International Business Machines (IBM)

(Delayed Data from NYSE)

$214.94 USD

+0.81 (0.38%)

Updated Sep 18, 2024 04:00 PM ET

After-Market: $215.09 +0.15 (0.07%) 7:58 PM ET

3-Hold of 5 3

C Value C Growth A Momentum C VGM

Company Summary

International Business Machines Corporation has gradually evolved as a provider of cloud and data platforms. Red Hat acquisition, in particular, has helped it in strengthening competitive position in the hybrid cloud market. With Red Hat buyout, the company offers Linux operating system — Red Hat Enterprise Linux — and hybrid cloud platform — Red Hat OpenShift — that aids enterprises with digital transformation. In addition, the company provides advanced information technology solutions, computer systems, quantum computing and super computing solutions, enterprise software, storage systems and microelectronics.

Armonk, NY-based, IBM reported revenues of $61.9 billion in 2023. ...

Company Summary

International Business Machines Corporation has gradually evolved as a provider of cloud and data platforms. Red Hat acquisition, in particular, has helped it in strengthening competitive position in the hybrid cloud market. With Red Hat buyout, the company offers Linux operating system — Red Hat Enterprise Linux — and hybrid cloud platform — Red Hat OpenShift — that aids enterprises with digital transformation. In addition, the company provides advanced information technology solutions, computer systems, quantum computing and super computing solutions, enterprise software, storage systems and microelectronics.

Armonk, NY-based, IBM reported revenues of $61.9 billion in 2023. It announced the spin-off of its legacy Managed Infrastructure Services business in a bid to accelerate its hybrid cloud growth strategy. IBM has restructured its segments post the separation of Kyndryl. The new segments of the company are Software, Consulting, Infrastructure and Financing.

Software (erstwhile Cloud & Cognitive Software): This segment consists of Hybrid Platform & Solutions comprising software services, Red Hat, automation and data & AI businesses and Transaction Processing. It recorded 42.7% of GAAP revenues in second-quarter 2024.

Consulting (erstwhile Global Business Services): This segment comprises Business Transformation, Technology Consulting and Application Operations. It recorded 32.8% of GAAP revenues in second-quarter 2024.

Infrastructure (erstwhile Systems): This segment comprises Hybrid Infrastructure and Infrastructure Support services. It recorded 23.1% of GAAP revenues in second-quarter 2024.

Financing (erstwhile Global Financing): This segment includes client and commercial financing services. It recorded 1.1% of GAAP revenues in second-quarter 2024.

General Information

International Business Machines Corporation

1 NEW ORCHARD ROAD

ARMONK, NY 10504

Phone: 914-499-1900

Fax: 914-765-6021

Web: http://www.ibm.com

Email: infoibm@us.ibm.com

| Industry | Computer - Integrated Systems |

| Sector | Computer and Technology |

| Fiscal Year End | December |

| Last Reported Quarter | 6/30/2024 |

| Earnings Date | 10/23/2024 |

EPS Information

| Current Quarter EPS Consensus Estimate | 2.25 |

| Current Year EPS Consensus Estimate | 10.10 |

| Estimated Long-Term EPS Growth Rate | 4.50 |

| Earnings Date | 10/23/2024 |

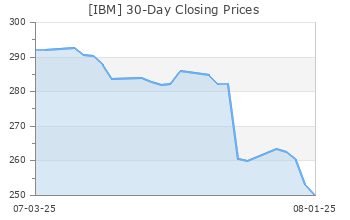

Price and Volume Information

| Zacks Rank | |

| Yesterday's Close | 214.13 |

| 52 Week High | 218.84 |

| 52 Week Low | 135.87 |

| Beta | 0.70 |

| 20 Day Moving Average | 3,366,115.25 |

| Target Price Consensus | 192.13 |

| 4 Week | 9.23 |

| 12 Week | 24.06 |

| YTD | 30.93 |

| 4 Week | 8.51 |

| 12 Week | 20.42 |

| YTD | 10.83 |

| Shares Outstanding (millions) | 921.15 |

| Market Capitalization (millions) | 197,245.47 |

| Short Ratio | NA |

| Last Split Date | 5/27/1999 |

| Dividend Yield | 3.12% |

| Annual Dividend | $6.68 |

| Payout Ratio | 0.66 |

| Change in Payout Ratio | -0.01 |

| Last Dividend Payout / Amount | 8/9/2024 / $1.67 |

Fundamental Ratios

| P/E (F1) | 21.19 |

| Trailing 12 Months | 21.03 |

| PEG Ratio | 4.76 |

| vs. Previous Year | 11.47% |

| vs. Previous Quarter | 44.64% |

| vs. Previous Year | 1.91% |

| vs. Previous Quarter | 9.04% |

| Price/Book | 8.18 |

| Price/Cash Flow | 14.74 |

| Price / Sales | 3.16 |

| 6/30/24 | 40.59 |

| 3/31/24 | 40.21 |

| 12/31/23 | 39.55 |

| 6/30/24 | 7.06 |

| 3/31/24 | 6.88 |

| 12/31/23 | 6.69 |

| 6/30/24 | 1.12 |

| 3/31/24 | 1.13 |

| 12/31/23 | 0.96 |

| 6/30/24 | 1.08 |

| 3/31/24 | 1.09 |

| 12/31/23 | 0.93 |

| 6/30/24 | 15.16 |

| 3/31/24 | 14.80 |

| 12/31/23 | 14.34 |

| 6/30/24 | 13.52 |

| 3/31/24 | 13.18 |

| 12/31/23 | 12.13 |

| 6/30/24 | 14.31 |

| 3/31/24 | 14.03 |

| 12/31/23 | 14.05 |

| 6/30/24 | 26.17 |

| 3/31/24 | 25.40 |

| 12/31/23 | 24.76 |

| 6/30/24 | 21.88 |

| 3/31/24 | 20.89 |

| 12/31/23 | 19.46 |

| 6/30/24 | 2.20 |

| 3/31/24 | 2.32 |

| 12/31/23 | 2.22 |

| 6/30/24 | 68.71 |

| 3/31/24 | 69.84 |

| 12/31/23 | 68.91 |