Home Depot (HD)

(Delayed Data from NYSE)

$390.34 USD

+6.33 (1.65%)

Updated Sep 19, 2024 04:00 PM ET

After-Market: $390.10 -0.24 (-0.06%) 7:58 PM ET

3-Hold of 5 3

B Value A Growth B Momentum A VGM

Company Summary

Based on net sales, The Home Depot Inc. is the world’s largest home improvement specialty retailer with 2,335 retail stores across the globe as of the end of fiscal 2023. It offers a diverse range of branded and proprietary home improvement items, building materials, lawn and garden products, décor products and related services.

With the help of its stores, the company operates throughout the United States (including Puerto Rico and the territories of the Virgin Islands and Guam), Canada and Mexico and employs more than 500,000 associates. The company’s average store ...

Company Summary

Based on net sales, The Home Depot Inc. is the world’s largest home improvement specialty retailer with 2,335 retail stores across the globe as of the end of fiscal 2023. It offers a diverse range of branded and proprietary home improvement items, building materials, lawn and garden products, décor products and related services.

With the help of its stores, the company operates throughout the United States (including Puerto Rico and the territories of the Virgin Islands and Guam), Canada and Mexico and employs more than 500,000 associates. The company’s average store area is almost 104,000 square feet with approximately 24,000 square feet of additional outside garden area. It also functions through a network of distribution and fulfillment centers, as well as a number of e-commerce websites.

The company typically serves three primary customer groups: Do-It-Yourself (DIY), Do-It-For-Me (DIFM), and Professional Customers.

DIY Customers: These customers are usually homeowners, who prefer purchasing products and completing installations on their own. The company engages these customers in various platforms to provide product and project knowledge.

DIFM Customers: These customers are usually homeowners, who purchase products on their own and employ third-parties to complete the projects and installations. The company offers a variety of installation services in sores, online, or in their homes through in-home consultations for DIFM customers.

Professional Customers: This customer segment mostly comprises professional remodelers, general contractors, repairmen, small business owners, and tradesmen. These customers build, renovate, remodel, repair and maintain residential properties, multifamily properties, hospitality properties and commercial facilities.

(Notes: Zacks identifies fiscal years by the month in which the fiscal year ends, while HD identifies its fiscal year by the calendar year in which it begins; so comparable figures for any given fiscal year, as published by HD, will refer to this same fiscal year as being the year before the same year, as identified by Zacks.)

General Information

The Home Depot, Inc

2455 PACES FERRY ROAD

ATLANTA, GA 30339

Phone: 770-433-8211

Fax: 770-431-2707

Email: investor_relations@homedepot.com

| Industry | Building Products - Retail |

| Sector | Retail-Wholesale |

| Fiscal Year End | January |

| Last Reported Quarter | 7/31/2024 |

| Exp Earnings Date | 11/12/2024 |

EPS Information

| Current Quarter EPS Consensus Estimate | 3.64 |

| Current Year EPS Consensus Estimate | 15.00 |

| Estimated Long-Term EPS Growth Rate | 9.60 |

| Exp Earnings Date | 11/12/2024 |

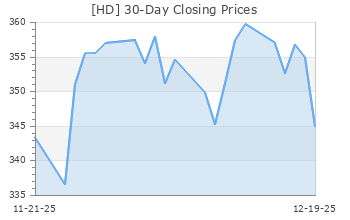

Price and Volume Information

| Zacks Rank | |

| Yesterday's Close | 384.01 |

| 52 Week High | 396.87 |

| 52 Week Low | 274.26 |

| Beta | 1.00 |

| 20 Day Moving Average | 2,722,882.75 |

| Target Price Consensus | 386.47 |

| 4 Week | 3.66 |

| 12 Week | 12.34 |

| YTD | 10.81 |

| 4 Week | 3.71 |

| 12 Week | 9.54 |

| YTD | -5.92 |

| Shares Outstanding (millions) | 993.29 |

| Market Capitalization (millions) | 381,434.59 |

| Short Ratio | NA |

| Last Split Date | 12/31/1999 |

| Dividend Yield | 2.34% |

| Annual Dividend | $9.00 |

| Payout Ratio | 0.60 |

| Change in Payout Ratio | 0.09 |

| Last Dividend Payout / Amount | 8/29/2024 / $2.25 |

Fundamental Ratios

| P/E (F1) | 25.60 |

| Trailing 12 Months | 25.72 |

| PEG Ratio | 2.66 |

| vs. Previous Year | 0.43% |

| vs. Previous Quarter | 28.65% |

| vs. Previous Year | 0.60% |

| vs. Previous Quarter | 18.55% |

| Price/Book | 86.30 |

| Price/Cash Flow | 20.69 |

| Price / Sales | 2.51 |

| 7/31/24 | 681.27 |

| 4/30/24 | 1,056.67 |

| 1/31/24 | 1,452.22 |

| 7/31/24 | 18.09 |

| 4/30/24 | 19.33 |

| 1/31/24 | 19.87 |

| 7/31/24 | 1.15 |

| 4/30/24 | 1.34 |

| 1/31/24 | 1.35 |

| 7/31/24 | 0.33 |

| 4/30/24 | 0.42 |

| 1/31/24 | 0.40 |

| 7/31/24 | 9.76 |

| 4/30/24 | 9.79 |

| 1/31/24 | 9.92 |

| 7/31/24 | 9.71 |

| 4/30/24 | 9.79 |

| 1/31/24 | 9.92 |

| 7/31/24 | 12.72 |

| 4/30/24 | 12.82 |

| 1/31/24 | 13.05 |

| 7/31/24 | 4.45 |

| 4/30/24 | 1.84 |

| 1/31/24 | 1.05 |

| 7/31/24 | 4.53 |

| 4/30/24 | 4.52 |

| 1/31/24 | 4.40 |

| 7/31/24 | 11.74 |

| 4/30/24 | 23.11 |

| 1/31/24 | 40.94 |

| 7/31/24 | 92.15 |

| 4/30/24 | 95.85 |

| 1/31/24 | 97.62 |