 |

| 12/31/23 | 1.29 |

| 6/30/24 | 12.83 |

| 3/31/24 | 12.94 |

| 12/31/23 | 12.99 |

| 6/30/24 | 10.21 |

| 3/31/24 | 10.62 |

| 12/31/23 | 11.30 |

| 6/30/24 | 12.47 |

| 3/31/24 | 12.69 |

| 12/31/23 | 13.46 |

| 6/30/24 | 30.18 |

| 3/31/24 | 30.52 |

| 12/31/23 | 30.70 |

| 6/30/24 | NA |

| 3/31/24 | NA |

| 12/31/23 | NA |

| 6/30/24 | 0.21 |

| 3/31/24 | 0.21 |

| 12/31/23 | 0.21 |

| 6/30/24 | 17.62 |

| 3/31/24 | 17.55 |

| 12/31/23 | 17.48 |