5 Best Oil Stocks to Buy Today

| Company (Ticker) | 12 Week Price Change | Forward PE | Price | Proj EPS Growth (1 Year) | Projected Sales Growth (1Y) |

|---|---|---|---|---|---|

| Plains Group (PAGP) | 14.77% | 11.14 | $20.28 | 26.98% | -5.16% |

| Centrus Energy (LEU) | -13.14% | 81.79 | $315.92 | -17.05% | 8.34% |

| Oceaneering International (OII) | 15.27% | 14.37 | $26.73 | -7.46% | -5.83% |

| Kimbell Royalty (KRP) | -7.96% | 25.02 | $12.26 | -22.22% | 1.21% |

| TechnipFMC (FTI) | 26.88% | 19.07 | $52.20 | 20.79% | 6.76% |

*Updated on January 21, 2026.

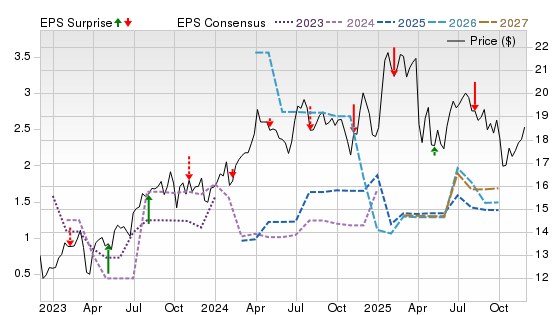

Plains Group (PAGP)

$20.28 USD -0.27 (-1.31%)

3-Year Stock Price Performance

Premium Research for PAGP

- Zacks Rank

- Strong Buy 1

- Style Scores

A Value A Growth D Momentum A VGM

- Market Cap:$4.07 B (Mid Cap)

- Projected EPS Growth: 175.00%

- Last Quarter EPS Growth:520.00%

- Last EPS Surprise: -26.19%

- Next EPS Report date:Feb. 6, 2026

Our Take:

Plains GP owns the general-partner and economic interests of Plains All American, a major crude and NGL midstream operator with deep Permian and Gulf Coast connectivity. Strategic moves since late 2025 are central to the appeal. Acquisition of EPIC extends its “wellhead-to-water” network.

The near-term setup rests on resilient Permian volumes, portfolio sharpening after the NGL sale agreement, and balance-sheet discipline that has remained near target leverage. These ingredients support incremental payout growth while preserving flexibility for bolt-on deals and debottlenecking projects.

A Zacks Rank #1 (Strong Buy) signals positive estimate revisions. Style Scores of A for Value and Growth point to attractive cash-flow valuation with improving earnings power, while a C Momentum score flags choppier near-term trading. On the Price, Consensus & EPS Surprise chart, the stock’s multi-year uptrend has tracked rising out-year EPS lines, with occasional pullbacks around estimate resets, typical for midstream names sensitive to volume and project headlines.

See more from Zacks Research for This Ticker

Normally $25 each - click below to receive one report FREE:

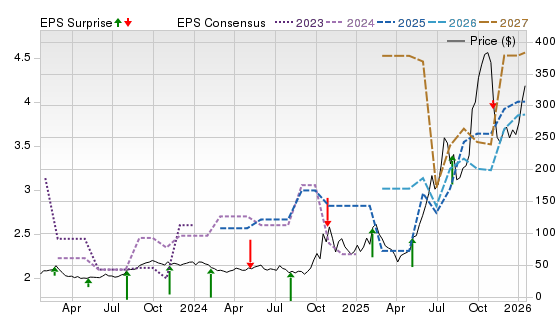

Centrus Energy (LEU)

$315.92 USD -15.11 (-4.56%)

3-Year Stock Price Performance

Premium Research for LEU

- Zacks Rank

Strong Buy 1

Strong Buy 1

- Style Scores

F Value F Growth B Momentum F VGM

- Market Cap:$6.03 B (Mid Cap)

- Projected EPS Growth:4.25%

- Last Quarter EPS Growth:-88.05%

- Last EPS Surprise:-5.00%

- Next EPS Report date:Feb. 5, 2026

Our Take:

Centrus supplies nuclear fuel and is ramping U.S. capacity for high-assay, low-enriched uranium (HALEU), a key input for advanced reactors and micro-reactors. The company’s role in domestic fuel security is strengthening as policy shifts away from Russian enrichment and toward localized supply.

It has delivered 900 kg of HALEU to the Department of Energy, secured an extension that keeps production in place with multi-year options, and recently won a DOE task order of about $900 million to expand commercial-scale capacity. Together, these milestones support a clearer runway for growth and cash generation.

A Zacks Rank #1 highlights positive estimate revisions. Style Scores of F for Value, D for Growth, and a C for Momentum indicate a premium, headline-sensitive profile. The chart shows a volatile base that turned higher as out-year EPS estimates inflected, suggesting improving confidence in the enrichment ramp even as swings are likely to persist.

See more from Zacks Research for This Ticker

Normally $25 each - click below to receive one report FREE:

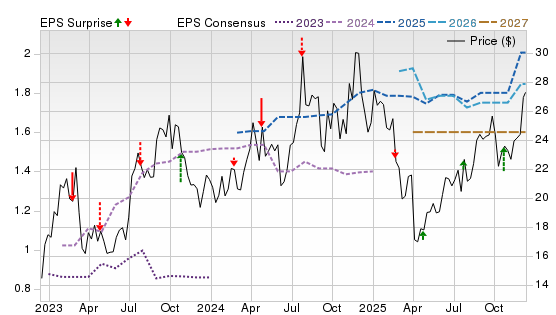

Oceaneering International (OII)

$26.73 USD -0.54 (-1.98%)

3-Year Stock Price Performance

Premium Research for OII

- Zacks Rank

Strong Buy 1

Strong Buy 1

- Style Scores

B Value C Growth D Momentum B VGM

- Market Cap:$2.72 B (Mid Cap)

- Projected EPS Growth:76.32%

- Last Quarter EPS Growth:12.24%

- Last EPS Surprise:30.95%

- Next EPS Report date:Feb. 18, 2026

Our Take:

Oceaneering International provides engineered services, robotic systems, and products to offshore energy, with complementary businesses in defense, aerospace, and manufacturing. Its subsea robotics and offshore projects operations are leveraged to a durable deepwater cycle, while diversification into Aerospace & Defense Technologies adds steadier, contract-backed demand and helps smooth cash generation.

Multi-contract wins with Petrobras underscore healthy ROV demand and expand Brazil exposure, while management commentary points to ongoing offshore activity and constructive day rates.

A Zacks Rank #1 reflects positive estimate revisions, with Style Scores of B for Value and Growth suggesting reasonable valuation against improving earnings power, while a D Momentum score cautions that near-term trading can be choppy. On the chart, the stock’s uptrend broadly tracks firming 2026–2027 EPS lines, with pullbacks around estimate resets followed by higher highs, consistent with a long-cycle offshore recovery supported by a more balanced portfolio.

See more from Zacks Research for This Ticker

Normally $25 each - click below to receive one report FREE:

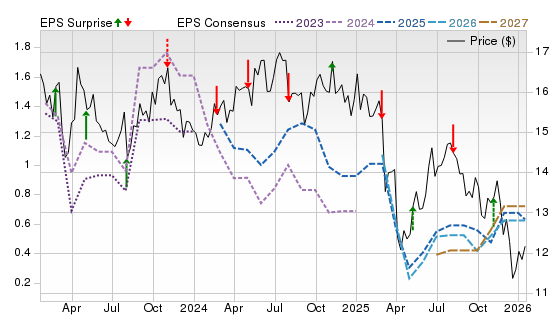

Kimbell Royalty (KRP)

$12.26 USD +0.10 (0.82%)

3-Year Stock Price Performance

Premium Research for KRP

- Zacks Rank

Buy 2

Buy 2

- Style Scores

C Value C Growth F Momentum D VGM

- Market Cap:$1.31 B (Small Cap)

- Projected EPS Growth:110.00%

- Last Quarter EPS Growth:850.00%

- Last EPS Surprise:46.15%

- Next EPS Report date:Feb. 26, 2026

Our Take:

Kimbell Royalty Partners owns mineral and royalty interests across the major U.S. shale basins, giving broad exposure to drilling and completions without operating or capex burdens.

The investment case centers on portfolio quality and balance-sheet flexibility. Kimbell expanded its Permian footprint with a $231 million Midland Basin deal anchored by Tier-1 operators and clear line-of-sight inventory, while lenders unanimously reaffirmed the $625 million revolver and extended its maturity to 2030, lowering funding risk through the cycle. Activity on Kimbell acreage remains healthy, reinforcing visibility to volumes that drive royalty cash flow.

A Zacks Rank #2 reflects favorable estimate trends, while C scores for Value and Growth suggest shares are near fair value with mixed fundamentals, while an F Momentum score flags weak near-term trading. The chart shows a recovery toward prior highs with modestly rising out-year EPS lines, implying improving visibility as well-turn-in-line cadence and Permian development support distributions.

See more from Zacks Research for This Ticker

Normally $25 each - click below to receive one report FREE:

TechnipFMC (FTI)

$52.20 USD +0.04 (0.08%)

3-Year Stock Price Performance

Premium Research for FTI

- Zacks Rank

Buy 2

Buy 2

- Style Scores

B Value A Growth C Momentum A VGM

- Market Cap:$21.10 B (Large Cap)

- Projected EPS Growth:24.73%

- Last Quarter EPS Growth:10.29%

- Last EPS Surprise:15.38%

- Next EPS Report date:Feb. 19, 2026

Our Take:

TechnipFMC designs, manufactures, and installs subsea production systems and services, giving direct leverage to the multi-year expansion of deepwater oil and gas. Standardized Subsea 2.0 equipment and integrated iEPCI awards are central to the model, improving cycle times and margins while deepening customer ties.

Fundamentals look durable. Management has outlined stronger free-cash-flow generation and specific 2026 Subsea targets, reflecting confidence in the mix and execution. Capital returns add support, with a new $2 billion repurchase authorization alongside a recurring dividend, signaling balance-sheet strength and commitment to shareholder payouts.

A Zacks Rank #2 with B Value and A Growth scores align with durable order growth and execution. B Momentum score reflects a stock that trends higher with pauses around award timing. On the chart, price stair-steps upward in tandem with rising 2026–2027 EPS lines and recurrent positive surprises, consistent with a sustained uptrend supported by backlog quality.

See more from Zacks Research for This Ticker

Normally $25 each - click below to receive one report FREE:

Methodology

The Zacks Rank is a proprietary stock-rating model that uses trends in earnings estimate revisions and earnings-per-share (EPS) surprises to classify stocks into five groups: #1 (Strong Buy), #2 (Buy), #3 (Hold), #4 (Sell) and #5 (Strong Sell). The Zacks Rank is calculated through four primary factors related to earnings estimates: analysts' consensus on earnings estimate revisions, the magnitude of revision change, the upside potential and estimate surprise (or the degree in which earnings per share deviated from the previous quarter).

Zacks builds the data from 3,000 analysts at over 150 different brokerage firms. The average yearly gain for Zacks Rank #1 (Strong Buy) stocks is +23.62% per year from January, 1988, through June 2, 2025.

Selections for Best Biotech Stocks are based on the current top ranking stocks based on Zacks Indicator Score, Style Scores and fundamentals. For this list, only companies that have average daily trading volumes of 100,000 shares or more of 95 energy companies listed on the New York Stock Exchange or Nasdaq. All information is current as of market open, Jan. 20, 2026.

General Questions About Energy Stocks

Types of energy stocks

Energy equities are diverse, spanning traditional oil and gas functions to electrification and renewable power. Below are the major categories with representative companies to help you understand where stocks fit in the broader sector.

Integrated producers

These are large energy companies involved in the full value chain—from finding and producing oil and gas (upstream), transporting it (midstream), refining it into fuels (downstream), and often selling it at retail. This breadth can help smooth earnings when one segment underperforms.

Examples:

- Exxon Mobil (XOM): One of the world’s largest integrated oil majors with operations across exploration, refining, petrochemicals and emerging low-carbon solutions.

- Chevron (CVX): Another U.S. supermajor with a globally diversified portfolio of upstream and downstream assets.

- BP plc (BP): UK-based integrated energy company with oil/gas and growing renewable investments.

- Shell plc (SHEL): Major European integrated producer also building out renewables and LNG infrastructure.

Exploration & Production (E&P)

Companies in this group focus chiefly on finding and drilling for crude oil and natural gas. Their earnings often move in step with commodity prices because they sell raw energy products.

Examples:

- ConocoPhillips (COP): A large independent producer with strong positions in U.S. shale and global fields.

- EQT Corporation (EQT): One of the biggest natural gas producers in the U.S., with deep Marcellus Basin exposure.

- Diamondback Energy (FANG): Focused on shale oil production in the Permian Basin.

- Civitas Resources (CIVI), Chord Energy (CHRD), Vista Energy (VIST): Examples of smaller/mid-cap E&Ps with exploration upside.

Midstream Pipelines

Midstream firms own and operate the infrastructure that moves and stores oil, natural gas, and related products. Their earnings tend to come from fee-based contracts rather than commodity prices, offering stability.

Examples:

- Enbridge Inc. (ENB): A Canadian giant operating one of North America’s largest pipeline networks for crude and natural gas.

- Kinder Morgan (KMI): Major U.S. pipeline owner transporting hydrocarbons and refined products.

- Enterprise Products Partners (EPD): One of the largest midstream master limited partnerships (MLPs) with thousands of miles of pipelines.

- MPLX (MPLX): A high-yield midstream MLP spun out of Marathon Petroleum.

- ONEOK (OKE): Midstream operator handling natural gas liquids and pipelines across the U.S.

Refiners

Refining companies take crude oil and transform it into usable products like gasoline, diesel, jet fuel, and petrochemicals. These stocks often do well when refining margins (crack spreads) are wide

Examples:

- Phillips 66 (PSX): A leading U.S. refiner also expanding into midstream infrastructure.

- Valero Energy (VLO): One of the largest independent refiners with global footprint.

- Marathon Petroleum (MPC): Large U.S. refiner with affiliated midstream operations.

Utilities

Utilities generate and deliver electricity or natural gas to consumers and businesses. These firms are typically more regulated and less volatile than pure commodity plays. Many are also transitioning to cleaner energy sources.

Examples:

- NextEra Energy (NEE): Largest U.S. utility with a major renewable generation portfolio.

- Duke Energy (DUK): Large diversified utility serving millions of customers.

- Southern Company (SO): Major southeastern U.S. utility investing in grid modernization and cleaner power.

- Portland General Electric (POR): Regional utility with a growing renewable footprint.

- Constellation Energy (CEG): Nuclear-focused power generator with natural gas and geothermal exposure.

Renewables

These stocks focus on energy generation from sustainable sources like wind, solar, hydro, geothermal, and emerging technologies such as hydrogen and wave power. They may also include service providers in the clean-energy infrastructure space.

Examples:

- Brookfield Renewable Partners (BEP): Operates an extensive portfolio of wind, solar, and hydro assets globally.

- Ormat Technologies (ORA): Specialized in geothermal and solar power projects.

- SolarEdge (SEDG), First Solar (FSLR), Canadian Solar (CSIQ): Growing names in solar generation and component manufacturing.

- Eco Wave Power (WAVE): Early-stage wave energy technology company with high growth potential.

- Quanta Services (PWR): Not a pure renewable but a key player in building and maintaining power grids and clean infrastructure.

Quick takeaway for Energy Stock Investing:

- Traditional energy investors often favor integrated producers and E&Ps for commodity exposure and dividends.

- Income-oriented investors may like midstream pipelines and utilities.

- Growth-focused strategies commonly target renewable energy and infrastructure names.

What are the benefits of buying energy stocks?

- High dividend yields relative to the broader market.

- Strong correlation to inflation and commodity cycles.

- Global demand for oil, natural gas, and power remains durable.

- Capital-return programs (buybacks, dividends) have strengthened in recent years.

What are the risks of buying energy stocks?

- Volatile crude and natural-gas prices.

- Political/regulatory risk.

- High capital requirements.

- Demand destruction during recessions.

- Technological disruption from clean-energy alternatives.

Energy Stocks vs. Energy ETFs

- Stocks offer targeted exposure and potential for outsized gains if you pick winners.

- ETFs provide diversification across subsectors, reducing company-specific risk.

Top Energy ETFs to Invest In

ETFs provide diversified exposure across oil producers, refiners, pipelines, and renewable-energy companies. Popular examples include:

- Energy Select Sector SPDR Fund (XLE) — Tracks major S&P 500 energy giants.

- Vanguard Energy ETF (VDE) — Broader basket of U.S. energy stocks.

- iShares Global Clean Energy ETF (ICLN) — Focused on solar, wind, and green-tech names.

- Alerian MLP ETF (AMLP) — Concentrates on income-heavy pipeline operators.

Investment Strategy & Suitability

Are dividend-paying energy stocks a good investment?

Yes—many investors favor energy companies for their historically strong dividends, supported by robust free-cash-flow generation and capital discipline.

Are energy stocks a good hedge against inflation?

Often. Oil and gas prices typically rise when inflation climbs, and producers can benefit from commodity-linked revenues.

How do energy stocks perform during a recession?

They tend to soften as fuel demand falls, though stable-cash-flow midstream operators and utilities often hold up better.

What energy stocks should I hold long-term?

Integrated majors, high-quality pipelines, regulated utilities, and established renewable developers tend to offer durable long-term returns.

Should I invest in traditional or renewable energy?

A balanced approach works for many investors: traditional companies provide cash stability, while renewables offer long-term growth potential.

How to Select Energy Stocks

When evaluating energy names, consider:

- Balance-sheet strength: Favor companies with low debt, strong cash flow, and solid liquidity to withstand commodity volatility.

- Capital-allocation strategy: Look for disciplined spending, smart investment priorities, and a clear plan for shareholder returns.

- Dividend sustainability: Choose firms with stable cash generation, reasonable payout ratios, and reliable long-term dividend policies.

- Exposure to favorable regions: Companies operating in high-productivity, low-cost areas (e.g., Permian Basin, LNG export hubs) often deliver stronger margins.

- Production cost per barrel: Low-cost producers are more resilient when oil and gas prices fall and typically outperform over time.

- Growth pipeline: Evaluate upcoming projects—such as renewable buildouts, LNG expansions, or refinery upgrades—that support future earnings.

- Historical returns on capital: Consistently strong ROIC signals efficient management and durable value creation.

Energy Stock Trends and Market Factors

How are energy stocks affected by oil prices?

Oil prices remain the most influential variable. Producers benefit from rising crude, while refiners perform best when input costs are low and demand is strong.

What’s the forecast for the energy sector?

Analysts expect continued capital discipline, stable dividends, and a multi-year growth cycle in LNG exports. Renewables should gain momentum as financing conditions improve and global clean-energy spending rises.

How do rising interest rates impact energy stocks?

Higher rates increase borrowing costs, which can slow renewable-energy development. For oil producers, the impact is milder due to strong cash positions.

What are analysts saying about the energy market?

Most major research firms see a balanced oil market, steady global demand growth, and favorable long-term trends for both LNG and low-carbon technologies. Volatility may remain elevated, but the sector’s valuation and cash-return profile remain attractive relative to the S&P 500.