5 Best AI Stocks to Buy Today

| Company (Ticker) | 12 Week Price Change | Forward PE | Price | Proj EPS Growth (1 Year) | Projected Sales Growth (1Y) |

|---|---|---|---|---|---|

| Micron Technology (MU) | 70.52% | 11.00 | $345.87 | 278.29% | 89.30% |

| Analog Devices (ADI) | 23.91% | 30.74 | $293.86 | 25.67% | 16.36% |

| NVIDIA (NVDA) | 0.90% | 39.64 | $184.94 | 55.97% | 62.39% |

| Marvell Technology (MRVL) | -5.38% | 29.28 | $82.89 | 81.03% | 41.87% |

| UiPath (PATH) | 5.70% | 24.45 | $17.24 | 25.94% | 11.52% |

*Updated on January 12, 2026.

Micron Technology (MU)

$345.87 USD +0.78 (0.23%)

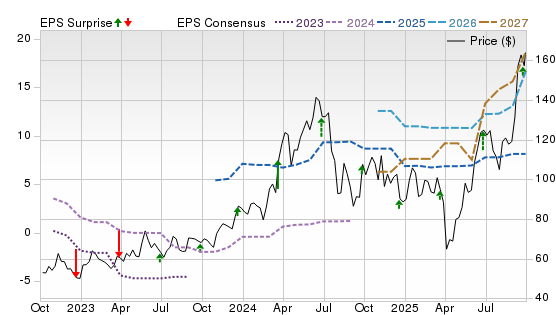

3-Year Stock Price Performance

Premium Research for MU

- Zacks Rank

- Strong Buy 1

- Style Scores

C Value A Growth B Momentum A VGM

- Market Cap: $388.40 B (Mega Cap)

- Projected EPS Growth:278.29%

- Last Quarter EPS Growth:61.19%

- Last EPS Surprise:22.25%

- Next EPS Report date:March 19, 2026

Our Take:

Micron supplies high-bandwidth DRAM and NAND that power training and inference in modern AI systems, including HBM3E stacked memory designed into leading AI accelerators. A Zacks Rank #1 (Strong Buy) reflects improving estimate revisions as AI servers drive a cyclical upturn in memory pricing and mix. Style Scores show a balanced setup with C for Value, A for Growth and B for Momentum, suggesting reasonable valuation support alongside accelerating fundamentals and constructive price action.

Strategically, Micron is benefitting from structural AI demand for bandwidth and capacity, with HBM and data-center DRAM anchored by design wins tied to NVIDIA platforms and an expanding HBM4 roadmap. That mix shift should support margins as supply remains disciplined.

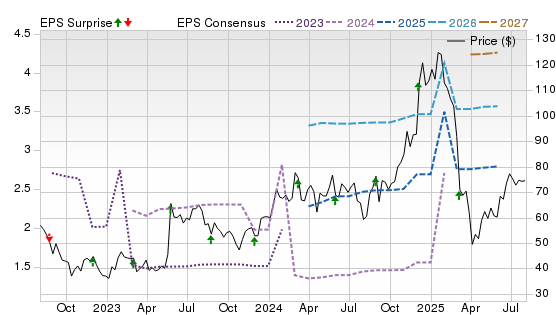

The Price, Consensus & EPS Surprise chart underscores the turn: out-year EPS lines for 2026–2027 trend higher while the stock pushes to new highs, indicating estimate momentum is leading the price.

Analog Devices (ADI)

$293.86 USD -7.07 (-2.35%)

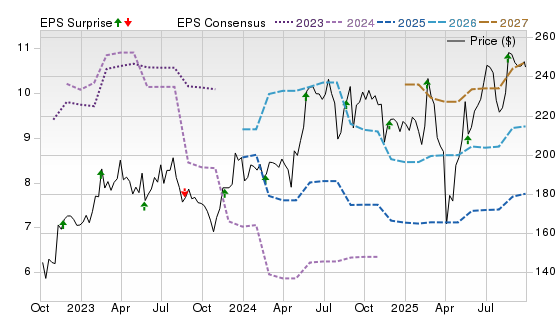

3-Year Stock Price Performance

Premium Research for ADI

- Zacks Rank

Strong Buy 1

Strong Buy 1

- Style Scores

F Value C Growth C Momentum D VGM

- Market Cap:$147.35 B (Large Cap)

- Projected EPS Growth:25.67%

- Last Quarter EPS Growth:10.24%

- Last EPS Surprise:1.80%

- Next EPS Report date:Feb. 18, 2026

Our Take:

Analog Devices builds high-performance analog, mixed-signal and embedded processing that brings intelligence to the edge, where AI inference increasingly occurs inside industrial, automotive and healthcare systems. A Zacks Rank #1 signals positive estimate revisions, despite a mixed Style Score profile of C for Growth and Momentum and F for Value, implying that the near-term setup is driven more by earnings inflection than by screens for valuation or technicals.

Its “Intelligent Edge” strategy moves signal processing closer to sensors, reducing cloud latency and power while enabling AI-ready data pipelines across factory automation and autos, segments with durable, long design cycles. That positioning should benefit as customers add on-device analytics and safety features.

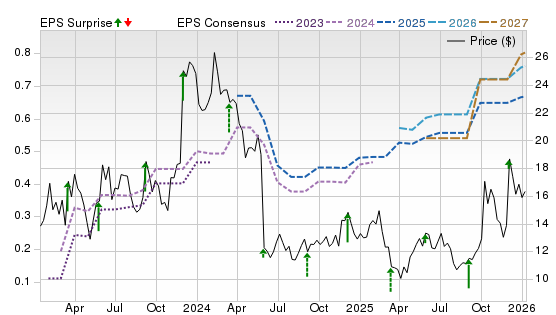

On the chart, the stock’s recovery aligns with gradually rising 2026–2027 EPS lines after a trough, and positive surprises are becoming more frequent. Continued operational normalization, driven by AI-linked catalysts, will enhance performance.

NVIDIA (NVDA)

$184.94 USD +0.08 (0.04%)

3-Year Stock Price Performance

Premium Research for NVDA

- Zacks Rank

Strong Buy 1

Strong Buy 1

- Style Scores

F Value B Growth C Momentum C VGM

- Market Cap: $4,492.10 B (Mega Cap)

- Projected EPS Growth: 55.85%

- Last Quarter EPS Growth: 25.25%

- Last EPS Surprise:4.84%

- Next EPS Report date: Feb. 25, 2026

Our Take:

NVIDIA designs the dominant accelerated-computing stack for AI, including GPUs, networking, software and platforms used to train and deploy generative AI at scale. It carries a Zacks Rank #1, supported by ongoing estimate upgrades. Style Scores of F for Value, B for Growth and C for Momentum indicate that investors are paying up for growth as fundamentals remain the primary driver.

The growth story rests on successive platform cycles, from Hopper to Blackwell and expanding enterprise software offerings, broadening the company’s reach from hyperscale training to inference, digital twins and edge AI. That integrated ecosystem deepens customer lock-in and lengthens visibility into data-center spend as demand continues to remain high.

The chart shows a powerful uptrend punctuated by estimate step-ups for 2026–2027 and largely positive surprises. Price has tracked those rising lines, reinforcing that earnings revisions, not multiple expansions alone, are propelling performance.

Marvell Technology (MRVL)

$82.89 USD -0.33 (-0.40%)

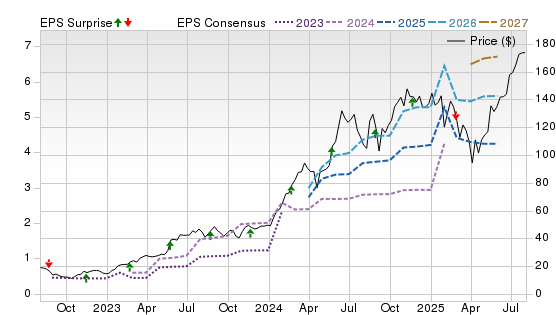

3-Year Stock Price Performance

Premium Research for MRVL

- Zacks Rank

Strong Buy 1

Strong Buy 1

- Style Scores

D Value C Growth B Momentum D VGM

- Market Cap:$70.58 B (Large Cap)

- Projected EPS Growth:80.89%

- Last Quarter EPS Growth:24.00%

- Last EPS Surprise:1.33%

- Next EPS Report date:March 4, 2026

Our Take:

Marvell provides essential silicon for AI data-center infrastructure, spanning optical DSPs, Ethernet switching and custom silicon for cloud customers, areas levered to the scale-out of AI clusters. A Zacks Rank #1 indicates favorable revisions. Style Scores of D for Value, C for Growth and B for Momentum reflect a growth-and-momentum skew rather than a pure value play.

Strategically, Marvell is deepening its AI positioning through interconnect and switching, where bandwidth and latency are gating factors for model training efficiency. Recent acquisitions in chip-to-chip connectivity and optical networking aim to strengthen the portfolio for next-gen AI systems and broaden cloud engagements.

On the chart, estimates for 2026–2027 trend steadily higher while the share price grinds up with intermittent consolidations, typical of infrastructure suppliers tied to multi-year capex. Consistent upside surprises and rising consensus suggest AI networking remains a durable demand tailwind.

UiPath (PATH)

$17.24 USD +0.92 (5.64%)

3-Year Stock Price Performance

Premium Research for PATH

- Zacks Rank

Strong Buy 1

Strong Buy 1

- Style Scores

F Value D Growth A Momentum F VGM

- Market Cap:$8.73 B (Mid Cap)

- Projected EPS Growth:26.42%

- Last Quarter EPS Growth:200.00%

- Last EPS Surprise:14.29%

- Next EPS Report date:March 11, 2026

Our Take:

UiPath delivers an AI-powered automation platform that combines robotic process automation with gen-AI copilots to interpret content, orchestrate workflows and accelerate software tasks at scale. A Zacks Rank #1 reflects positive estimate momentum. The Style Scores indicate a mixed profile with A for Momentum, F for Value and D for Growth, implying sentiment and technicals have turned ahead of full growth reacceleration.

The investment case hinges on deeper AI integration using Autopilot and foundation models to move beyond basic RPA into document understanding and agent-based automation. This will boost retention and stickiness among large enterprises, giving the company a steady base.

The chart depicts a base-building price pattern while out-year EPS lines for 2026–2027 edge higher following several positive surprises. The improving consensus backdrop and strengthening momentum suggest that the market is anticipating steadier adoption of AI-native automation across customers.

Methodology

The Zacks Rank is a proprietary stock-rating model that uses trends in earnings estimate revisions and earnings-per-share (EPS) surprises to classify stocks into five groups: #1 (Strong Buy), #2 (Buy), #3 (Hold), #4 (Sell) and #5 (Strong Sell). The Zacks Rank is calculated through four primary factors related to earnings estimates: analysts' consensus on earnings estimate revisions, the magnitude of revision change, the upside potential and estimate surprise (or the degree in which earnings per share deviated from the previous quarter).

Zacks builds the data from 3,000 analysts at over 150 different brokerage firms. The average yearly gain for Zacks Rank #1 (Strong Buy) stocks is +23.62% per year from January, 1988, through June 2, 2025.

Selections for Best AI Stocks are based on the current top ranking stocks based on Zacks Indicator Score. For this list, only companies that have average daily trading volumes of 100,000 shares or more and at least five analysts covering the stock were considered. All information is current as of market open, Jan. 12, 2026.

Guide to AI Stocks

The classification of “AI Stocks” is actually quite broad, ranging from companies that provide the essential hardware, companies that create the software to run Large Language Models, and a whole host of other industries and companies that are creating the Artificial Intelligence ecosystem. All stand to gain – or lose – depending on the fortunes of AI tech.

Types of AI Stocks

Hardware (GPUs, Chips) Stocks – NVIDIA, AMD, TSMC, Broadcom

The backbone of AI is raw computing power, and this comes primarily from specialized chips like graphics processing units (GPUs) and AI-focused accelerators. NVIDIA (NVDA) is the undisputed leader in GPUs used for training large language models.

Advanced Micro Devices (AMD) is a rising competitor, with its MI300 series targeting data center AI workloads. Taiwan Semiconductor Manufacturing Co. (TSMC) doesn’t make its own chips but manufactures advanced nodes for nearly every big tech firm—including Apple, Nvidia, and AMD—making it critical to the global AI supply chain. Broadcom (AVGO) has carved a niche in custom ASICs (application-specific integrated circuits) for hyperscale cloud providers, which value tailored chips that reduce energy use and maximize throughput.

These companies benefit from structural demand for more computing capacity, but they also face geopolitical risks such as U.S.-China export restrictions and cyclical swings in semiconductor demand.

AI Cloud & Infrastructure – Microsoft, Amazon, Alphabet

Building AI applications at scale requires massive computing infrastructure. Azure from Microsoft (MSFT) has become a leader by integrating OpenAI’s models directly into its cloud offerings, giving it a first-mover advantage in AI enterprise adoption. Amazon Web Services, a subsidiary of Amazon (AMZN) is deploying its in-house Trainium and Inferentia chips, aiming to lower costs for AI workloads while retaining dominance in cloud services. Alphabet’s (GOOG) Google Cloud is leaning heavily on its proprietary Tensor Processing Units (TPUs) and Gemini AI models to differentiate itself.

Investing in these players is less about speculative growth and more about diversified tech giants whose AI investments bolster an already profitable core business.

Enterprise AI Software & Analytics – Palantir, C3.ai, Adobe, Snowflake

AI isn’t just about hardware; software platforms are where businesses actually apply machine intelligence. Palantir (PLTR) powers decision-making for defense and large corporations with its Foundry and Gotham platforms. C3.ai (AI) focuses specifically on AI-driven applications across industries like energy, finance, and manufacturing. Adobe (ADBE) has integrated AI across its creative suite (e.g., Firefly in Photoshop), while Snowflake (SNOW) has added AI-enabled analytics to its cloud data warehousing business.

These stocks tend to have higher growth potential but also higher risk, as adoption timelines and customer budgets can vary widely.

Cybersecurity AI – CrowdStrike

The rise of AI also heightens cyber risks. CrowdStrike (CRWD) leads in AI-powered threat detection, using machine learning to flag suspicious behavior across millions of endpoints in real time. With ransomware and nation-state attacks increasing, demand for AI-driven security remains strong. Cybersecurity names often benefit from recurring revenue models, which may help smooth out volatility compared to hardware peers.

Benefits and Risks of AI Stocks

Benefits:

- Secular Growth: AI adoption is still in early innings, with enterprise use cases expanding rapidly.

- Diversified Exposure: Investors can target infrastructure, software, or services depending on risk tolerance.

- First-Mover Advantage: Leaders like NVIDIA and Microsoft are shaping the ecosystem, creating strong economic moats.

Risks:

- Valuations: Many AI leaders are priced for perfection, leaving little margin of safety.

- Hype Cycle: Investor enthusiasm may outrun near-term fundamentals, creating bubble risk.

- Regulation: Governments are exploring AI rules around privacy, bias, and national security, which could reshape business models.

- Competition: Barriers to entry are high, but fast innovation means today’s leader can quickly lose ground.

How to Choose AI Stocks

When evaluating AI stocks, consider:

- Revenue Mix: How much of the company’s growth is truly driven by AI vs. traditional segments?

- Moat & Differentiation: Does the company control unique technology (like NVIDIA’s CUDA software ecosystem)?

- Customer Adoption: Look for companies with recurring contracts or wide adoption across industries.

- Financial Health: Strong balance sheets matter in a capital-intensive industry.

- Valuation Metrics: Compare price-to-earnings (P/E) ratio, price-to-sales (P/S) ratio, and forward growth projections to industry peers.

How to Invest in AI Stocks

There are multiple entry points depending on your goals:

- Direct Stock Picks: Best if you want concentrated exposure to specific company leaders or disruptors.

- AI Exchange-Traded Funds (ETFs): ETFs such as Global X Robotics & Artificial Intelligence ETF (BOTZ) or iShares Robotics and AI ETF (IRBO) provide diversification by investing in a broad range of companies in the AI space.

- Broad Tech ETFs: Like Invesco QQQ (QQQ) or Vanguard Information Technology ETF (VGT), offering AI exposure as part of a bigger tech basket.

- Dollar-Cost Averaging (DCA): A strategy to smooth price volatility by buying at regular intervals AI stocks or funds.

- Long-Term Holds: Since AI is a multi-decade trend, investors who can weather short-term swings may see the best results.

AI Stocks Alternatives

If you want exposure to AI without betting on a single stock:

- ETFs: Offer diversification and reduce single-company risk.

- Private Markets: Startups in robotics, generative AI, and enterprise AI could offer upside, though access is limited to accredited investors, which face income or licensing limitations (such as a net worth of $1 million, excluding primary residence, plus a high annual income – $300,000 if married.

- Picks-and-Shovels Plays: Companies supplying infrastructure, like power management (e.g., Eaton) or data center REITs (e.g., Equinix), benefit indirectly from AI growth.

Strategies for AI Stocks Moving Forward

- Barbell Approach: Combine stable mega-caps (Microsoft, Nvidia) with speculative names (Quantum Computing Inc., Credo) for balanced exposure.

- Rebalancing: Trim positions after strong rallies to lock in gains and redeploy into underweighted sectors.

- Monitor Earnings: Focus on whether AI adoption translates into sustainable revenue growth.

- Look Beyond the U.S.: Consider emerging AI leaders in Europe and Asia for diversification.

- Stay Agile: AI is evolving rapidly; reassess holdings every quarter as new winners emerge.

Frequently Asked Questions About AI Stocks

Are AI stocks overvalued?

Many AI leaders are priced at steep multiples compared to the broader market. That doesn’t mean all are bubbles, but investors should separate hype from earnings-driven growth.

What is the forecast for AI stocks?

Most analysts expect AI demand to expand through at least the next decade, with data center spending, AI-as-a-service, and AI-enabled enterprise tools driving revenue.

What metrics best signal AI efficacy?

- Growth in AI-specific revenue lines.

- Gross margin improvements tied to AI.

- Customer retention and expansion.

- Evidence of scale: Contracts, partnerships, recurring revenue.