Qorvo (QRVO)

(Delayed Data from NSDQ)

$122.01 USD

+3.34 (2.81%)

Updated Jul 26, 2024 04:00 PM ET

After-Market: $122.07 +0.06 (0.05%) 7:58 PM ET

3-Hold of 5 3

C Value A Growth C Momentum B VGM

Company Summary

Qorvo Inc. is a leading provider of core technologies and radio frequency (RF) solutions for mobile, infrastructure and aerospace/defense applications.

The company was formed with the merger of semiconductor manufacturing firms RF Micro Devices Inc. and TriQuint Semiconductor Inc. in an all-stock transaction. Qorvo went public in 2015.

Headquartered in Greensboro, North Carolina, Qorvo reported revenues of $3,569.4 billion in fiscal 2023. The company’s reportable segments are Mobile Products (MP) and Infrastructure & Defense Products (IDP).

MP supplies cellular RF and WiFi solutions into a variety of mobile devices, including ...

Company Summary

Qorvo Inc. is a leading provider of core technologies and radio frequency (RF) solutions for mobile, infrastructure and aerospace/defense applications.

The company was formed with the merger of semiconductor manufacturing firms RF Micro Devices Inc. and TriQuint Semiconductor Inc. in an all-stock transaction. Qorvo went public in 2015.

Headquartered in Greensboro, North Carolina, Qorvo reported revenues of $3,569.4 billion in fiscal 2023. The company’s reportable segments are Mobile Products (MP) and Infrastructure & Defense Products (IDP).

MP supplies cellular RF and WiFi solutions into a variety of mobile devices, including smartphones, notebook computers, wearables, tablets, and cellular-based applications for the Internet of Things (IoT).

The segment’s product offerings include Bulk Acoustic Wave (BAW) and surface acoustic wave (SAW) filters, power amplifiers (PAs), low noise amplifiers (LNAs), switches, multimode multi-band PAs and transmit modules, RF power management integrated circuits (ICs), diversity receive modules, antenna switch modules, antenna tuning and control solutions, modules incorporating PAs and duplexers (PADs) and modules incorporating switches, PAs and duplexers (S-PADs).

IDP’s products are used in high performance defense systems such as radar, electronic warfare and communication systems, WiFi customer premises equipment for home and work, high speed connectivity in Long-Term Evolution ("LTE") and 5G base stations, cloud connectivity via data center communications and telecom transport, automotive connectivity and smart home solutions.

The products include high power GaAs and GaN PAs, LNAs, switches, CMOS system-on-a-chip (SoC) solutions, premium BAW and SAW filter solutions and various multi-chip and hybrid assemblies.

Qorvo primarily competes with Broadcom, Skyworks, Qualcomm, Analog Devices, and Cree, among others.

General Information

Qorvo, Inc

7628 THORNDIKE ROAD

GREENSBORO, NC 27409

Phone: 336-664-1233

Fax: NA

Web: http://www.qorvo.com

Email: NA

| Industry | Semiconductors - Radio Frequency |

| Sector | Computer and Technology |

| Fiscal Year End | March |

| Last Reported Quarter | 6/30/2024 |

| Earnings Date | 7/30/2024 |

EPS Information

| Current Quarter EPS Consensus Estimate | 0.71 |

| Current Year EPS Consensus Estimate | 6.11 |

| Estimated Long-Term EPS Growth Rate | 20.10 |

| Earnings Date | 7/30/2024 |

Price and Volume Information

| Zacks Rank | |

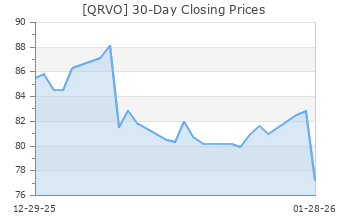

| Yesterday's Close | 118.67 |

| 52 Week High | 130.99 |

| 52 Week Low | 80.62 |

| Beta | 1.46 |

| 20 Day Moving Average | 1,197,594.25 |

| Target Price Consensus | 111.21 |

| 4 Week | 5.59 |

| 12 Week | 24.04 |

| YTD | 5.38 |

| 4 Week | 7.22 |

| 12 Week | 16.34 |

| YTD | -6.90 |

| Shares Outstanding (millions) | 95.03 |

| Market Capitalization (millions) | 11,277.07 |

| Short Ratio | NA |

| Last Split Date | NA |

| Dividend Yield | 0.00% |

| Annual Dividend | $0.00 |

| Payout Ratio | 0.00 |

| Change in Payout Ratio | 0.00 |

| Last Dividend Payout / Amount | NA / $0.00 |

Fundamental Ratios

| P/E (F1) | 19.42 |

| Trailing 12 Months | 19.08 |

| PEG Ratio | 0.97 |

| vs. Previous Year | 963.64% |

| vs. Previous Quarter | -38.10% |

| vs. Previous Year | 48.73% |

| vs. Previous Quarter | -12.38% |

| Price/Book | 3.22 |

| Price/Cash Flow | 14.14 |

| Price / Sales | 2.99 |

| 6/30/24 | NA |

| 3/31/24 | 13.43 |

| 12/31/23 | 10.41 |

| 6/30/24 | NA |

| 3/31/24 | 7.47 |

| 12/31/23 | 5.89 |

| 6/30/24 | NA |

| 3/31/24 | 1.99 |

| 12/31/23 | 1.90 |

| 6/30/24 | NA |

| 3/31/24 | 1.41 |

| 12/31/23 | 1.33 |

| 6/30/24 | NA |

| 3/31/24 | 13.20 |

| 12/31/23 | 11.41 |

| 6/30/24 | NA |

| 3/31/24 | -1.86 |

| 12/31/23 | -6.11 |

| 6/30/24 | NA |

| 3/31/24 | 1.95 |

| 12/31/23 | -4.48 |

| 6/30/24 | NA |

| 3/31/24 | 36.83 |

| 12/31/23 | 37.68 |

| 6/30/24 | NA |

| 3/31/24 | 2.86 |

| 12/31/23 | 2.73 |

| 6/30/24 | NA |

| 3/31/24 | 0.44 |

| 12/31/23 | 0.43 |

| 6/30/24 | NA |

| 3/31/24 | 30.34 |

| 12/31/23 | 29.88 |