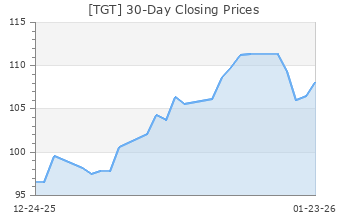

Target (TGT)

(Delayed Data from NYSE)

$149.00 USD

+2.71 (1.85%)

Updated Jul 26, 2024 04:00 PM ET

After-Market: $149.05 +0.05 (0.03%) 7:58 PM ET

4-Sell of 5 4

A Value B Growth B Momentum A VGM

Company Summary

Target Corporation has evolved from just being a pure brick-&-mortar retailer to an omni-channel entity. The company has been making investment in technologies, improving websites and mobile apps and modernizing supply chain to keep pace with the changing retail landscape and better compete with pure e-commerce players. Its acquisition of Shipt to provide same-day delivery of groceries, essentials, home, electronics as well as other products is worth noting.

Founded in 1902, Target provides an array of goods ranging from household essentials and electronics to toys and apparel for men, women ...

Company Summary

Target Corporation has evolved from just being a pure brick-&-mortar retailer to an omni-channel entity. The company has been making investment in technologies, improving websites and mobile apps and modernizing supply chain to keep pace with the changing retail landscape and better compete with pure e-commerce players. Its acquisition of Shipt to provide same-day delivery of groceries, essentials, home, electronics as well as other products is worth noting.

Founded in 1902, Target provides an array of goods ranging from household essentials and electronics to toys and apparel for men, women and kids. It also houses food and pet supplies, home furnishings and décor, home improvement, automotive products, and seasonal merchandise.

This Minneapolis, MN-based company sells merchandise through periodic exclusive design and creative partnerships, and shop-in-shop experiences, with partners such as Apple, Disney, Levi's and Ulta Beauty, and generate revenue from in-store amenities such as Target Café, Starbucks and Target Optical.

As of May 4, 2024, Target operates nearly 1,963 stores. A greater number of general merchandise stores provides an edited food assortment, including perishables, dry grocery, dairy, and frozen items. The company's stores, which are larger than 170,000 square feet, offer a full line of food items comparable to traditional supermarkets.

Some of the company's Owned Brands includes: A New Day, Cat & Jack, Cloud Island, Made By Design, Opalhouse, Project 62, Ava & Viv, Smith & Hawken, Universal Thread and Wild Fable.

Some of the company's Exclusive Adult Beverage Brands includes: California Roots, Photograph, SunPop, Headliner, Jingle & Mingle, Rosé Bae, Wine Cube and others.

(Note: Zacks identifies fiscal years by the month in which the fiscal year ends, while TGT identifies their fiscal year by the calendar year in which it begins; so comparable figures for any given fiscal year, as published by TGT, will refer to this same fiscal year as being the year before the same year, as identified by Zacks)

General Information

Target Corporation

1000 NICOLLET MALL

MINNEAPOLIS, MN 55403

Phone: 612-304-6073

Fax: 612-761-5555

Email: investorrelations@target.com

| Industry | Retail - Discount Stores |

| Sector | Retail-Wholesale |

| Fiscal Year End | January |

| Last Reported Quarter | 4/30/2024 |

| Earnings Date | 8/21/2024 |

EPS Information

| Current Quarter EPS Consensus Estimate | 2.17 |

| Current Year EPS Consensus Estimate | 9.31 |

| Estimated Long-Term EPS Growth Rate | 11.40 |

| Earnings Date | 8/21/2024 |

Price and Volume Information

| Zacks Rank | |

| Yesterday's Close | 146.29 |

| 52 Week High | 181.86 |

| 52 Week Low | 102.93 |

| Beta | 1.19 |

| 20 Day Moving Average | 3,565,830.00 |

| Target Price Consensus | 174.43 |

| 4 Week | -0.29 |

| 12 Week | -7.48 |

| YTD | 2.72 |

| 4 Week | 1.25 |

| 12 Week | -13.22 |

| YTD | -9.26 |

| Shares Outstanding (millions) | 462.64 |

| Market Capitalization (millions) | 67,679.10 |

| Short Ratio | NA |

| Last Split Date | 7/20/2000 |

| Dividend Yield | 3.01% |

| Annual Dividend | $4.40 |

| Payout Ratio | 0.49 |

| Change in Payout Ratio | 0.06 |

| Last Dividend Payout / Amount | 5/14/2024 / $1.10 |

Fundamental Ratios

| P/E (F1) | 15.71 |

| Trailing 12 Months | 16.42 |

| PEG Ratio | 1.38 |

| vs. Previous Year | -0.98% |

| vs. Previous Quarter | -31.88% |

| vs. Previous Year | -3.12% |

| vs. Previous Quarter | -23.15% |

| Price/Book | 4.89 |

| Price/Cash Flow | 9.73 |

| Price / Sales | 0.63 |

| 4/30/24 | 31.91 |

| 1/31/24 | 33.41 |

| 10/31/23 | 30.69 |

| 4/30/24 | 7.51 |

| 1/31/24 | 7.63 |

| 10/31/23 | 6.76 |

| 4/30/24 | 0.86 |

| 1/31/24 | 0.91 |

| 10/31/23 | 0.86 |

| 4/30/24 | 0.27 |

| 1/31/24 | 0.29 |

| 10/31/23 | 0.18 |

| 4/30/24 | 3.87 |

| 1/31/24 | 3.85 |

| 10/31/23 | 3.40 |

| 4/30/24 | 3.87 |

| 1/31/24 | 3.85 |

| 10/31/23 | 3.40 |

| 4/30/24 | 4.98 |

| 1/31/24 | 4.93 |

| 10/31/23 | 4.26 |

| 4/30/24 | 29.92 |

| 1/31/24 | 29.09 |

| 10/31/23 | 27.11 |

| 4/30/24 | 6.02 |

| 1/31/24 | 5.99 |

| 10/31/23 | 5.85 |

| 4/30/24 | 0.97 |

| 1/31/24 | 1.11 |

| 10/31/23 | 1.19 |

| 4/30/24 | 49.35 |

| 1/31/24 | 52.63 |

| 10/31/23 | 54.32 |