5 Best Cheap Stocks to Buy Today

| Company (Ticker) | 12 Week Price Change | Forward PE | Price | Proj EPS Growth (1 Year) | Projected Sales Growth (1Y) |

|---|---|---|---|---|---|

| Skillsoft (SKIL) | -41.66% | 1.94 | $8.81 | -3.70% | -3.55% |

| Seanergy Maritime Holdings (SHIP) | 20.12% | 6.65 | $9.72 | 39.23% | 8.16% |

| Ironwood Pharmaceuticals (IRWD) | 153.42% | 8.77 | $4.01 | 190.63% | -10.17% |

| CION Investment Corporation (CION) | 0.11% | 6.48 | $9.69 | -19.89% | -13.23% |

| Drilling Tools International Corp. (DTI) | 32.39% | 18.80 | $2.71 | 650.00% | 0.59% |

*Updated on January 8, 2026.

Skillsoft (SKIL)

$8.81 USD +0.70 (8.63%)

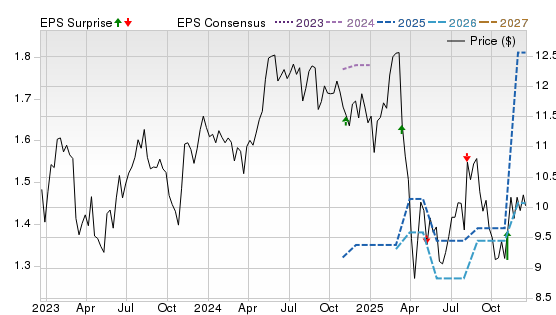

3-Year Stock Price Performance

Premium Research for SKIL

- Zacks Rank

Strong Buy 1

Strong Buy 1

- Style Scores

A Value B Growth A Momentum A VGM

- Market Cap:$74.18 M (Micro Cap)

- Projected EPS Growth:-3.70%

- Last Quarter EPS Growth:172.34%

- Last EPS Surprise:30.95%

- Next EPS Report date: April 13, 2026

Our Take:

Skillsoft provides corporate digital learning via its Percipio platform and related content, serving enterprise skilling needs. It has a market cap of $74.2 million. A Zacks Rank #1 (Strong Buy) alongside Style Scores of A for Value, Momentum, and a B for Growth points to improving earnings expectations at a discounted valuation with strengthening price action.

In Q3 fiscal 2026, revenue was $129 million with adjusted EBITDA of $28 million (22% margin). Management launched the AI-native Percipio platform, reported 99% LTM dollar-retention, and kept TDS guidance intact while exploring strategic alternatives for the lower-margin Global Knowledge unit. The TDS federal business improved with 104% retention, supporting a pivot toward software-like, recurring revenue.

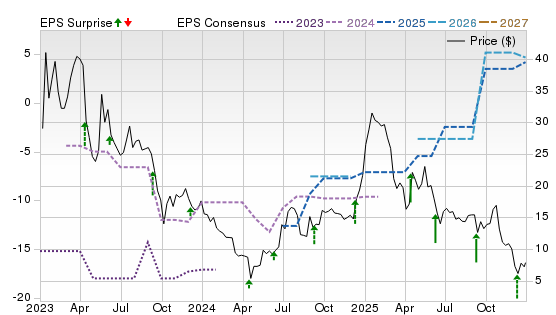

On the Price, Consensus & EPS Surprise chart, 2026–27 consensus lines inflected higher late in 2025 while the stock based near lows, echoing the Style Score profile and recent operational progress.

Seanergy Maritime Holdings (SHIP)

$9.72 USD +0.05 (0.52%)

3-Year Stock Price Performance

Premium Research for SHIP

- Zacks Rank

Strong Buy 1

Strong Buy 1

- Style Scores

A Value D Growth F Momentum C VGM

- Market Cap: $198.36 M (Small Cap)

- Projected EPS Growth: -55.88%

- Last Quarter EPS Growth:416.67%

- Last EPS Surprise: 45.65%

- Next EPS Report date: March 5, 2026

Our Take:

Seanergy Maritime is a pure-play Capesize dry-bulk shipowner focused on transporting iron ore and coal. It has a $198.4 million market cap. A Zacks Rank #1 paired with a Style Score of A for Value frames SHIP attractively on earnings and cash-flow metrics, though D scores for Growth and Momentum reflect shipping cyclicality.

The latest quarter captured a firmer Capesize market. Q3 2025 net revenue rose to $47 million with higher profitability, and the board declared a 13-cent quarterly dividend, its 16th consecutive payout under the capital return policy, while liquidity and equity levels remained solid. Management emphasized market recovery and fleet optimization to support cash generation into 2026.

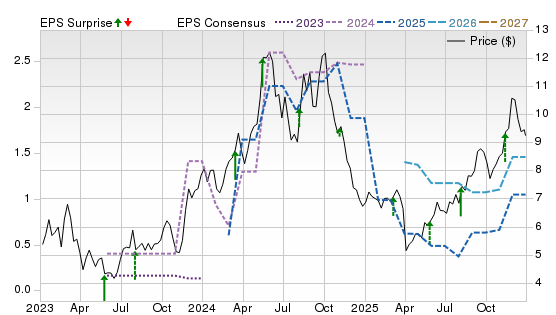

On the chart, 2026 estimates stabilized after earlier cuts and have begun to trend higher as spot rates improved. The stock has climbed from mid-2025 lows in tandem with that estimate reset, consistent with the Rank and Value setup.

Ironwood Pharmaceuticals (IRWD)

$4.01 USD -0.07 (-1.72%)

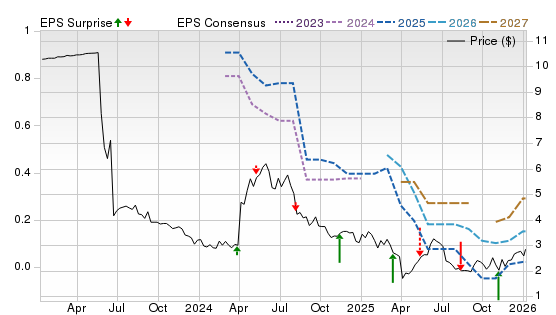

3-Year Stock Price Performance

Premium Research for IRWD

- Zacks Rank

Strong Buy 1

Strong Buy 1

- Style Scores

A Value B Growth D Momentum A VGM

- Market Cap:$746.70 M (Small Cap)

- Projected EPS Growth:300.00%

- Last Quarter EPS Growth:71.43%

- Last EPS Surprise:166.67%

- Next EPS Report date:Feb. 26, 2026

Our Take:

Ironwood Pharmaceuticals develops GI therapies led by Linzess, co-promoted with AbbVie, and is advancing apraglutide for short-bowel syndrome. It has a $746.7 million market cap. A Zacks Rank #1 reflects positive earnings estimate revisions, while A Score for Value and a B for Growth suggest an appealing entry point with improving fundamentals; the D for Momentum flags recent volatility.

Fundamentally, Linzess is reaccelerating, with Q3’25 U.S. net sales up about 40% year over year and higher 2025 guidance as demand and net pricing improved. The FDA’s November 2025 pediatric IBS-C approval should extend the franchise. Management’s stronger 2026 outlook reflects a pricing reset lowering rebates, even as apraglutide faces an added confirmatory Phase 3, delaying that program.

On the chart, estimates were cut through 2024–25 alongside the apraglutide setback, then turned higher for 2026–27 as Linzess trends firmed, and the stock has begun to rebound from late-2025 lows, consistent with the Rank’s positive revision.

CION Investment Corporation (CION)

$9.69 USD +0.29 (3.09%)

3-Year Stock Price Performance

Premium Research for CION

- Zacks Rank

- Strong Buy 1

- Style Scores

A Value A Growth B Momentum A VGM

- Market Cap: $505.76 M (Small Cap)

- Projected EPS Growth: 1.12%

- Last Quarter EPS Growth:131.25%

- Last EPS Surprise: 111.43%

- Next EPS Report date:March 12, 2026

Our Take:

CION Investment is a middle-market business development company focused on predominantly first-lien, floating-rate loans. It has a market cap of about $505.8 million. A Zacks Rank #1 reflects positive estimate revisions, while A Scores for Value and Growth indicate inexpensive fundamentals with improving earnings power, despite a C Momentum score.

The most recent quarter reinforced the investment thesis, driven by consistent NAV growth and a conservatively structured portfolio heavily weighted toward first-lien loans (about 80% of assets). Roughly 89% of performing loans are floating-rate, helping sustain income as interest rates normalize. Leverage is well managed, with net debt-to-equity improving to 1.28x. Portfolio is broadly diversified across 91 companies and 23 industries, and management shifted the base distribution to monthly payments starting in 2026.

On the chart, 2026 estimates inflected higher late in 2025 following these results, and shares have stabilized after prior volatility, aligning with the favorable Rank and Style Score profile.

Drilling Tools International Corp. (DTI)

$2.71 USD -0.11 (-3.90%)

3-Year Stock Price Performance

Premium Research for DTI

- Zacks Rank

- Strong Buy 1

- Style Scores

A Value C Growth F Momentum B VGM

- Market Cap:$99.96 M (Micro Cap)

- Projected EPS Growth:-93.55%

- Last Quarter EPS Growth:200.00%

- Last EPS Surprise:300.00%

- Next EPS Report date:March 12, 2026

Our Take:

Drilling Tools International rents and manufactures downhole tools for horizontal and directional drilling, with a nearly $100 million market cap. A Zacks Rank #1 reflects positive estimate revisions. An A Score for Value points to attractive pricing, while a C for Growth and Momentum suggests that execution is improving but not yet consistently reflected in trend data.

Fundamentals firmed in the latest quarter. Q3 2025 revenue was $38.8 million with adjusted EBITDA of $9.1 million and positive adjusted EPS, as rental mix and disciplined costs offset a sluggish rig backdrop; adjusted free cash flow reached $5.6 million. Management reaffirmed its 2025 revenue guidance of $145–$165 million and highlighted the expansion of Eastern Hemisphere contributions. Its international expansion provides relative resilience versus drilling cycles.

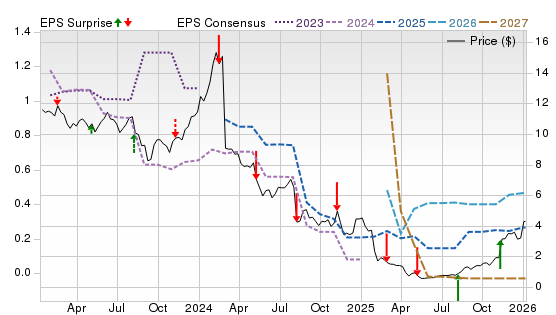

On the chart, estimates fell through 2024–25 after the post-SPAC reset, then stabilized for 2026–27 as results improved. Shares are basing with a modest uptick following the Q3 beat, consistent with the Rank’s revision signal.

Methodology

The Zacks Rank is a proprietary stock-rating model that uses trends in earnings estimate revisions and earnings-per-share (EPS) surprises to classify stocks into five groups: #1 (Strong Buy), #2 (Buy), #3 (Hold), #4 (Sell) and #5 (Strong Sell). The Zacks Rank is calculated through four primary factors related to earnings estimates: analysts' consensus on earnings estimate revisions, the magnitude of revision change, the upside potential and estimate surprise (or the degree in which earnings per share deviated from the previous quarter).

Zacks builds the data from 3,000 analysts at over 150 different brokerage firms. The average yearly gain for Zacks Rank #1 (Strong Buy) stocks is +23.62% per year from January, 1988, through June 2, 2025.

Selections for Best Cheap Stocks Under $10 are based on the current top ranking stocks based on Zacks Indicator Score, Style Scores and fundamentals. For this list, only companies that have average daily trading volumes of 100,000 shares or more were considered, as well as companies from the top 50% of all industries. All information is current as of market open, Jan. 7, 2026.

General Questions About Cheap Stocks

What are the Benefits of Buying Cheap Stocks?

Cheap stocks can make investing more accessible, especially for investors who don’t want to commit large sums to a single position. Because these stocks trade at lower prices, investors can spread their capital across multiple companies, sectors, or strategies, helping improve diversification.

In addition, many stocks fall below $10 not because the underlying business is broken, but because of temporary challenges such as economic slowdowns, industry cycles, earnings volatility, or broader market sell-offs. When conditions improve, these stocks may rebound sharply, offering attractive upside potential. Cheap stocks can also provide exposure to undervalued or overlooked sectors that are out of favor but poised for recovery.

Learn more about Cheap Stocks Under $10 from Zacks.

What are the Risks of Buying Cheap Stocks?

The primary risk with cheap stocks is that their low price may reflect genuine business problems rather than temporary setbacks. These companies often experience higher volatility, meaning prices can swing sharply in either direction. Many also have weaker balance sheets, higher debt loads, or limited cash reserves, making them more vulnerable during economic downturns.

Additionally, cheap stocks may face challenges raising capital, maintaining profitability, or competing with larger rivals. Without careful analysis, investors risk buying into so-called “value traps” — stocks that appear inexpensive but continue to decline because fundamentals fail to improve.

Can Cheap Stocks Actually Make Money?

Yes, cheap stocks can generate meaningful returns when purchased at the right time and for the right reasons. Numerous well-known companies have traded below $10 during periods of market stress, corporate restructuring, or industry downturns before eventually recovering.

That said, success is far from guaranteed. Cheap stocks tend to require patience, a willingness to tolerate volatility, and a focus on long-term business trends rather than short-term price movements.

Are Cheap Stocks a Good Investment for Beginners?

Cheap stocks can be suitable for beginners if approached cautiously. Their lower price points allow new investors to learn portfolio management, diversification, and risk control without committing excessive capital.

However, beginners should avoid concentrating too much money in a single cheap stock or chasing speculative names purely because they look inexpensive. Focusing on established companies, clear business models, and basic fundamentals can help reduce risk while building investing experience.

What is the Difference Between Cheap Stocks and Penny Stocks?

Cheap stocks generally trade under $10 but are listed on major exchanges like the NYSE or Nasdaq and are required to meet stricter regulatory and reporting standards. Penny stocks, by contrast, often trade under $5 — and frequently under $1 — and are commonly found on over-the-counter (OTC) markets.

Penny stocks typically carry far higher risk due to low liquidity, limited transparency, and greater susceptibility to manipulation. While some cheap stocks are speculative, they usually offer better disclosure and stability than penny stocks.

How to Select Fundamentally Strong Cheap Stocks

How can I Analyze a Cheap Stock's Potential?

Analyzing a cheap stock starts with examining its financial health and business model. Key areas to review include revenue growth trends, profitability or progress toward profitability, debt levels, and cash flow generation. Investors should also evaluate the company’s competitive position within its industry, the durability of its products or services, and management’s long-term strategy.

Beyond the numbers, it’s important to consider industry tailwinds, upcoming catalysts such as new products or restructuring efforts, and whether the company has a credible path to improving performance.

How do I Know if a Stock is Cheap or Just Bad?

A truly cheap stock trades at a low valuation relative to its future earnings potential, assets, or cash flow, often due to temporary challenges. These companies usually have a realistic plan for recovery, cost control, or growth.

A bad stock, on the other hand, lacks earnings visibility, suffers from persistent losses, carries excessive debt, or operates in a declining or obsolete industry. If management cannot articulate a clear strategy for improvement, or if fundamentals continue to deteriorate, the stock may remain cheap for the wrong reasons.

Strategy and Portfolio Building with Cheap Stocks

Is it Better to Buy 100 Shares of a Cheap Stock, or 1 Share of an Expensive Stock?

The number of shares owned is largely irrelevant. What matters is the percentage return on investment and the level of risk taken. A single share of a high-quality company can outperform hundreds of shares of a struggling business. Investors should focus on expected returns, downside risk, and how each position fits within the broader portfolio.

How do I Build a Diversified Portfolio Using Cheap Stocks?

Diversification with cheap stocks involves spreading investments across multiple sectors, industries, and business models. Combining growth-oriented names with income or value stocks can help balance risk and reward. Limiting position sizes — especially for more speculative companies — helps prevent any single stock from dominating portfolio performance.

How can I Screen for Cheap Stocks with Growth Potential?

Investors can use stock screeners to identify candidates by filtering for price, market capitalization, revenue growth, manageable debt levels, and improving margins. Additional filters such as analyst earnings revisions, insider buying, or strong free cash flow can further refine results. Screening helps narrow the field, but deeper research is still essential before investing.

Cheap Stock Investing Through ETFs

What are Some Good ETFs that Hold Cheap or Value Stocks?

Investors who prefer diversification over picking individual stocks may consider value-focused ETFs. Examples include:

- Vanguard Value ETF (VTV).

- iShares Russell 2000 Value ETF (IWN).

- SPDR Portfolio S&P 600 Small Cap Value ETF (SLYV).

These funds hold baskets of undervalued stocks across multiple sectors and market capitalizations. ETFs can reduce single-stock risk while still providing exposure to companies trading at attractive valuations.