5 Best Stocks to Buy Today

| Company (Ticker) | 12 Week Price Change | Forward PE | Price | Proj EPS Growth (1 Year) | Projected Sales Growth (1Y) |

|---|---|---|---|---|---|

| New Gold (NGD) | 42.67% | 7.92 | $9.95 | 112.29% | NA |

| AngloGold Ashanti PLC (AU) | 33.80% | 11.77 | $94.85 | 40.45% | 22.49% |

| SK Telecom Co. (SKM) | 40.25% | 9.46 | $27.91 | 156.90% | 4.68% |

| Southwest Airlines (LUV) | 46.44% | 12.82 | $49.64 | 298.68% | 11.57% |

| Seagate Technology (STX) | 45.94% | 32.99 | $432.95 | 52.58% | 24.62% |

*Updated on February 2, 2026.

New Gold (NGD)

$9.95 USD -0.08 (-0.80%)

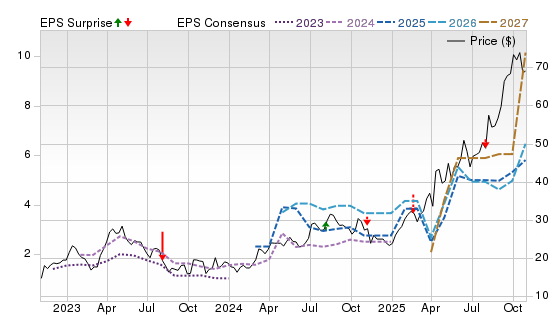

3-Year Stock Price Performance

Premium Research for NGD

- Zacks Rank

Strong Buy 1

Strong Buy 1

- Style Scores

C Value A Growth A Momentum A VGM

- Market Cap:$7.94 B (Mid Cap)

- Projected EPS Growth:200.00%

- Last Quarter EPS Growth:127.27%

- Last EPS Surprise:38.89%

- Next EPS Report date:Feb. 18, 2026

Our Take:

Reasons to Buy

New Gold operates two mines, Rainy River in Ontario and New Afton in British Columbia, giving investors gold-and-copper exposure in stable jurisdictions. In Q3 2025, Rainy River delivered record output and drove record free cash flow, while New Afton’s B3 cave continued to outperform as C-Zone construction advanced on schedule. Debt paydown accelerated as cash generation surged. Guidance remained on track with AISC trending toward the high end but supported by stronger realized prices.

Potential Risks

Only two producing assets heighten concentration and execution risk. Rainy River’s underground ramp and New Afton’s block-cave transition must stay on time and budget.

Forecast

A Zacks Rank #1 (Strong Buy) with Style Scores of A for Growth and Momentum and C for Value signals favorable revisions and improving sentiment. The Price, Consensus & EPS Surprise chart shows a sharp price breakout with 2026–2027 estimates rising and a tilt toward recent beats.

AngloGold Ashanti PLC (AU)

$94.85 USD +1.98 (2.13%)

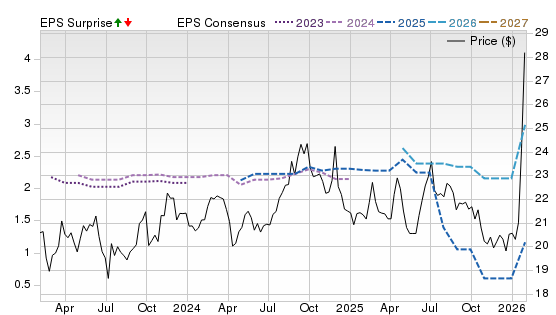

3-Year Stock Price Performance

Premium Research for AU

- Zacks Rank

Strong Buy 1

Strong Buy 1

- Style Scores

C Value A Growth B Momentum A VGM

- Market Cap:$38.98 B (Large Cap)

- Projected EPS Growth:154.30%

- Last Quarter EPS Growth:5.60%

- Last EPS Surprise:-1.49%

- Next EPS Report date:Feb. 18, 2026

Our Take:

Reasons to Buy

AngloGold is a global gold miner with tier-one assets across Africa, the Americas and Australia. The Q3 2025 marked a record cash-generation quarter: production rose 17% YoY, adjusted EBITDA more than doubled, free cash flow hit $920 million, and the balance sheet swung to $450 million net cash. The board declared a 91-cent dividend while reaffirming guidance. Growth was led by Obuasi’s ramp, Kibali and Geita, with Sukari strengthening the portfolio.

Potential Risks

AISC rose on royalties and sustaining capex. Multi-country exposure introduces geopolitical, regulatory and operational risks. Any sustained reversal in bullion prices would pressure margins.

Forecast

A Zacks Rank #1 with A for Growth, B for Momentum and C for Value points to positive revisions and improving trend quality. The chart shows price stabilization and recovery alongside rising 2027 consensus and mixed but improving surprise patterns, consistent with continued rerating if execution holds.

SK Telecom Co. (SKM)

$27.91 USD -0.28 (-0.99%)

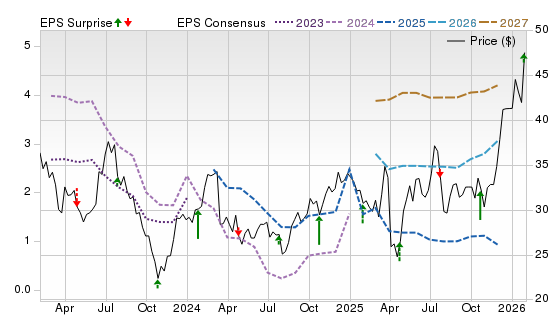

3-Year Stock Price Performance

Premium Research for SKM

- Zacks Rank

Strong Buy 1

Strong Buy 1

- Style Scores

A Value D Growth A Momentum B VGM

- Market Cap:$11.10 B (Large Cap)

- Projected EPS Growth:-52.65%

- Last Quarter EPS Growth:-581.25%

- Last EPS Surprise:NA

- Next EPS Report date:Feb. 11, 2026

Our Take:

Reasons to Buy

SK Telecom is Korea’s leading wireless operator, pivoting to an “AI-native” telco spanning connectivity, data-center and enterprise AI. The Q3 2025 headline results were weak after customer-compensation actions, but the AI segment grew 35.7% year over year, management emphasized recovery from Q4, and construction of an AI data center plus partnerships (including an OpenAI MoU) support longer-term mix shift beyond core mobile.

Potential Risks

Near-term earnings remain exposed to churn from the cybersecurity incident, tariff discounts, and regulatory scrutiny. Competitive intensity, capex for AI infrastructure and macro softness could weigh on returns.

Forecast

A Zacks Rank #1 with A for Value and Momentum and D for Growth suggests estimate upgrades and improving tape despite uneven fundamentals. The chart shows a late-stage rally with 2026–2027 estimates turning higher and a mixed surprise record, supporting a rebound case, albeit with execution risk as AI ventures scale.

Southwest Airlines (LUV)

$49.64 USD +2.12 (4.46%)

3-Year Stock Price Performance

Premium Research for LUV

- Zacks Rank

Strong Buy 1

Strong Buy 1

- Style Scores

B Value D Growth A Momentum B VGM

- Market Cap:$24.58 B (Large Cap)

- Projected EPS Growth:298.92%

- Last Quarter EPS Growth:427.27%

- Last EPS Surprise:3.57%

- Next EPS Report date:April 22, 2026

Our Take:

Reasons to Buy

Southwest Airlines is a large U.S. carrier undergoing a revenue transformation. During Q4 2025 results, management guided to 2026 adjusted EPS at a minimum of $4 as assigned seating, bag fees and new fare bundles expand ancillary revenue and improve unit RASM, a notable pivot versus its historical no-fees model. Its Q4 EPS beat and 2026 setup imply materially higher profitability.

Potential Risks

Execution risk around product changes, labor costs and potential demand elasticity could temper benefits. Any disruption in Boeing deliveries and certification timelines could impact the schedule. Fuel volatility and weather events remain headwinds.

Forecast

A Zacks Rank #1 with A for Momentum, B for Value and D for Growth reflects strong revisions and technical strength following guidance. The chart shows price rebounding sharply with the 2027 consensus lifting and a mixed surprise pattern turning more favorable, consistent with improving earnings visibility as the new revenue streams season.

Seagate Technology (STX)

$432.95 USD +25.26 (6.20%)

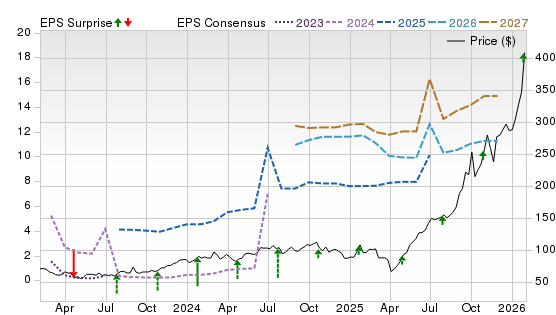

3-Year Stock Price Performance

Premium Research for STX

- Zacks Rank

Strong Buy 1

Strong Buy 1

- Style Scores

F Value A Growth A Momentum B VGM

- Market Cap:$87.07 B (Large Cap)

- Projected EPS Growth:52.59%

- Last Quarter EPS Growth:15.54%

- Last EPS Surprise:9.89%

- Next EPS Report date:May 5, 2026

Our Take:

Reasons to Buy

Seagate designs mass-capacity HDDs and has a massive portfolio of storage systems used by cloud and enterprise customers. Fiscal Q2 2026 delivered 21.5% revenue growth year over year, 42.2% adjusted gross margins and strong free cash flow as data center demand remains durable and HAMR-based Mozaic products continue to ramp. Management highlighted its areal-density-driven product roadmap and evolving storage requirements underpinning the mix.

Potential Risks

Storage demand is cyclical; a pause in cloud capex or competitive responses from peers could pressure pricing. Export-control scrutiny and supply-chain sensitivities around critical materials add compliance and cost risk.

Forecast

A Zacks Rank #1 with A for Growth and Momentum and F for Value points to robust revisions and trend strength, albeit with a premium valuation. The chart shows a pronounced price uptrend with rising 2026–2027 consensus lines and a recent beat-leaning cadence, supporting constructive momentum as HAMR scales.

Best Stocks to Buy Now: How to Use This List

It’s important to understand what this list is, and what it isn’t.

For decades, the Zacks Rank has been a proven system that has helped investors identify stocks most likely to outperform. Instead of relying on hunches or hype, it’s grounded in earnings estimate revisions — a factor strongly correlated with stock price movement. When combined with additional fundamental metrics, the approach becomes even more powerful.

Still, it’s important to understand these basics:

- While the list offers exposure across several industries, it is not a fully diversified portfolio. You should think of it as a starting point, not a complete investing strategy.

- Even though these stocks are backed by a proven system, nothing protects you from short-term downside. Depending on market conditions, most — or even all — could decline in the near term.

- The Zacks Rank works because it captures trends in earnings momentum. That power plays out over weeks and months, not days. Investors with patience and discipline are more likely to benefit.

- Before buying any single stock, check how it aligns with your goals, risk tolerance, and broader portfolio.

Methodology

The Zacks Rank is a proprietary stock-rating model that uses trends in earnings estimate revisions and earnings-per-share (EPS) surprises to classify stocks into five groups: #1 (Strong Buy), #2 (Buy), #3 (Hold), #4 (Sell) and #5 (Strong Sell). The Zacks Rank is calculated through four primary factors related to earnings estimates: analysts' consensus on earnings estimate revisions, the magnitude of revision change, the upside potential and estimate surprise (or the degree in which earnings per share deviated from the previous quarter).

Zacks builds the data from 3,000 analysts at over 150 different brokerage firms. The average yearly gain for Zacks Rank #1 (Strong Buy) stocks is +23.62% per year from January, 1988, through June 2, 2025.

For this list, only companies in the top 50% of industries that have average daily trading volumes of 100,000 shares or more were considered. Stocks with a share value of $5 or less were excluded. These companies earned Zacks Rank #1 (Strong Buy) between Jan. 12, 2026 and Jan. 24, 2026. All information is current as of market open, Feb. 02, 2026.

Common Questions of New Investors

Where to Buy Stocks

To invest in stocks, you must open a brokerage account, fund the account and purchase stocks through your selected brokerage. Investors may also purchase stocks through a financial advisor or an automated robo advisor. Some publicly traded companies also offer a direct stock purchase plan, where you can purchase shares directly from the company.

Alternative Ways to Invest in Stocks

You can also invest in stock funds, such as mutual funds, index funds and exchange-traded funds, where the fund managers select the pool of stocks that follow an investing strategy. These funds may broadly cover an entire index, such as the S&P 500, or specific types of stocks, such as industries like technology and energy companies, company size such as small cap companies, or location like international companies.

How to Start Investing in Stocks Today

It’s easy to start investing by opening an online brokerage account. Opening a standard brokerage account takes about 20 minutes and you’ll need to have some personal information ready, such as your social security number and your bank details to fund your account.

You’ll need to decide whether to open a taxable account (most common), a tax-deferred retirement account such as a traditional IRA or a tax-free retirement account such as a Roth IRA, which is funded with after-tax dollars, but qualified withdrawals are tax-free. A margin account allows for borrowing to purchase stocks and is best for experienced traders.

Set goals before you begin investing – determine how much you can afford to invest and your tolerance for risk.

What to Look for When You Buy Stocks?

The goal in all equities investment is to buy low and sell high, growing your wealth over time. Researching the companies to invest in is key – what kind of product or service do they offer? How do they compare with competitors? How fast are they growing? Does the stock pay regular dividends to shareholders? Does the stock help diversify your portfolio by giving you exposure to a market segment you currently don’t hold?

Understanding fundamental analysis can help determine whether the stock has the potential for growth at its current purchase price. Factors that can help determine that include earnings per share (EPS), price-to-earnings ratio and PE growth. Technical analysis is used looking at statistical patterns to potentially predict future price moves. Some investors may look for a growth and income strategy, looking for stocks with solid revenues that pay good dividends, or a value strategy, looking if a current stock price is below what their revenue, EPS and other factors suggest.

Analysts also often look for the momentum of a stock by looking at moving averages of a stock's closing price over a 50-day, 100-day or 12-month trailing time period to determine signals whether to buy or sell a stock.