Monolithic Power Systems (MPWR)

(Delayed Data from NSDQ)

$860.66 USD

-6.65 (-0.77%)

Updated Sep 18, 2024 04:00 PM ET

After-Market: $851.58 -9.08 (-1.06%) 7:58 PM ET

3-Hold of 5 3

F Value B Growth B Momentum D VGM

Company Summary

Monolithic Power Systems, based in Kirkland, WA, designs, develops and markets high-performance power solutions. The company focuses on the market for high-performance analog and mixed-signal integrated circuits (ICs).

Monolithic’s products are widely utilized in industrial applications, telecommunication infrastructures, cloud computing, automotive and consumer applications.

Being a fabless company, Monolithic works with third-party contractors and chip assemblers for the manufacturing, assembling and testing of wafers and ICs. This approach permits the company to focus more on the designing and development of process technology at a lower-fixed cost.

Unlike other fabless semiconductor companies, Monolithic ...

Company Summary

Monolithic’s products are widely utilized in industrial applications, telecommunication infrastructures, cloud computing, automotive and consumer applications.

Being a fabless company, Monolithic works with third-party contractors and chip assemblers for the manufacturing, assembling and testing of wafers and ICs. This approach permits the company to focus more on the designing and development of process technology at a lower-fixed cost.

Unlike other fabless semiconductor companies, Monolithic installs its own proprietary process technologies in third-party contractors’ equipment and facilities.

Monolithic reported total revenues of $507.4 million in the second quarter of 2024. The company’s key product families are direct current to direct current (DC to DC) products and Lighting Control products.

DC to DC ICs are used to convert and control voltages within a broad range of electronic systems, such as portable electronic devices, wireless LAN access points, computers and monitors, automobiles and medical equipment. The product line accounted for 98.8% of total revenues in the second quarter of 2024.

Lighting control ICs are used in backlighting and general illumination products. In the second quarter of 2024, the product line accounted for 1.2% of total revenues.

End-market-wise, 22.6% of total revenues came from Computing and Storage in the second quarter of 2024.

Precisely, Enterprise Data, Consumer, Industrial, Automotive and Communications end-markets contributed 36.9%, 8.3%, 6.4%, 17.2% and 8.6%, respectively, to the second quarter of 2024 revenues.

Monolithic’s primary competitors are Skyworks Solutions (SWKS), Microchip Technology (MCHP), Lattice Semiconductor (LSCC), IPG Photonics (IPGP), Power Integrations (POWI), Cree (CREE), Semtech (SMTC), Micron Technology (MU), Analog Devices (ADI), and GLOBALFOUNDRIES (GFS).

General Information

Monolithic Power Systems, Inc

5808 LAKE WASHINGTON BLVD. NE

KIRKLAND, WA 98033

Phone: 425-296-9956

Fax: 408-826-0601

Web: http://www.monolithicpower.com

Email: mpsinvestor.relations@monolithicpower.com

| Industry | Semiconductor - Analog and Mixed |

| Sector | Computer and Technology |

| Fiscal Year End | December |

| Last Reported Quarter | 6/30/2024 |

| Exp Earnings Date | 11/4/2024 |

EPS Information

| Current Quarter EPS Consensus Estimate | 3.96 |

| Current Year EPS Consensus Estimate | 13.96 |

| Estimated Long-Term EPS Growth Rate | 20.80 |

| Exp Earnings Date | 11/4/2024 |

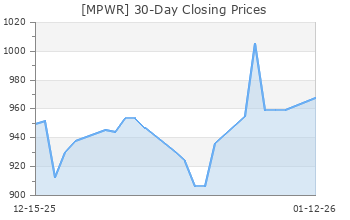

Price and Volume Information

| Zacks Rank | |

| Yesterday's Close | 867.31 |

| 52 Week High | 959.64 |

| 52 Week Low | 392.10 |

| Beta | 1.12 |

| 20 Day Moving Average | 507,212.91 |

| Target Price Consensus | 934.78 |

| 4 Week | -4.13 |

| 12 Week | 5.79 |

| YTD | 37.50 |

| 4 Week | -4.77 |

| 12 Week | 2.68 |

| YTD | 16.40 |

| Shares Outstanding (millions) | 48.75 |

| Market Capitalization (millions) | 42,283.10 |

| Short Ratio | NA |

| Last Split Date | NA |

| Dividend Yield | 0.58% |

| Annual Dividend | $5.00 |

| Payout Ratio | 0.58 |

| Change in Payout Ratio | 0.03 |

| Last Dividend Payout / Amount | 6/28/2024 / $1.25 |

Fundamental Ratios

| P/E (F1) | 62.13 |

| Trailing 12 Months | 72.64 |

| PEG Ratio | 2.99 |

| vs. Previous Year | 1.95% |

| vs. Previous Quarter | 6.09% |

| vs. Previous Year | 15.03% |

| vs. Previous Quarter | 10.82% |

| Price/Book | 19.26 |

| Price/Cash Flow | 89.74 |

| Price / Sales | 22.32 |

| 6/30/24 | 20.24 |

| 3/31/24 | 21.01 |

| 12/31/23 | 22.66 |

| 6/30/24 | 16.82 |

| 3/31/24 | 17.47 |

| 12/31/23 | 18.72 |

| 6/30/24 | 6.77 |

| 3/31/24 | 6.34 |

| 12/31/23 | 7.74 |

| 6/30/24 | 5.32 |

| 3/31/24 | 5.07 |

| 12/31/23 | 6.11 |

| 6/30/24 | 22.18 |

| 3/31/24 | 22.84 |

| 12/31/23 | 23.67 |

| 6/30/24 | 21.70 |

| 3/31/24 | 22.44 |

| 12/31/23 | 23.47 |

| 6/30/24 | 25.68 |

| 3/31/24 | 26.33 |

| 12/31/23 | 27.78 |

| 6/30/24 | 45.04 |

| 3/31/24 | 43.42 |

| 12/31/23 | 42.75 |

| 6/30/24 | 2.11 |

| 3/31/24 | 2.03 |

| 12/31/23 | 1.95 |

| 6/30/24 | 0.00 |

| 3/31/24 | 0.00 |

| 12/31/23 | 0.00 |

| 6/30/24 | 0.00 |

| 3/31/24 | 0.00 |

| 12/31/23 | 0.00 |