5 Best Dividend Stocks to Buy Today

| Company (Ticker) | 12 Week Price Change | Annual Dividend | Annualized Dividend Growth | Dividend Payout Ratio | Dividend Yield |

|---|---|---|---|---|---|

| Copa Holdings (CPA) | 2.63% | $6.44 | 59.43% | 40.00% | 5.28% |

| TIM (TIMB) | -10.04% | $0.95 | 10.47% | 55.00% | 4.73% |

| Prudential Financial (PRU) | 10.06% | $5.40 | 4.17% | 38.00% | 4.73% |

| Petroleo Brasileiro (PBR) | -6.56% | $0.53 | 31.65% | 40.00% | 4.47% |

| Host Hotels & Resorts (HST) | 7.87% | $0.80 | 47.73% | 40.00% | 4.36% |

*Updated on December 24, 2025.

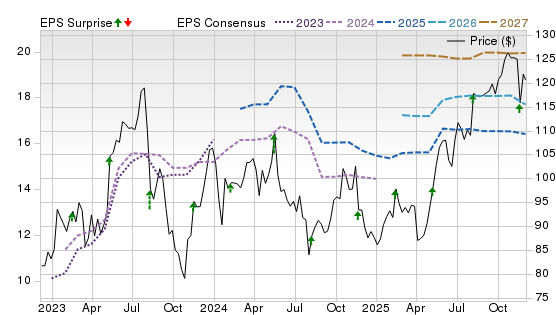

Copa Holdings (CPA)

$121.71 USD -0.24 (-0.20%)

3-Year Stock Price Performance

Premium Research for CPA

- Zacks Rank

- Hold 3

- Style Scores

A Value C Growth B Momentum A VGM

- Market Cap:$5.02 B (Mid Cap)

- Last Announced Dividend Amount: $1.61

- Last Dividend Payout Date:Dec. 15, 2025

- Projected EPS Growth:14.97%

- Next EPS Report Date: Feb. 11, 2026

Our Take:

Copa Holdings operates Copa Airlines and Copa Colombia, running a hub-and-spoke network through Panama City that efficiently connects North, Central, and South America. It operates a modern all-Boeing 737 fleet and is expanding with additional 737 MAX deliveries through 2028.

For dividend investors, the appeal starts with a 5.28% yield and a 40% payout ratio, which suggests management isn’t stretching to fund distributions. A low 5.35x price-to-cash-flow and strong 26.4% ROE reinforce that the dividend is being supported by real profitability, not leverage.

Operationally, Copa’s geographic hub advantage can translate into higher aircraft utilization and sustained regional demand, which is crucial for maintaining cash returns in a cyclical industry.

With a Zacks Rank #3 (Hold) but a Value Score of A, the setup looks more like a reasonably priced cash compounder than a momentum trade, useful context when prioritizing steady income over perfect timing.

See more from Zacks Research for This Ticker

Normally $25 each - click below to receive one report FREE:

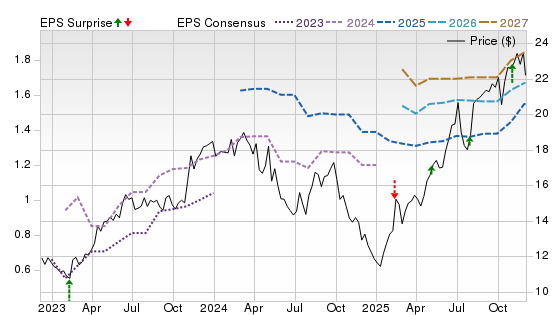

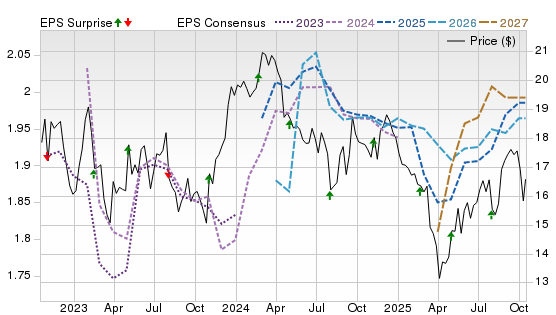

TIM (TIMB)

$20.26 USD +0.18 (0.90%)

3-Year Stock Price Performance

Premium Research for TIMB

- Zacks Rank

Strong Buy 1

Strong Buy 1

- Style Scores

A Value C Growth A Momentum A VGM

- Market Cap:$9.72 B (Mid Cap)

- Last Announced Dividend Amount:$0.64

- Dividend Payout Date:Jan. 7, 2026

- Projected EPS Growth:28.93%

- Next EPS Report Date:Feb. 10, 2026

Our Take:

TIM is a major Brazilian telecom operator, providing mobile connectivity and related services nationwide, supported by shared-fiber venture I-Systems.

The dividend case is anchored by a 4.73% yield and a 55% payout ratio, higher than some U.S. peers but still within a range that can be backed by recurring subscription revenue. TIM’s shareholder-remuneration framework and consistent distributions in recent years add credibility for income-focused holders.

Beyond the payout, TIMB’s cash-flow profile tends to be resilient, backed by a 5.15x price-to-cash-flow and mid-teens ROE. The tower infrastructure expansion partnership with IHS Brasil will be utilized in both B2C and B2B operations. This will reinforce the company’s competitive positioning for stable cash generation.

A Zacks Rank #1 (Strong Buy) highlights favorable estimate momentum, while the Value Score of A supports the idea that investors are not overpaying for that income stream, an important discipline in emerging-market dividends.

See more from Zacks Research for This Ticker

Normally $25 each - click below to receive one report FREE:

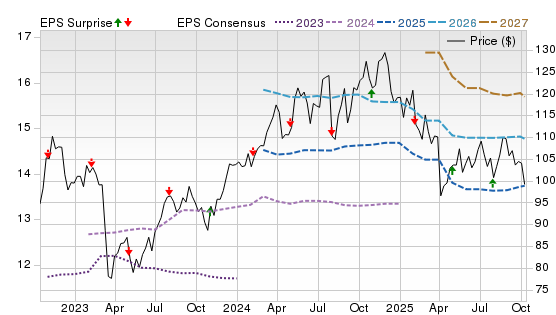

Prudential Financial (PRU)

$114.50 USD +0.32 (0.28%)

3-Year Stock Price Performance

Premium Research for PRU

- Zacks Rank

- Hold 3

- Style Scores

A Value D Growth B Momentum B VGM

- Market Cap:$39.96 B (Large Cap)

- Last Announced Dividend Amount: $1.35

- Last Dividend Payout Date:Dec. 11, 2025

- Projected EPS Growth:14.90%

- Next EPS Report Date:Feb. 3, 2026

Our Take:

Prudential Financial is a diversified insurer and asset manager spanning retirement solutions, workplace benefits, life insurance and PGIM investment management. Favorable underwriting results in the domestic and international operations, along with lower expenses, continue to support its profit growth.

Income investors get a 4.73% yield with a conservative 38% payout ratio, leaving room for the company to manage cycles without immediately pressuring the dividend. The Value Score of A also signals a reasonable entry point for a franchise where sentiment can swing with rates and markets.

Fundamentally, PGIM’s scale and performance-sensitive fees diversify earnings beyond traditional spread businesses, and management has highlighted continued growth in assets under management and institutional inflows.

With a Zacks Rank #3, the story is not purely about near-term catalysts; it is about collecting a well-covered dividend with strong ROE from a broad platform that can monetize retirement demand over time.

See more from Zacks Research for This Ticker

Normally $25 each - click below to receive one report FREE:

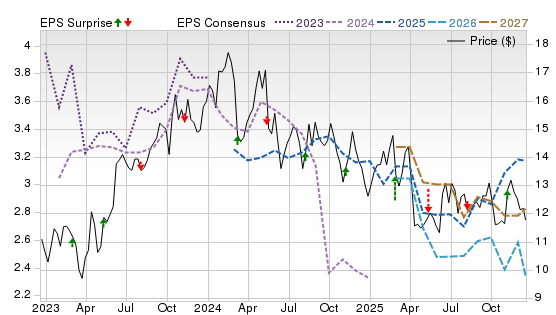

Petroleo Brasileiro (PBR)

$11.86 USD +0.03 (0.25%)

3-Year Stock Price Performance

Premium Research for PBR

- Zacks Rank

- Hold 3

- Style Scores

A Value C Growth B Momentum A VGM

- Market Cap:$76.24 B (Large Cap)

- Last Announced Dividend Amount:$0.17

- Dividend Payout Date:March 27, 2026

- Projected EPS Growth:6.38%

- Next EPS Report date:Feb. 25, 2026

Our Take:

Petróleo Brasileiro S.A. (Petrobras) is Brazil’s state-owned dominant integrated oil and gas company, with core production centered on high-quality offshore assets.

The stock’s 4.47% yield and 40% payout ratio look attractive when paired with a very low 2.39x price-to-cash-flow and strong 23.3% ROE, metrics that imply substantial cash generation relative to price. That said, Petrobras’ dividends are inherently tied to commodity prices and policy choices, so “steady” here means covered by cash flow, not perfectly smooth quarter to quarter.

Petrobras prioritizes core pre-salt development and disciplined capex. Recent reporting points to a multi-year plan that still contemplates sizable ordinary dividends, albeit with less emphasis on outsized extras, which can make the income stream more predictable.

A Zacks Rank #3 and Value Score of A support a valuation-driven approach for investors who accept the trade-off between high cash returns and higher variance and are comfortable with state oversight.

See more from Zacks Research for This Ticker

Normally $25 each - click below to receive one report FREE:

Host Hotels & Resorts (HST)

$18.52 USD +0.16 (0.87%)

3-Year Stock Price Performance

Premium Research for HST

- Zacks Rank

Hold 3

Hold 3

- Style Scores

B Value D Growth D Momentum D VGM

- Market Cap: $12.63 B (Large Cap)

- Last Announced Dividend Amount: $0.35

- Dividend Payout Date:Jan. 15, 2026

- Projected EPS Growth: 4.06%

- Next EPS Report Date: Feb. 18, 2026

Our Take:

Host Hotels is the largest lodging REIT, owning a geographically diverse portfolio of luxury and upper-upscale hotels, primarily across key U.S. markets. Top brands like Marriott and Hyatt are its key tenants, anchoring portfolio stability.

From an income standpoint, a 4.36% yield with a 40% payout ratio can be attractive for a REIT when paired with a measured balance-sheet posture. The 8.74x price-to-cash-flow is higher than most deeply discounted names, but the trade-off is typically quality: premier assets, strong operators and pricing power in top markets.

Hotel cash flows are cyclical, yet Host’s scale and its ability to recycle capital through renovations and selective asset sales can help smooth its through‑cycle dividend capacity.

With a Zacks Rank #3 and a Value Score of B, the pitch is less about bargain-basement valuation and more about collecting a well-supported yield from a high-end portfolio as travel demand normalizes.

See more from Zacks Research for This Ticker

Normally $25 each - click below to receive one report FREE:

Methodology

The Zacks Rank is a proprietary stock-rating model that uses trends in earnings estimate revisions and earnings-per-share (EPS) surprises to classify stocks into five groups: #1 (Strong Buy), #2 (Buy), #3 (Hold), #4 (Sell) and #5 (Strong Sell). The Zacks Rank is calculated through four primary factors related to earnings estimates: analysts' consensus on earnings estimate revisions, the magnitude of revision change, the upside potential and estimate surprise (or the degree in which earnings per share deviated from the previous quarter).

Zacks builds the data from 3,000 analysts at over 150 different brokerage firms. The average yearly gain for Zacks Rank #1 (Strong Buy) stocks is +23.62% per year from January, 1988, through June 2, 2025.

For this list, only companies trading on the New York Stock Exchange or NASDAQ with a dividend yield of 4 to 6% were included. We also only evaluated stock with a low debt-to-equity ratio, as well as a conservative payout ratio and dividend growth. Only stocks with a Zacks Rank #3 (Hold) or higher were considered. All information is current as of market open, Dec. 24, 2025.

Guide to Best Dividend Stocks

What Are Dividend Stocks?

Dividend stocks are shares of companies that return a portion of their earnings to shareholders on a regular basis. Rather than relying solely on stock price appreciation, dividend investors benefit from this income stream, which can complement long-term growth.

How Do Dividend Stocks Work?

Corporations that generate surplus cash may decide to share part of it with shareholders through dividends. The firm’s board will declare a dividend — often expressed as a dollar amount per share — and set a record date to identify eligible shareholders. On the payment date, the company sends the dividend (in cash or additional shares) to investors who held the stock on the record date.

Dividends typically come out of a company’s profits or free cash flow. To continue paying dividends, companies need consistent earnings, prudent capital allocation, and manageable debt levels.

How Often Do Dividend Stocks Pay in a Year?

Most U.S. dividend-paying companies distribute dividends quarterly (four times per year). Some firms choose semiannual or annual payments, depending on business norms or cash flow timing. What matters more than the frequency is consistency — companies that maintain or increase their dividend over time tend to instill more investor confidence.

Benefits and Risks of Dividend Stocks

Benefits:

- Supplemental income stream — Dividends provide cash flow even if the stock price is flat or in decline.

- Total return boost — Over long horizons, dividends have historically contributed a meaningful share of returns. (Many capital markets analyses show dividends often account for 30–50% of total equity returns.)

- Downside cushion — In volatile markets, dividend income helps offset capital losses.

- Sign of stability — Companies that consistently pay or increase dividends often have disciplined management and stable cash flows.

Risks:

- Dividend cuts — If a company hits a rough patch, it might reduce or suspend dividends, which often leads to share price declines.

- Limited growth reinvestment — High dividend payments may reduce funds available for expansion or innovation.

- Interest rate competition — When bond yields rise, dividend stocks (especially those with modest growth prospects) may look less attractive in comparison.

- Tax drag — Dividends are taxed (depending on account structure and holding period), which can eat into net return.

Dividend Stock ETFs vs Individual Stocks

When considering dividend exposure, investors have two main paths:

- Individual dividend stocks: You pick specific companies you trust to pay and grow dividends. This gives you direct control over stocks and allows targeted allocation to sectors or themes you favor.

- Dividend ETFs / mutual funds: Pools of dividend-paying stocks maintained by professional managers. These provide instant diversification, reduce individual stock risk, and simplify portfolio management.

Pros of Dividend ETFs

- Automatic diversification lowers the risk of a single holding failing.

- Fund managers monitor holdings and rebalance.

- Easier to scale and maintain, especially for smaller portfolios.

Cons of Dividend ETFs vs Individual Stocks

- Yields tend to be diluted by including lower-yielding names.

- Less control over specific holdings or sector weightings.

- Management fees may erode yields over time.

Many investors use a hybrid strategy: core allocation via a dividend ETF (for stability) supplemented by hand-picked individual dividend stocks for yield or growth.

How to Choose the Best Dividend Stocks

Not all dividend stocks are created equal. Here’s what to look for when evaluating candidates:

Dividend Yield

Yield = (Annual Dividend per Share) ÷ (Current Share Price). A moderate, well-supported yield (say 2 %–6 %, depending on sector) can be healthy, while extremely high yields often signal trouble (e.g. deep decline in share price)

Dividend Payout Ratio

This ratio shows what percentage of a company’s earnings are paid out as dividends. If a company distributes too much (e.g. > 80–90 %), it may lack flexibility to weather downturns. More conservative ratios (e.g. 30–60 %) often indicate room for future increases or a buffer in tough times.

Dividend Growth History

Look for firms that have steadily raised their dividends over years. A consistent upward trend signals confidence in future earnings. Dividend “Aristocrats” — firms in the S&P 500 that have raised dividends for at least 25 consecutive years — are often viewed as safer dividend picks.

Company Financial Health

Examine fundamentals:

- Free cash flow and cash flow stability

- Debt load and interest coverage

- Profit margins

- Growth prospects

- Competitive advantage (moat)

A company with healthy cash flow and manageable debt is more likely to sustain and grow dividends.

Sector and Market Trends

Some sectors are inherently more dividend-friendly (utilities, consumer staples, real estate, energy) because they generate steady cash flows. Others (like high-growth tech) may pay little to none in dividends as they reinvest heavily.

Also consider macro conditions — for example, rising interest rates, inflation pressures, regulatory risks — which may disproportionately affect certain sectors.

Tips for Building a Dividend Portfolio

- Start with a foundation of blue-chip dividend stocks — Established companies with strong balance sheets and long payout histories.

- Diversify across sectors — Avoid being overly concentrated in one industry (e.g. energy or REITs).

- Reinvest dividends — Using a Dividend Reinvestment Plan (DRIP) can compound returns over time.

- Allocate some portion to growth or higher-yield names, if your risk tolerance allows — but don’t let them dominate.

- Review and rebalance periodically — Monitor fundamentals, payout changes, valuation shifts, and sector dynamics.

- Use metrics and screening tools — Apply filters (yield, payout ratios, growth, fundamentals) to narrow your universe, then do deeper research.

Mistakes to Avoid about Dividend Stocks

- Chasing the highest yield blindly — extremely high yields can indicate a distressed company or impending cuts.

- Ignoring payout sustainability — yield without coverage (earnings, cash flow) is precarious.

- Overconcentration in one stock or sector — a dividend cut or sector downturn can deeply hurt.

- Neglecting growth potential — pure high-yield stocks may underperform in growth cycles.

- Forgetting taxes and fees — dividends taxed or fees eroding yield can reduce net returns.

Also, be cautious if yield spikes because of falling share price — that could be a warning sign rather than opportunity.

Frequently Asked Questions About Dividend Stocks

How are dividends taxed?

In the U.S., qualified dividends (if holding periods are met) are taxed at long-term capital gains rates (0 %, 15 %, or 20 %, depending on income bracket). Non-qualified dividends are taxed at ordinary income rates. Additionally, when you sell shares, capital gains taxes may apply to the appreciation portion.

Are dividend stocks good for retirees?

Yes. They can provide a predictable stream of income and may buffer volatility. However, retirees should emphasize safety and sustainability — favor those with strong balance sheets, stable business models, and moderate payout ratios. Also, be aware of tax effects and inflation.

What’s a good dividend yield?

There’s no one “ideal” yield. Many investors view 2 %–6 % as reasonable, depending on the sector and interest rate environment. Yields well above that range warrant extra scrutiny — high yields often come with higher risk.

Are dividend stocks safe for beginners?

They can be, especially when you start with well-known, financially sound dividend payers and diversify. The income cushion helps offset downside risk. But beginners must still research fundamentals, avoid yield traps, and avoid overconcentration.