CyberArk Software (CYBR)

(Delayed Data from NSDQ)

$242.60 USD

-2.47 (-1.01%)

Updated Apr 26, 2024 04:00 PM ET

After-Market: $242.64 +0.04 (0.02%) 7:58 PM ET

1-Strong Buy of 5 1

F Value B Growth D Momentum D VGM

Company Summary

Headquartered in Petah Tikva, Israel, CyberArk Software Ltd. was founded in 1999. Together with its subsidiaries, the company provides information technology security solutions. The company is a vital security partner to more than 5,400 global businesses, which include over 50% of the Fortune 500 and more than 35% of the Global 2000 companies.

CyberArk offers services, which protect organizational privileged accounts from cyber-attacks. Its products include CyberArk Shared Technology Platform, Privileged Account Security Solution and Sensitive Information Management Solution.

The company’s privileged account security solution consists of enterprise password vault, which provides a tool to manage ...

Company Summary

Headquartered in Petah Tikva, Israel, CyberArk Software Ltd. was founded in 1999. Together with its subsidiaries, the company provides information technology security solutions. The company is a vital security partner to more than 5,400 global businesses, which include over 50% of the Fortune 500 and more than 35% of the Global 2000 companies.

CyberArk offers services, which protect organizational privileged accounts from cyber-attacks. Its products include CyberArk Shared Technology Platform, Privileged Account Security Solution and Sensitive Information Management Solution.

The company’s privileged account security solution consists of enterprise password vault, which provides a tool to manage and protect physical, virtual, or cloud-based assets in an organization; privileged session manager that protects IT assets; and application identity manager, which addresses the challenges of hard-coded, embedded credentials, and cryptographic keys being hijacked and exploited by malicious insiders or external cyber attackers.

The company offers its products to energy and utilities, financial services, healthcare, manufacturing, retail, technology, and telecommunications industries, as well as government agencies through resellers and distributors.

CyberArk operates under three broad categories — Subscription, Perpetual License, and Maintenance and Professional Services. In 2023, Subscription revenues made up 63% of total revenue, while Perpetual License and Maintenance and Professional Services accounted for 3% and 34%, respectively.

In 2022, the company generated approximately 53% of revenues from the United States, 30% from the EMEA region and the remaining 17% from the Rest of World.

In the access and identity management market CA, Dell, IBM, Microsoft and Oracle are CyberArk’s main competitors. In the advanced threat protection solutions space, its competitors include HP Inc., IBM, FireEye, Splunk, Check Point Software and Palo Alto Networks.

CyberArk has offices in the U.S., Israel, Singapore, Australia, the U.K., Italy, France, Germany, Spain, Japan, Netherlands and Turkey.

General Information

CyberArk Software Ltd

9 HAPSAGOT STREET PARK OFER B P.O. BOX 3143

PETACH-TIKVA, L3 4951040

Phone: 972-3918-0000

Fax: 972-3924-0111

Email: ir@cyberark.com

| Industry | Computers - IT Services |

| Sector | Computer and Technology |

| Fiscal Year End | December |

| Last Reported Quarter | 3/31/2024 |

| Earnings Date | 5/2/2024 |

EPS Information

| Current Quarter EPS Consensus Estimate | 0.27 |

| Current Year EPS Consensus Estimate | 1.76 |

| Estimated Long-Term EPS Growth Rate | 20.00 |

| Earnings Date | 5/2/2024 |

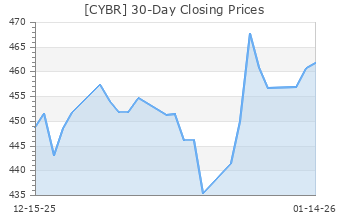

Price and Volume Information

| Zacks Rank | |

| Yesterday's Close | 245.07 |

| 52 Week High | 283.00 |

| 52 Week Low | 120.11 |

| Beta | 1.05 |

| 20 Day Moving Average | 363,549.94 |

| Target Price Consensus | 280.74 |

| 4 Week | -7.74 |

| 12 Week | 3.81 |

| YTD | 11.88 |

| 4 Week | -3.98 |

| 12 Week | 0.89 |

| YTD | 5.70 |

| Shares Outstanding (millions) | 42.26 |

| Market Capitalization (millions) | 10,355.52 |

| Short Ratio | NA |

| Last Split Date | NA |

| Dividend Yield | 0.00% |

| Annual Dividend | $0.00 |

| Payout Ratio | NA |

| Change in Payout Ratio | NA |

| Last Dividend Payout / Amount | NA / $0.00 |

Fundamental Ratios

| P/E (F1) | 139.49 |

| Trailing 12 Months | 224.84 |

| PEG Ratio | 6.97 |

| vs. Previous Year | 138.00% |

| vs. Previous Quarter | 161.29% |

| vs. Previous Year | 31.90% |

| vs. Previous Quarter | 16.66% |

| Price/Book | 13.07 |

| Price/Cash Flow | NA |

| Price / Sales | 13.77 |

| 3/31/24 | NA |

| 12/31/23 | -8.23 |

| 9/30/23 | -12.68 |

| 3/31/24 | NA |

| 12/31/23 | -3.16 |

| 9/30/23 | -4.80 |

| 3/31/24 | NA |

| 12/31/23 | 1.08 |

| 9/30/23 | 2.22 |

| 3/31/24 | NA |

| 12/31/23 | 1.08 |

| 9/30/23 | 2.22 |

| 3/31/24 | NA |

| 12/31/23 | -7.89 |

| 9/30/23 | -12.58 |

| 3/31/24 | NA |

| 12/31/23 | -8.84 |

| 9/30/23 | -13.99 |

| 3/31/24 | NA |

| 12/31/23 | -8.41 |

| 9/30/23 | -14.15 |

| 3/31/24 | NA |

| 12/31/23 | 18.75 |

| 9/30/23 | 17.56 |

| 3/31/24 | NA |

| 12/31/23 | NA |

| 9/30/23 | NA |

| 3/31/24 | NA |

| 12/31/23 | 0.00 |

| 9/30/23 | 0.79 |

| 3/31/24 | NA |

| 12/31/23 | 0.00 |

| 9/30/23 | 44.24 |