Moderna (MRNA)

(Delayed Data from NSDQ)

$64.14 USD

-1.55 (-2.36%)

Updated Sep 23, 2024 04:00 PM ET

After-Market: $64.19 +0.05 (0.08%) 6:02 PM ET

4-Sell of 5 4

F Value C Growth F Momentum F VGM

Company Summary

Cambridge, MA-based Moderna, Inc. is a commercial-stage pharmaceutical company primarily focused on discovering and developing messenger-RNA (mRNA) based therapies.

Moderna’s first marketed product is its COVID-19 vaccine, Spikevax, which is approved/authorized for use in multiple countries in individuals as young as six months, either as primary two-dose regimens or as booster doses.

In May 2024, the FDA approved the company’s RSV vaccine mRNA-1345 to prevent RSV-associated lower respiratory tract disease (RSV-LRTD) in older adults aged 60 years and above. The vaccine is marketed under the trade name mResvia.<...

Company Summary

Cambridge, MA-based Moderna, Inc. is a commercial-stage pharmaceutical company primarily focused on discovering and developing messenger-RNA (mRNA) based therapies.

Moderna’s first marketed product is its COVID-19 vaccine, Spikevax, which is approved/authorized for use in multiple countries in individuals as young as six months, either as primary two-dose regimens or as booster doses.

In May 2024, the FDA approved the company’s RSV vaccine mRNA-1345 to prevent RSV-associated lower respiratory tract disease (RSV-LRTD) in older adults aged 60 years and above. The vaccine is marketed under the trade name mResvia.

Moderna also has several promising pipeline candidates in different stages of development, targeting multiple indications including cancer and cardiovascular. It is also developing a few prophylactic vaccines and cancer vaccines.

The company has more than 40 mRNA-based investigational candidates, with many candidates in the clinical development stage. Key candidates in the mRNA pipeline are mRNA-1647, mRNA-1010, and mRNA-4157, which are currently either in regulatory review or undergoing late-stage development. These include mRNA-1647 [cytomegalovirus (CMV) vaccine], mRNA-1010 (influenza vaccine), mRNA-4157/V940 [individualized neoantigen therapy (INT)], and mRNA-1083 (COVID-19 plus influenza combination vaccine).

Moderna is also evaluating mRNA-based investigational candidates in multiple mid-stage and early-stage stages of clinical studies, including mRNA-1018 (for bird flu virus), mRNA-1893 (for Zika virus), mRNA-3927 (for propionic acidemia), and mRNA-3705 (for methylmalonic acidemia).

Moderna's mRNA technology has helped it to enter into several collaborations with large pharma/biotech companies, namely Merck and Vertex Pharmaceuticals. It also has strategic alliances with some government-sponsored organizations and private foundations.

Moderna recorded total revenues of $6.8 billion in 2023, down 64% year over year.

General Information

Moderna, Inc

325 BINNEY STREET

CAMBRIDGE, MA 02142

Phone: 617-714-6500

Fax: NA

Email: ir@modernatx.com

| Industry | Medical - Biomedical and Genetics |

| Sector | Medical |

| Fiscal Year End | December |

| Last Reported Quarter | 6/30/2024 |

| Exp Earnings Date | 11/7/2024 |

EPS Information

| Current Quarter EPS Consensus Estimate | -1.84 |

| Current Year EPS Consensus Estimate | -9.86 |

| Estimated Long-Term EPS Growth Rate | 16.60 |

| Exp Earnings Date | 11/7/2024 |

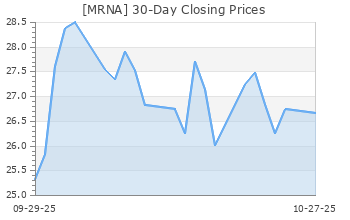

Price and Volume Information

| Zacks Rank | |

| Yesterday's Close | 65.69 |

| 52 Week High | 170.47 |

| 52 Week Low | 62.55 |

| Beta | 1.68 |

| 20 Day Moving Average | 5,669,437.00 |

| Target Price Consensus | 108.74 |

| 4 Week | -20.32 |

| 12 Week | -44.68 |

| YTD | -33.95 |

| 4 Week | -21.27 |

| 12 Week | -47.03 |

| YTD | -44.75 |

| Shares Outstanding (millions) | 384.40 |

| Market Capitalization (millions) | 25,250.98 |

| Short Ratio | NA |

| Last Split Date | NA |

| Dividend Yield | 0.00% |

| Annual Dividend | $0.00 |

| Payout Ratio | NA |

| Change in Payout Ratio | NA |

| Last Dividend Payout / Amount | NA / $0.00 |

Fundamental Ratios

| P/E (F1) | NA |

| Trailing 12 Months | NA |

| PEG Ratio | NA |

| vs. Previous Year | 8.01% |

| vs. Previous Quarter | -8.47% |

| vs. Previous Year | -29.94% |

| vs. Previous Quarter | 44.31% |

| Price/Book | 2.16 |

| Price/Cash Flow | NA |

| Price / Sales | 5.00 |

| 6/30/24 | -21.35 |

| 3/31/24 | -20.10 |

| 12/31/23 | -10.23 |

| 6/30/24 | -15.75 |

| 3/31/24 | -15.00 |

| 12/31/23 | -7.70 |

| 6/30/24 | 4.09 |

| 3/31/24 | 4.03 |

| 12/31/23 | 3.42 |

| 6/30/24 | 3.92 |

| 3/31/24 | 3.91 |

| 12/31/23 | 3.36 |

| 6/30/24 | -54.79 |

| 3/31/24 | -55.66 |

| 12/31/23 | -23.57 |

| 6/30/24 | -116.18 |

| 3/31/24 | -115.82 |

| 12/31/23 | -68.84 |

| 6/30/24 | -85.78 |

| 3/31/24 | -93.19 |

| 12/31/23 | -57.56 |

| 6/30/24 | 30.47 |

| 3/31/24 | 33.44 |

| 12/31/23 | 36.33 |

| 6/30/24 | 9.78 |

| 3/31/24 | 9.41 |

| 12/31/23 | 8.79 |

| 6/30/24 | 0.05 |

| 3/31/24 | 0.04 |

| 12/31/23 | 0.04 |

| 6/30/24 | 4.69 |

| 3/31/24 | 4.29 |

| 12/31/23 | 3.98 |