5 Top Biotech Stocks to Buy Today

| Company (Ticker) | 12 Week Price Change | Forward PE | Price | Proj EPS Growth (1 Year) | Projected Sales Growth (1Y) |

|---|---|---|---|---|---|

| Keros Therapeutics (KROS) | 25.51% | NA | $19.26 | -249.05% | -95.31% |

| Catalyst Pharmaceuticals (CPRX) | 10.49% | 9.09 | $22.96 | 3.87% | 8.32% |

| ADMA Biologics (ADMA) | 20.58% | 21.51 | $17.50 | 49.12% | NA |

| Rigel Pharmaceuticals (RIGL) | 27.47% | 10.83 | $37.78 | -45.25% | -5.37% |

| Biohaven Ltd. (BHVN) | -29.01% | NA | $11.92 | 55.67% | 425.47% |

*Updated on January 15, 2026.

Keros Therapeutics (KROS)

$19.26 USD -0.27 (-1.38%)

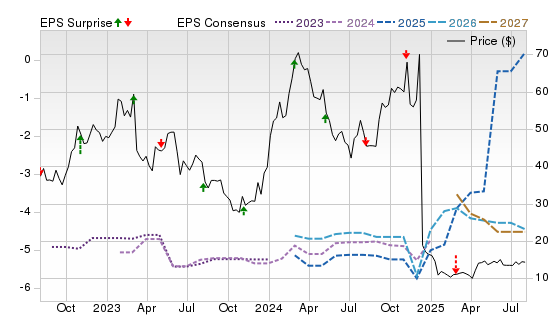

3-Year Stock Price Performance

Premium Research for KROS

- Zacks Rank

Strong Buy 1

Strong Buy 1

- Style Scores

B Value A Growth F Momentum B VGM

- Market Cap:$594.09 M (Small cap)

- Projected EPS Growth: 145.00%

- Last Quarter EPS Growth:76.32%

- Last EPS Surprise:83.78%

- Next EPS Report date:Feb. 25, 2026

Our Take:

Keros is a clinical-stage biopharmaceutical company developing TGF-β–modulating therapies, led by rinvatercept (KER-065), a modified activin receptor type II ligand trap for neuromuscular and neurodegenerative diseases, with a Phase 2 Duchenne muscular dystrophy trial planned for early 2026.

Fundamentals reflect a focused pipeline and partner-supported financial profile. Keros licensed elritercept to Takeda in a global deal featuring a $200 million upfront payment and significant milestone and royalty potential, allowing Keros to concentrate resources on advancing rinvatercept.

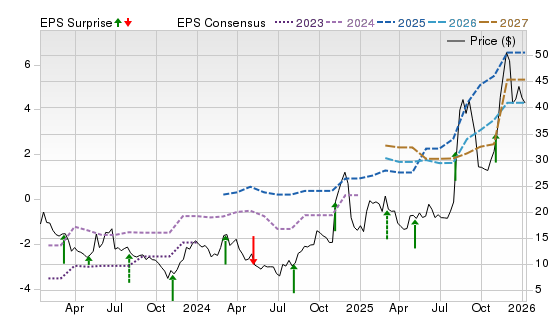

A Zacks Rank #1 (Strong Buy) signals positive estimate revisions, consistent with the cleaner financial profile. A Value Score of C, Growth Score of A and Momentum Score of F suggest improving fundamentals but uneven trading. On the Price, Consensus & EPS Surprise chart, shares rallied through 2024–25 with rising out-year EPS estimates, then pulled back as the stock digested gains, a pattern typical of clinical catalysts and financing headlines.

Catalyst Pharmaceuticals (CPRX)

$22.96 USD -0.21 (-0.91%)

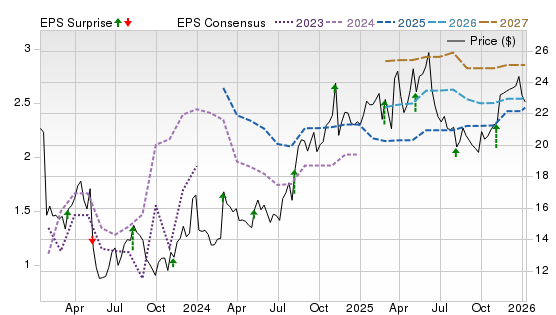

3-Year Stock Price Performance

Premium Research for CPRX

- Zacks Rank

- Buy 2

- Style Scores

A Value C Growth F Momentum B VGM

- Market Cap:$2.75 B (Mid Cap)

- Projected EPS Growth:11.31%

- Last Quarter EPS Growth:3.23%

- Last EPS Surprise:33.33%

- Next EPS Report date:Feb. 25, 2026

Our Take:

Catalyst is a profitable, commercial-stage rare-disease company with a diversified U.S. portfolio spanning FIRDAPSE, AGAMREE, and FYCOMPA. The January 2026 update highlights seven straight years of profitability, record 2025 net product revenues, raised full-year guidance, and a debt-free balance sheet with more than $700 million in cash.

The growth outlook is driven by durable FIRDAPSE demand across idiopathic and cancer-associated LEMS, expanding AGAMREE penetration supported by lifecycle studies, and resilient FYCOMPA performance. Strong patient access infrastructure, high prescription compliance, and significant acquisition capacity provide sustained multi-product leverage and visibility.

A Zacks Rank 2 aligns with steady estimate revisions. The Value Score of A, Growth Score of C, and Momentum Score of C indicate attractive cash generation at a reasonable multiple while the stock trades sideways. On the chart, price has trended higher with 2025–2027 EPS estimates, though periodic consolidations around earnings reflect normal price behavior.

ADMA Biologics (ADMA)

$17.50 USD -0.78 (-4.27%)

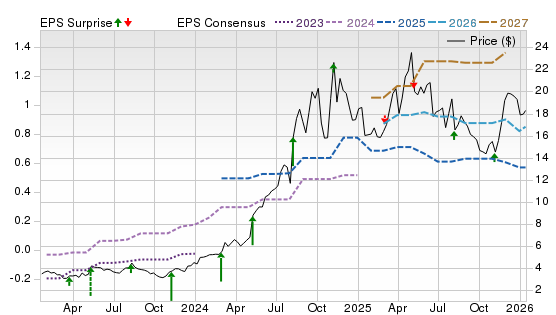

3-Year Stock Price Performance

Premium Research for ADMA

- Zacks Rank

Buy 2

Buy 2

- Style Scores

C Value D Growth A Momentum D VGM

- Market Cap:$4.21 B (Mid Cap)

- Projected EPS Growth:16.33%

- Last Quarter EPS Growth:6.67%

- Last EPS Surprise:0.00%

- Next EPS Report date:Mar. 2, 2026

Our Take:

ADMA Biologics is a U.S.-based, vertically integrated immunoglobulin manufacturer with FDA-approved ASCENIV and BIVIGAM. Revenue, gross profit, and adjusted earnings continue to rise, supported by scaling operations and the transition toward yield-enhanced production beginning to impact reported results.

The thesis rests on supply-chain control, expanding ASCENIV penetration in complex PI patients, and margin uplift from FDA-approved yield enhancement, delivering roughly 20% incremental output. Growing cash generation underpins shareholder returns and disciplined pipeline investment, led by the SG-001 hyperimmune program.

A Zacks Rank 2 with a Value Score of C, Growth Score of D and Momentum Score of A reflect upward earnings revisions and strong trading on execution, despite a premium to slower-growing peers. On the chart, shares have stair-stepped higher alongside rising 2025–2027 EPS estimates, with brief pullbacks around updates that reset expectations before the next leg up.

Rigel Pharmaceuticals (RIGL)

$37.78 USD -1.34 (-3.43%)

3-Year Stock Price Performance

Premium Research for RIGL

- Zacks Rank

Hold 3

Hold 3

- Style Scores

B Value A Growth C Momentum A VGM

- Market Cap:$689.03 M (Small Cap)

- Projected EPS Growth:566.67%

- Last Quarter EPS Growth:-55.49%

- Last EPS Surprise:56.99%

- Next EPS Report date:March 3, 2026

Our Take:

Rigel is a commercial-stage hematology-oncology company with three approved products that include TAVALISSE for chronic ITP, REZLIDHIA for relapsed or refractory mIDH1 AML, and GAVRETO for RET-driven cancers. The fourth quarter of 2025 delivered strong net product sales, positive net income, and a materially strengthened cash position.

A diversified commercial portfolio, collaboration revenue, and an advancing pipeline distinguish Rigel among small-cap biopharma peers. R289, an IRAK1/4 inhibitor in lower-risk MDS, has shown encouraging early data and earned Fast Track and Orphan status.

A Zacks Rank 3 (Hold), paired with B Value, A Growth and B Momentum Scores, fits a company with improving earnings power but a stock that has already discounted part of the rebound. The chart shows a long volatile range resolving into an estimated upturn for 2026–2027, with price following higher yet prone to sharp swings around results.

Biohaven Ltd. (BHVN)

$11.92 USD +0.22 (1.88%)

3-Year Stock Price Performance

Premium Research for BHVN

- Zacks Rank

Hold 3

Hold 3

- Style Scores

F Value C Growth A Momentum D VGM

- Market Cap:$1.16 B (Small Cap)

- Projected EPS Growth:25.75%

- Last Quarter EPS Growth:15.46%

- Last EPS Surprise:14.14%

- Next EPS Report date:Mar. 2, 2026

Our Take:

Biohaven is a clinical-stage biotechnology company advancing extracellular protein degraders (MoDE and TRAP), Kv7 ion-channel activation, myostatin–activin inhibition, and next-generation ADCs, with broad programs spanning immunology, neurology, metabolic disease, and oncology.

The investment appeal centers on a diversified platform with multiple pivotal initiations, phase-two readouts, and oncology expansions expected through 2026, supported by recent capital raises and cash resources, as reflected in the company’s disclosed development plans and forward-looking statements, while near-term value inflection is anchored by multiple 2026 clinical milestones, including pivotal trial initiations and oncology program expansion.

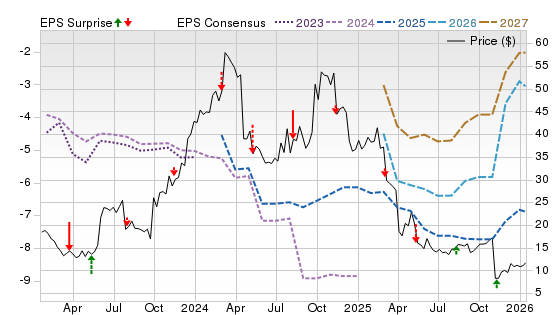

A Zacks Rank 3 with an F Value, C Growth and B Momentum Score capture mixed fundamentals with improving sentiment. On the chart, the stock recovered from mid-cycle lows as 2026–2027 loss estimates improved, but the price has been choppy, reflecting sensitivity to trial updates. That setup can reward successful readouts while demanding risk tolerance.

Methodology

The Zacks Rank is a proprietary stock-rating model that uses trends in earnings estimate revisions and earnings-per-share (EPS) surprises to classify stocks into five groups: #1 (Strong Buy), #2 (Buy), #3 (Hold), #4 (Sell) and #5 (Strong Sell). The Zacks Rank is calculated through four primary factors related to earnings estimates: analysts' consensus on earnings estimate revisions, the magnitude of revision change, the upside potential and estimate surprise (or the degree in which earnings per share deviated from the previous quarter).

Zacks builds the data from 3,000 analysts at over 150 different brokerage firms. The average yearly gain for Zacks Rank #1 (Strong Buy) stocks is +23.62% per year from January, 1988, through June 2, 2025.

Selections for Best Biotech Stocks are based on the current top ranking stocks based on Zacks Indicator Score, Style Scores and fundamentals. For this list, only companies that have average daily trading volumes of 100,000 shares or more of 135 biotech companies listed on the New York Stock Exchange or Nasdaq. All information is current as of market open, Jan. 15, 2026.

General Biotech Investment Questions

What Are Biotech Stocks?

Biotech stocks are shares of companies that use biological systems and organisms to develop new drugs, therapies, and diagnostics. These firms invest heavily in research & development and often carry greater risk than traditional pharmaceutical companies.

Types of Biotech Stocks

- Platform biotechs: Focus on enabling technologies (e.g., mRNA, gene editing, synthetic biology).

- Therapeutic biotechs: Develop specific drug candidates (e.g., rare disease, oncology).

- Service biotechs: Provide research tools, reagents, or contract research services.

What Are the Benefits of Buying Biotech Stocks?

- High upside: Successful trials or approvals can lead to big gains.

- Innovative exposure: Access to cutting-edge science (e.g., gene therapy).

- Diversification: Biotech can be a non-cyclical growth lever in a portfolio.

- Partnering potential: Smaller biotech firms are often acquired by larger pharma.

What Are the Risks of Buying Biotech Stocks?

- Clinical risk: Many drugs fail in trials

- Cash burn: R&D is expensive, and many biotechs depend on funding.

- Regulatory risk: FDA decisions can make or break a company.

- Volatility: Stock prices swing wildly on news.

Biotech Stocks vs. Biotech ETFs

- Stocks: Higher potential reward, but higher risk and volatility

- ETFs: Diversified exposure, smoother ride, less binary outcomes

Which is right depends on your risk tolerance and conviction in individual companies.

Why Are Biotech Stocks So Volatile?

- Clinical trial outcomes are binary (success/failure).

- Regulatory approvals depend on strict criteria.

- Biotechs often raise capital, diluting shareholders.

- News-driven: trial results, partnership deals, or FDA news can swing sentiment.

Is It Too Late to Invest in Biotech Stocks?

Not necessarily. While some biotechs (especially large-caps) may look fully valued, many smaller, clinical-stage companies still offer asymmetric upside. Plus, emerging trends — gene editing, synthetic biology, AI-driven drug discovery — continue to open new frontiers.

Best Biotech ETFs

Not all investors want to take on the risk of single biotechs. Below are some top ETFs that offer diversified exposure:

- iShares Biotechnology ETF (IBB): Focuses on large-cap biotech names, offering lower volatility compared to smaller biotechs.

- SPDR S&P Biotech ETF (XBI): Equal-weighted, which means more exposure to mid- and small-cap biotech companies — higher risk, potentially higher reward.

- VanEck Biotech ETF (BBH): Concentrated in major pure-play biotech names.

These ETFs help mitigate the binary risk inherent in individual biotech names by spreading exposure across many companies.

Biotech Stocks Trends and Forecast

What Biotech Stocks Could Benefit from New FDA Approvals?

- Sarepta (SRPT): Pipeline in DMD and other neuromuscular disorders.

- Beam (BEAM): Base-editing therapies could attract regulatory attention as clinical data matures.

- Arcellx: Its CAR-T programs (e.g., anito-cel) could hit registrational milestones soon.

Which Biotech Firms Are Leading in Gene Editing or mRNA?

- Beam Therapeutics: Base editing platform.

- CRISPR Therapeutics / Vertex: CRISPR-based therapies.

- Moderna: mRNA-based vaccines and therapies.

What Are the Most Promising Biotech Trends for 2025/2026?

- Base editing and next-gen CRISPR.

- Synthetic biology for therapeutics.

- Precision medicine for rare diseases.

- AI-driven drug discovery.

- Cell and gene therapies for “undruggable” conditions.

How Does Interest Rate Policy Affect Biotech Valuations?

Higher interest rates make future cash flows less valuable, which disproportionately affects pre-commercial biotech companies. Biotechs with strong cash reserves, recurring revenues, or partnerships may weather a high-rate environment better than early-stage names.

What Startups Could Be the Next Big Biotech Breakout?

Some emerging companies to watch include those in base editing (like Beam) or synthetic biology (like Twist Bioscience). Also, small gene therapy firms that prove safety and efficacy could be acquisition targets.

How to Select Biotech Stocks

How to Evaluate a Biotech Company’s Pipeline

- Examine clinical trial phases and data (Phase 1–3).

- Check regulatory designations (Orphan, Fast Track, Breakthrough).

- Assess manufacturing strategy (can they scale?)

- Review partnerships with big pharma.

What Financial Metrics Should I Look at When Selecting Biotech Stocks?

- Cash runway — Months until they need to raise capital.

- Burn rate — How fast they spend R&D cash?

- Debt levels — To help understand leverage risk.

- Revenue sources — If any (e.g., royalties, partnerships).

- Valuation multiples — P/E for commercial companies, or price-to-cash for R&D firms.

Which Biotech Companies Are Using AI for Drug Discovery?

Several biotech firms now leverage AI to speed up target identification, optimize molecules, and predict clinical success. While specific names vary, more platform-focused biotechs (especially in synthetic biology and precision medicine) are adopting AI broadly.

Advanced or Thematic Biotech Investing

Best Gene Therapy, Immunotherapy, or Synthetic Biology Stocks

- Gene Therapy: Beam (base editing), Sarepta (DMD)

- Immunotherapy/CAR-T: Arcellx (anito-cel).

- Synthetic Biology: Twist Bioscience (DNA synthesis).

Top AI-Driven Biotech Companies to Watch

Companies combining AI with biology to accelerate drug development are particularly exciting. Though many remain private, public players using AI in drug discovery or platform development may include synthetic biology firms and next-gen therapeutic companies.

Small-Cap vs. Large-Cap Biotech Investing Strategies

- Small-Cap: Higher risk/reward; ideal for speculative, event-driven plays.

- Large-Cap: More stability, some revenue streams, diversified pipelines.

- Balanced Approach: Use ETFs for broad exposure + pick 1–2 individual names for high conviction.

How FDA Approval Cycles Impact Biotech Valuations

Each clinical milestone (Phase 2 readout, Phase 3 initiation, NDA/BLA filing) can trigger major revaluations. Investors often build models around key FDA dates, trial data, and partner commitments. Failure or delay can lead to steep losses; success can lead to multi-bagger returns.