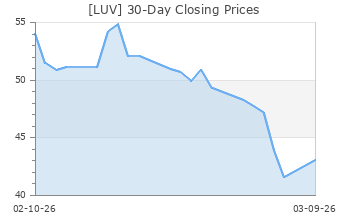

Southwest Airlines (LUV)

(Delayed Data from NYSE)

$29.75 USD

+0.12 (0.40%)

Updated Sep 24, 2024 04:00 PM ET

After-Market: $29.74 -0.01 (-0.03%) 7:58 PM ET

3-Hold of 5 3

B Value D Growth B Momentum C VGM

Company Summary

Based in Dallas, TX, Southwest Airlines is a passenger airline that provides scheduled air transportation in the United States and 'ten near-international' markets. The company, incorporated in Texas in 1967, commenced operations on Jun 18, 1971, with three Boeing 737 jets serving the cities of Dallas, Houston and San Antonio.

Per the U.S. Department of Transportation's latest available data, Southwest Airlines has emerged as the largest domestic air carrier (measured in terms of the number of domestic originating passengers boarded) in the United States. During 2018, the carrier commenced operating flights from Indianapolis, San Jose, Sacramento, Columbus, ...

Company Summary

Based in Dallas, TX, Southwest Airlines is a passenger airline that provides scheduled air transportation in the United States and 'ten near-international' markets. The company, incorporated in Texas in 1967, commenced operations on Jun 18, 1971, with three Boeing 737 jets serving the cities of Dallas, Houston and San Antonio.

Per the U.S. Department of Transportation's latest available data, Southwest Airlines has emerged as the largest domestic air carrier (measured in terms of the number of domestic originating passengers boarded) in the United States. During 2018, the carrier commenced operating flights from Indianapolis, San Jose, Sacramento, Columbus, New Orleans, Pittsburgh, and Raleigh-Durham.

Additionally, during 2018, the carrier started shipping cargo to international destinations like Mexico City, Cancun, Cabo San Lucas/Los Cabos, Puerto Vallarta, Montego Bay, and San Jose, Costa Rica.

The company is constantly looking to modernize its fleet. LUV received 33 Boeing 737-8 aircraft during fourth quarter 2022, which includes two additional -8 aircraft deliveries than previously planned, for a total of 68 -8 aircraft deliveries in 2022, compared with previous guidance of 66. Overall, LUV ended 2022 with 770 aircraft, which reflects 26 -700 aircraft retirements, including five retirements in fourth quarter. The carrier used its fleet to serve 121 destinations in 42 states, the District of Columbia, the Commonwealth of Puerto Rico, and ten near-international countries: Mexico, Jamaica, The Bahamas, Aruba, Dominican Republic, Costa Rica, Belize, Cuba, the Cayman Islands, and Turks and Caicos. As part of its expansion efforts, Southwest Airlines started operating flights to Hawaii from March 2019.

Southwest Airlines provides short-haul, high frequency, point-to-point and low-fare services. The company’s point-to-point route structure includes services to and from many secondary or downtown airports such as Dallas Love Field, Houston Hobby, Chicago Midway, Baltimore-Washington International and Ft. Lauderdale-Hollywood. The company also offers long-haul nonstop service between markets like Oakland and Orlando, Los Angeles and Nashville, Las Vegas and Orlando, San Diego and Baltimore, Houston and New York LaGuardia, Los Angeles and Tampa, Oakland and Baltimore, San Diego and Newark.

General Information

Southwest Airlines Co

2702 LOVE FIELD DRIVE P O BOX 36611

DALLAS, TX 75235

Phone: 214-792-4000

Fax: 214-792-5015

Email: investor.relations@wnco.com

| Industry | Transportation - Airline |

| Sector | Transportation |

| Fiscal Year End | December |

| Last Reported Quarter | 6/30/2024 |

| Earnings Date | 10/24/2024 |

EPS Information

| Current Quarter EPS Consensus Estimate | -0.23 |

| Current Year EPS Consensus Estimate | 0.24 |

| Estimated Long-Term EPS Growth Rate | 4.60 |

| Earnings Date | 10/24/2024 |

Price and Volume Information

| Zacks Rank | |

| Yesterday's Close | 29.63 |

| 52 Week High | 35.18 |

| 52 Week Low | 21.91 |

| Beta | 1.16 |

| 20 Day Moving Average | 7,054,622.50 |

| Target Price Consensus | 27.65 |

| 4 Week | 5.07 |

| 12 Week | 5.41 |

| YTD | 2.60 |

| 4 Week | 3.20 |

| 12 Week | 0.92 |

| YTD | -14.42 |

| Shares Outstanding (millions) | 599.16 |

| Market Capitalization (millions) | 17,753.02 |

| Short Ratio | NA |

| Last Split Date | 2/16/2001 |

| Dividend Yield | 2.43% |

| Annual Dividend | $0.72 |

| Payout Ratio | 0.74 |

| Change in Payout Ratio | 0.37 |

| Last Dividend Payout / Amount | 9/4/2024 / $0.18 |

Fundamental Ratios

| P/E (F1) | 123.57 |

| Trailing 12 Months | 30.55 |

| PEG Ratio | 26.92 |

| vs. Previous Year | -46.79% |

| vs. Previous Quarter | 261.11% |

| vs. Previous Year | 4.50% |

| vs. Previous Quarter | 16.20% |

| Price/Book | 1.70 |

| Price/Cash Flow | 7.04 |

| Price / Sales | 0.66 |

| 6/30/24 | 5.92 |

| 3/31/24 | 8.91 |

| 12/31/23 | 9.40 |

| 6/30/24 | 1.72 |

| 3/31/24 | 2.60 |

| 12/31/23 | 2.76 |

| 6/30/24 | 0.90 |

| 3/31/24 | 1.09 |

| 12/31/23 | 1.14 |

| 6/30/24 | 0.85 |

| 3/31/24 | 1.02 |

| 12/31/23 | 1.07 |

| 6/30/24 | 2.31 |

| 3/31/24 | 3.55 |

| 12/31/23 | 3.84 |

| 6/30/24 | 0.41 |

| 3/31/24 | 1.59 |

| 12/31/23 | 1.91 |

| 6/30/24 | 0.49 |

| 3/31/24 | 2.02 |

| 12/31/23 | 2.43 |

| 6/30/24 | 17.47 |

| 3/31/24 | 17.04 |

| 12/31/23 | 17.64 |

| 6/30/24 | 26.87 |

| 3/31/24 | 26.78 |

| 12/31/23 | 26.63 |

| 6/30/24 | 0.48 |

| 3/31/24 | 0.78 |

| 12/31/23 | 0.76 |

| 6/30/24 | 32.61 |

| 3/31/24 | 43.89 |

| 12/31/23 | 43.14 |