FTI Consulting (FCN)

(Delayed Data from NYSE)

$227.10 USD

+1.84 (0.82%)

Updated Sep 20, 2024 04:00 PM ET

After-Market: $227.03 -0.07 (-0.03%) 7:58 PM ET

3-Hold of 5 3

C Value A Growth B Momentum B VGM

Company Summary

Based in Baltimore, Maryland, and founded in 1982, FTI Consulting is a global business advisory firm aimed at helping organizations manage change, mitigate risk and resolve financial, legal, operational, political and regulatory, reputational and transactional disputes. The company provides specialized consulting services across 57 foreign countries with a total headcount of more than 7,990 employees. The company has a team of highly qualified professionals, who provide problem-solving and technology services primarily to major corporations, financial institutions and law firms.The company's client list comprises a large percentage of the Fortune 500 companies, the FTSE 100 companies, as well as the ...

Company Summary

Based in Baltimore, Maryland, and founded in 1982, FTI Consulting is a global business advisory firm aimed at helping organizations manage change, mitigate risk and resolve financial, legal, operational, political and regulatory, reputational and transactional disputes. The company provides specialized consulting services across 57 foreign countries with a total headcount of more than 7,990 employees. The company has a team of highly qualified professionals, who provide problem-solving and technology services primarily to major corporations, financial institutions and law firms.The company's client list comprises a large percentage of the Fortune 500 companies, the FTSE 100 companies, as well as the majority of the largest 25 banks and the top 100 law firms in the world. The company’s five main business segments include Corporate Finance and Restructuring, Forensic and Litigation Consulting, Strategic Communications, Technology, and Economic Consulting.

The Corporate Finance and Restructuring segment (39% of 2023 revenues) focuses on strategic, operational, financial and capital needs of businesses. The company offers a wide range of service offerings related to restructuring, business transformation and transaction support.

The Forensic and Litigation Consulting segment (19%) provides law firms, companies, government clients and other interested parties with end-to-end forensic and litigation services including pre-filing assessments, discovery, trial preparation, expert testimony, and other trial support services.

The Strategic Communications segment (9%) provides advice and consulting services related to financial communications, brand communications, public affairs and reputation management and business consulting.

The Technology segment (11%) provides products, services and consulting to law firms, corporations and government agencies, and also focuses on collection, preservation, review and production of electronically stored information.

The Economic Consulting segment (22%) provides law firms, companies, government entities and other interested parties with a clear analysis of complex economic issues for legal and regulatory proceedings, strategic decision making and public policy debates in U.S.

General Information

FTI Consulting, Inc

555 12TH STREET NORTH WEST

WASHINGTON, DC 20004

Phone: 202-312-9100

Fax: 202-312-9101

Web: http://www.fticonsulting.com

Email: mollie.hawkes@fticonsulting.com

| Industry | Consulting Services |

| Sector | Business Services |

| Fiscal Year End | December |

| Last Reported Quarter | 6/30/2024 |

| Exp Earnings Date | 10/24/2024 |

EPS Information

| Current Quarter EPS Consensus Estimate | 2.06 |

| Current Year EPS Consensus Estimate | 8.48 |

| Estimated Long-Term EPS Growth Rate | NA |

| Exp Earnings Date | 10/24/2024 |

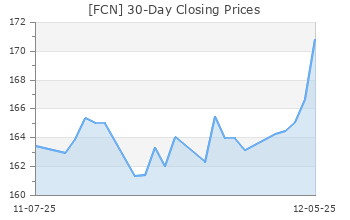

Price and Volume Information

| Zacks Rank | |

| Yesterday's Close | 225.26 |

| 52 Week High | 243.60 |

| 52 Week Low | 175.03 |

| Beta | 0.10 |

| 20 Day Moving Average | 115,184.25 |

| Target Price Consensus | 243.00 |

| 4 Week | 1.60 |

| 12 Week | 3.58 |

| YTD | 14.03 |

| 4 Week | -0.75 |

| 12 Week | -0.41 |

| YTD | -5.57 |

| Shares Outstanding (millions) | 35.90 |

| Market Capitalization (millions) | 8,153.34 |

| Short Ratio | NA |

| Last Split Date | 6/5/2003 |

| Dividend Yield | 0.00% |

| Annual Dividend | $0.00 |

| Payout Ratio | 0.00 |

| Change in Payout Ratio | 0.00 |

| Last Dividend Payout / Amount | NA / $0.00 |

Fundamental Ratios

| P/E (F1) | 26.80 |

| Trailing 12 Months | 24.71 |

| PEG Ratio | NA |

| vs. Previous Year | 33.71% |

| vs. Previous Quarter | 4.93% |

| vs. Previous Year | 9.78% |

| vs. Previous Quarter | 2.22% |

| Price/Book | 3.79 |

| Price/Cash Flow | 24.88 |

| Price / Sales | 2.21 |

| 6/30/24 | 16.34 |

| 3/31/24 | 15.97 |

| 12/31/23 | 14.94 |

| 6/30/24 | 9.87 |

| 3/31/24 | 9.30 |

| 12/31/23 | 8.46 |

| 6/30/24 | 2.20 |

| 3/31/24 | 2.46 |

| 12/31/23 | 1.74 |

| 6/30/24 | 2.20 |

| 3/31/24 | 2.46 |

| 12/31/23 | 1.74 |

| 6/30/24 | 8.90 |

| 3/31/24 | 8.51 |

| 12/31/23 | 7.88 |

| 6/30/24 | 8.90 |

| 3/31/24 | 8.51 |

| 12/31/23 | 7.88 |

| 6/30/24 | 11.17 |

| 3/31/24 | 10.95 |

| 12/31/23 | 10.27 |

| 6/30/24 | 59.87 |

| 3/31/24 | 57.55 |

| 12/31/23 | 55.81 |

| 6/30/24 | NA |

| 3/31/24 | NA |

| 12/31/23 | NA |

| 6/30/24 | 0.03 |

| 3/31/24 | 0.10 |

| 12/31/23 | 0.00 |

| 6/30/24 | 2.72 |

| 3/31/24 | 9.07 |

| 12/31/23 | 0.00 |