5 Best Stocks to Buy Today

| Company (Ticker) | 12 Week Price Change | Forward PE | Price | Proj EPS Growth (1 Year) | Projected Sales Growth (1Y) |

|---|---|---|---|---|---|

| AngloGold Ashanti PLC (AU) | 56.26% | 13.46 | $112.90 | 41.33% | 22.49% |

| Science Applications International (SAIC) | 17.53% | 11.06 | $103.31 | 9.12% | -2.56% |

| Forum Energy Technologies (FET) | 62.88% | 26.68 | $43.66 | 197.27% | 2.75% |

| Soleno Therapeutics (SLNO) | -36.93% | 10.90 | $42.58 | 2,619.94% | 156.15% |

| Aris Mining Corporation (ARMN) | 105.06% | 5.66 | $21.25 | 155.71% | NA |

*Updated on January 26, 2026.

AngloGold Ashanti PLC (AU)

$112.90 USD +6.64 (6.25%)

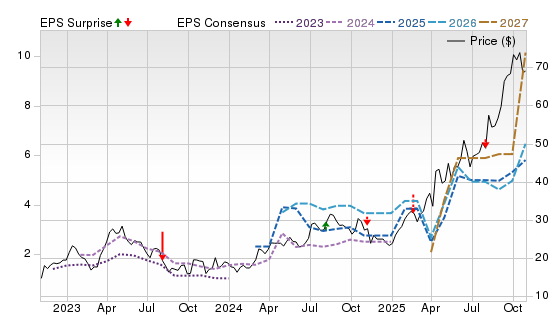

3-Year Stock Price Performance

Premium Research for AU

- Zacks Rank

Strong Buy 1

Strong Buy 1

- Style Scores

C Value A Growth A Momentum A VGM

- Market Cap:$44.60 B (Large Cap)

- Projected EPS Growth:152.94%

- Last Quarter EPS Growth:5.60%

- Last EPS Surprise:-1.49%

- Next EPS Report date:Feb. 18, 2026

Our Take:

Reasons to Buy

AngloGold Ashanti is a multinational gold producer with core assets across Africa and the Americas. Management has prioritized cash generation and capital discipline, reinstating a shareholder-friendly dividend policy that targets a 50% payout of free cash flow when leverage is low. The move followed a step-change in free cash flow and profitability in the latest annual cycle and was reinforced by subsequent updates that kept production and cost guidance intact. Operational improvements at Obuasi, Geita, and other hubs support stronger cash generation through the cycle.

Potential Risks

Earnings remain highly levered to gold prices. Multi-country exposure brings security, regulatory, and tax regime risk; underground operations add safety and execution complexity.

Forecast

Zacks Rank #1 reflects favorable estimate revisions. Growth and Momentum scores of A underscore accelerating fundamentals and relative strength, while a C Value score implies the shares aren’t statistically cheap. The chart depicts a decisive up-move with the 2026–2027 consensus inflecting higher. Estimates are still advancing, and momentum could persist provided operating delivery tracks guidance.

See more from Zacks Research for This Ticker

Normally $25 each - click below to receive one report FREE:

Science Applications International (SAIC)

$103.31 USD -6.83 (-6.20%)

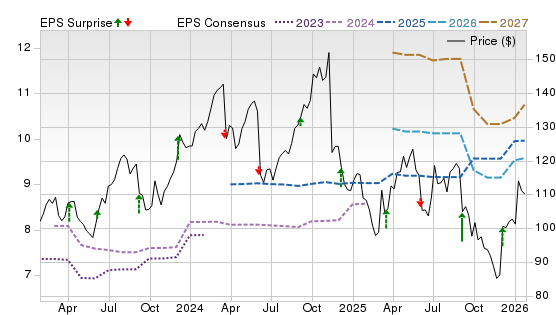

3-Year Stock Price Performance

Premium Research for SAIC

- Zacks Rank

Strong Buy 1

Strong Buy 1

- Style Scores

A Value C Growth B Momentum A VGM

- Market Cap:$4.97 B (Mid Cap)

- Projected EPS Growth:9.09%

- Last Quarter EPS Growth:-28.93%

- Last EPS Surprise:24.64%

- Next EPS Report date:March 16, 2026

Our Take:

Reasons to Buy

SAIC integrates mission IT and engineering for U.S. defense, intelligence, and civilian customers. Recent results reflect solid free-cash-flow conversion, book-to-bill above 1x, and a backlog near the mid-$20-billion range. SAIC holds a prime position on the Pentagon’s $1.8 billion PRISM vehicle and has logged sizeable Army wins. The completed purchase of SilverEdge expands cleared talent and SaaS-like cyber/intelligence capabilities.

Potential Risks

Federal budget uncertainties, continuing-resolution spending, and shutdown risk can delay awards and slow task-order ramps, producing revenue lumpiness and temporary margin pressure.

Forecast

Zacks Rank #1 (Strong Buy) with Style Scores of A for Value, C for Growth, and B for Momentum tilts the setup toward estimate revisions and valuation support rather than pure technicals. On the Price, Consensus & EPS Surprise chart, 2026–2027 estimates have turned up while the share price has cooled from mid-2025 highs, an alignment that often precedes catch-up if awards convert and guidance maintains its upward bias.

See more from Zacks Research for This Ticker

Normally $25 each - click below to receive one report FREE:

Forum Energy Technologies (FET)

$43.66 USD +0.04 (0.09%)

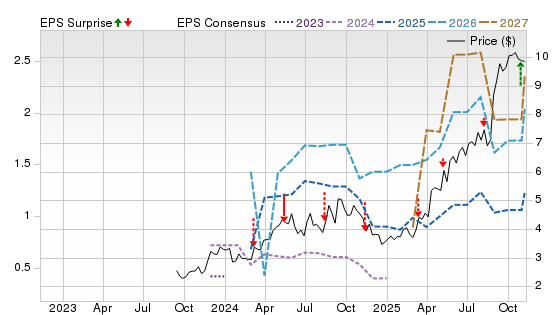

3-Year Stock Price Performance

Premium Research for FET

- Zacks Rank

Strong Buy 1

Strong Buy 1

- Style Scores

C Value A Growth D Momentum A VGM

- Market Cap: $496.31 M (Small Cap)

- Projected EPS Growth:163.95%

- Last Quarter EPS Growth: 370.00%

- Last EPS Surprise:42.11%

- Next EPS Report date:Feb. 19, 2026

Our Take:

Reasons to Buy

Forum Energy Technologies provides equipment and services across drilling, completions, and subsea/production markets, offering leverage to the multi-year international and offshore upcycle. Recent updates showed book-to-bill above 1x, the largest backlog in more than a decade, and raised full-year free-cash-flow guidance, signs that portfolio simplification and discipline are translating into healthier earnings quality. Management has also been repurchasing shares alongside balance-sheet cleanup.

Potential Risks

The business remains tied to energy-capex cycles. Restructuring and asset-impairment charges highlight execution and asset-quality risk. Any slowdown in backlog conversion or project execution could spur estimate resets and renewed balance-sheet concerns.

Forecast

Zacks Rank #1 indicates positive estimate revisions. With a C Value, A Growth, and D Momentum score, forward returns may hinge more on earnings traction than technicals. The chart depicts a sharp price breakout, 2027 consensus lines trending higher after earlier cuts, and a lately beat-tilted surprise pattern, consistent with improving execution supported by a larger backlog and cash-flow focus.

See more from Zacks Research for This Ticker

Normally $25 each - click below to receive one report FREE:

Soleno Therapeutics (SLNO)

$42.58 USD +0.22 (0.52%)

3-Year Stock Price Performance

Premium Research for SLNO

- Zacks Rank

Strong Buy 1

Strong Buy 1

- Style Scores

D Value A Growth A Momentum A VGM

- Market Cap:$2.28 B (Mid Cap)

- Projected EPS Growth:103.20%

- Last Quarter EPS Growth:622.22%

- Last EPS Surprise:NA

- Next EPS Report date:Feb. 26, 2026

Our Take:

Reasons to Buy

Soleno Therapeutics develops treatments for rare diseases and is commercializing VYKAT XR for hyperphagia in Prader-Willi syndrome. The therapy won U.S. approval and launched in 2025. Early uptake has been robust, with acceleration in demand, indicating rapid patient adoption and payer traction in a concentrated market. Management is also pursuing international expansion through an EMA pathway, extending the long-term runway for the franchise.

Potential Risks

Commercial execution is still early; persistence, safety management, and access decisions will shape the slope of the launch. Orphan markets can mature quickly, and emerging competitors in PWS could cap longer-term growth or pricing power.

Forecast

Zacks Rank #1 with A scores for Growth and Momentum and D for Value indicates favorable estimate revisions and constructive sentiment despite a richer valuation profile. The chart shows a clear price uptrend, rising out-year consensus lines, and a beat-leaning surprise pattern, signals that earnings revisions, not just multiple expansion, are driving the story.

See more from Zacks Research for This Ticker

Normally $25 each - click below to receive one report FREE:

Aris Mining Corporation (ARMN)

$21.25 USD +0.99 (4.89%)

3-Year Stock Price Performance

Premium Research for ARMN

- Zacks Rank

Strong Buy 1

Strong Buy 1

- Style Scores

C Value A Growth C Momentum B VGM

- Market Cap:$4.16 B (Mid Cap)

- Projected EPS Growth:311.76%

- Last Quarter EPS Growth: 39.13%

- Last EPS Surprise:33.33%

- Next EPS Report date:March, 11, 2026

Our Take:

Reasons to Buy

Aris Mining is a Colombia-focused gold producer led by the Segovia district and the Marmato project. Production rose to 256,503 ounces in 2025, with guidance of 300,000–350,000 ounces for 2026 as Segovia’s second mill ramps up and Marmato’s CIP plant contributes late year. Cash exceeded US$390 million at end-2025, funding capex and optionality at Soto Norte and Toroparu. A January 2026 update expanded Segovia reserves and resources, extending mine life.

Potential Risks

Country risk dominates the narrative, with permitting uncertainty, stakeholder relations, and security factors posing execution challenges. Timely and effective progress at Marmato is essential.

Forecast

A Zacks Rank #1 signals favorable estimate revisions, while Value C, Growth A, and Momentum C scores suggest returns may hinge more on earnings traction than short-term price action. The chart shows a sharp late-2025 price surge while 2026–2027 consensus EPS lines step higher and recent EPS surprises skew positive after earlier mixed prints.

See more from Zacks Research for This Ticker

Normally $25 each - click below to receive one report FREE:

Best Stocks to Buy Now: How to Use This List

It’s important to understand what this list is, and what it isn’t.

For decades, the Zacks Rank has been a proven system that has helped investors identify stocks most likely to outperform. Instead of relying on hunches or hype, it’s grounded in earnings estimate revisions — a factor strongly correlated with stock price movement. When combined with additional fundamental metrics, the approach becomes even more powerful.

Still, it’s important to understand these basics:

- While the list offers exposure across several industries, it is not a fully diversified portfolio. You should think of it as a starting point, not a complete investing strategy.

- Even though these stocks are backed by a proven system, nothing protects you from short-term downside. Depending on market conditions, most — or even all — could decline in the near term.

- The Zacks Rank works because it captures trends in earnings momentum. That power plays out over weeks and months, not days. Investors with patience and discipline are more likely to benefit.

- Before buying any single stock, check how it aligns with your goals, risk tolerance, and broader portfolio.

Methodology

The Zacks Rank is a proprietary stock-rating model that uses trends in earnings estimate revisions and earnings-per-share (EPS) surprises to classify stocks into five groups: #1 (Strong Buy), #2 (Buy), #3 (Hold), #4 (Sell) and #5 (Strong Sell). The Zacks Rank is calculated through four primary factors related to earnings estimates: analysts' consensus on earnings estimate revisions, the magnitude of revision change, the upside potential and estimate surprise (or the degree in which earnings per share deviated from the previous quarter).

Zacks builds the data from 3,000 analysts at over 150 different brokerage firms. The average yearly gain for Zacks Rank #1 (Strong Buy) stocks is +23.62% per year from January, 1988, through June 2, 2025.

For this list, only companies in the top 50% of industries that have average daily trading volumes of 100,000 shares or more were considered. Stocks with a share value of $5 or less were excluded. These companies earned Zacks Rank #1 (Strong Buy) between Jan. 12, 2026 and Jan. 24, 2026. All information is current as of market open, Jan. 26, 2026.

Common Questions of New Investors

Where to Buy Stocks

To invest in stocks, you must open a brokerage account, fund the account and purchase stocks through your selected brokerage. Investors may also purchase stocks through a financial advisor or an automated robo advisor. Some publicly traded companies also offer a direct stock purchase plan, where you can purchase shares directly from the company.

Alternative Ways to Invest in Stocks

You can also invest in stock funds, such as mutual funds, index funds and exchange-traded funds, where the fund managers select the pool of stocks that follow an investing strategy. These funds may broadly cover an entire index, such as the S&P 500, or specific types of stocks, such as industries like technology and energy companies, company size such as small cap companies, or location like international companies.

How to Start Investing in Stocks Today

It’s easy to start investing by opening an online brokerage account. Opening a standard brokerage account takes about 20 minutes and you’ll need to have some personal information ready, such as your social security number and your bank details to fund your account.

You’ll need to decide whether to open a taxable account (most common), a tax-deferred retirement account such as a traditional IRA or a tax-free retirement account such as a Roth IRA, which is funded with after-tax dollars, but qualified withdrawals are tax-free. A margin account allows for borrowing to purchase stocks and is best for experienced traders.

Set goals before you begin investing – determine how much you can afford to invest and your tolerance for risk.

What to Look for When You Buy Stocks?

The goal in all equities investment is to buy low and sell high, growing your wealth over time. Researching the companies to invest in is key – what kind of product or service do they offer? How do they compare with competitors? How fast are they growing? Does the stock pay regular dividends to shareholders? Does the stock help diversify your portfolio by giving you exposure to a market segment you currently don’t hold?

Understanding fundamental analysis can help determine whether the stock has the potential for growth at its current purchase price. Factors that can help determine that include earnings per share (EPS), price-to-earnings ratio and PE growth. Technical analysis is used looking at statistical patterns to potentially predict future price moves. Some investors may look for a growth and income strategy, looking for stocks with solid revenues that pay good dividends, or a value strategy, looking if a current stock price is below what their revenue, EPS and other factors suggest.

Analysts also often look for the momentum of a stock by looking at moving averages of a stock's closing price over a 50-day, 100-day or 12-month trailing time period to determine signals whether to buy or sell a stock.