The Zacks Industry Rank

Even the stock of a great company will languish if it is within an industry that is out of favor with investors. The key to investment success is finding great stocks in great industries. The Zacks Industry Rank will help you accomplish this feat by leveraging the power of earnings estimate revisions. Here you will find industries with improving earnings prospects, which is the surest bait to lure investor interest. Once you have found the right industries, you can then drill down to find the best companies to add to your portfolio.

What is the Zacks Industry Rank?

The Zacks Industry Rank is based on the highly successful Zacks Rank indicator. As many of you already know, the Zacks Rank is our proprietary quantitative model that uses trends in earnings estimate revisions and EPS surprises to classify stocks into five groups:

| Zacks Rank |

Rating |

| 1 |

Strong Buy |

| 2 |

Buy |

| 3 |

Hold |

| 4 |

Sell |

| 5 |

Strong Sell |

Since 1988, Zacks #1 Rank stocks have generated an annualized return of 25.67%, nearly three times better than the S&P 500's return of 10.79%. The Zacks Rank has also been very successful in telling investors which stocks to avoid. Since 1988, Zacks #5 Rank stocks have been flat. Learn more about the Zacks Rank.

The Zacks Industry Rank applies this powerful indicator to the industry group level. Each of the 264 industry groups is classified based on the strength of the stocks within them.

Many people assume that they have to buy stocks from one of the top few industries out of the 264 that we follow in order to be successful. This is not necessarily the case. There are many great stocks that reside in industries that are in the top third of the ones we cover. Obviously, industries ranked closer to the top are better, but the point is not to avoid companies that are in industries ranked in the 50's and 60's.

What we did was split the industries into three groups: The good (green) being 1-88, the neutral (yellow) 89-176, and the bad (red) 177-264. They are color-coded so as to make them more visually intuitive. The green third is clearly where you should start your research for potential stocks as they reside in the best industries. Yellow doesn't necessarily mean to avoid the industries, but it means to proceed with caution. Red industries should be avoided. An important point to remember is that an excellent stock that is ranked #1 in a bad industry will likely underperform as it is pulled down by its peers.

| Zacks Industry Rank |

| 1-88 |

Good |

| 89-176 |

Neutral |

| 177-264 |

Bad |

How is the Zacks Industry Rank Calculated?

The Zacks Industry Rank is the average Zacks Rank for all companies within a specific industry group. For example, an industry containing five stocks with Zacks Ranks of 1, 2, 2, 3 and 5 will have a Zacks Industry Rank of 2.60 since that is the average of the individual Zacks Rank scores.

Lower scores are better than higher scores. In order to get a lower score, an industry group must have a greater proportion of stocks with Zacks Rank of #1 ("Strong Buy") or #2 ("Buy"). These are stocks with the most positive trend in earnings estimate revisions. When analysts raise their profit forecasts on multiple companies within the same group, often there is underlying factor that is benefiting the industry (e.g. greater demand, the ability to charge more, etc.). Therefore, by utilizing the Zacks Industry Rank, you are finding stocks that can benefit from both favorable industry and company trends. A win-win situation.

How to Read the Zacks Industry Rank Table

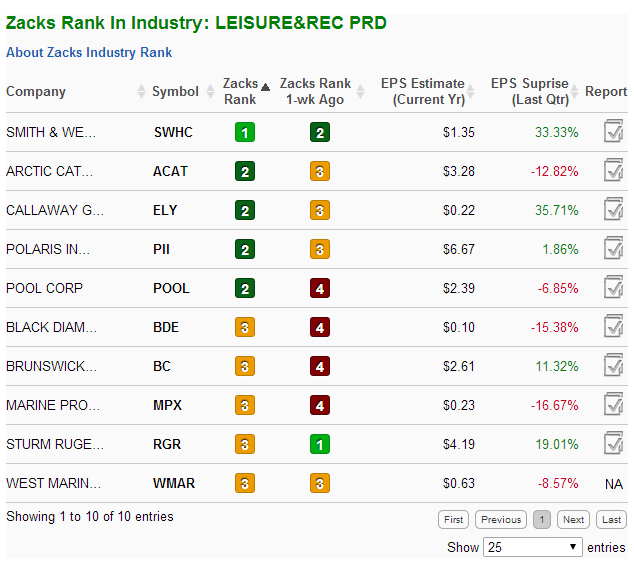

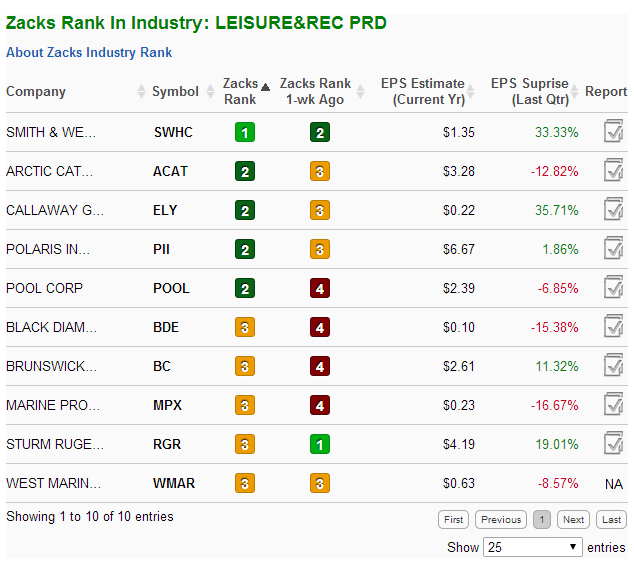

Here is a snapshot of the Zacks Industry Rank table. Descriptions of each column are provided below. The table can be resorted by clicking on any of the column headings.

Rank - How each industry group ranks against the 264 industry groups. If multiple groups have the same Zacks Industry Rank score, they will have the same rank on the page. However, the group with the higher percentage of positive estimate revisions will be displayed first. Notice in the above snapshot that there are three firms tied for second and two firms tied for sixth place.

1-Week Change - The change in rank from a week ago. The direction of the change is more important than the absolute rank level. You want to be investing in highly ranked industries showing solid week over week improvement.

Industry - The name of the industry and, in parentheses, the number of stocks within the group. To view the stocks within a specific industry, simply click on the industry group's name. You will be directed to a new page that provides detailed information on each stock within the industry group.

Zacks Rank - The current Zacks Industry Rank. Lower scores are better.

Zacks Rank 1-wk Ago - The Zacks Industry Rank of a week ago. You want industry groups with week-over-week improvements in the Zacks Rank.

% of Positive Revisions - The net proportion of earnings estimates revised upwards over the past four weeks. A higher number implies that more analysts are in agreement that the outlook for the industry group has improved recently.

To understand how this number is calculated, assume a group has five companies, each of which is followed by four analysts. This group would have a total of 20 earnings estimates (5 stocks x 4 analysts). If two analysts raised their estimates on all five companies, there would be 10 positive estimate revisions (2 analysts X 5 stocks = 10). If one analyst cut his forecasts on all five stocks, there would be five negative revisions (1 analyst X 5 stocks = 5). This would give us a net total of 5 positive estimate revisions (10 positive revisions - 5 negative revisions = 5 net positive revisions). To calculate the % of Positive Revisions, we then divide the net positive revisions by the total number of estimates (5 net positive revisions / 20 total estimates = 25%).

Positive Revisions - The total number of estimates that have been revised upwards over the past four weeks. This number can vary by the size of the industry group and the number of analysts following the stocks within the group. Higher numbers are preferable, since they imply agreement on the part of the analysts that outlook is improving.

Negative Revisions - The total number of estimates that have been revised downwards over the past four weeks. This number can vary by the size of the industry group and the analysts following the stocks within the group. Lower numbers are preferable.

Using the Zacks Industry Rank

Zacks Industry Rank is calculated by averaging the Zacks Rank for all stocks within a specific industry. The industry with the lowest score will be considered the #1 ranked industry and the group with the highest score will be ranked at the bottom. The strength of the score is dependant on the proportion of companies that are experiencing positive earnings estimate revisions. In other words, Industry Rank tells you whether or not analysts believe earnings at the group level will be better than originally thought.

The absolute Zacks Rank score (4th column in the display) for an industry is not as important as how the Industry ranks relative to other industries. We have run internal tests to find the value of these rankings whereby we grouped the Industries into quintiles (essentially 5 groups of 53 stocks). The first quintile had the top 53 rated industries. Those industries outperformed the next quintile and so on.

Since you always want a diversified portfolio, you should not want all of your stocks from the #1 industry. In general you should populate your portfolio with stocks in the top two quintiles (top 106 industries). The more stocks in the Top 53 industries the better.

Quite often industries with just one or two stocks may have an artificially high or low Industry Rank. A group with a single stock will have an Zacks Rank that exactly matches the stock's Zacks Rank. Conversely, a large group will only achieve a high ranking only if analysts are raising their forecasts on multiple companies within the group. Smaller companies with high scores can still make for good investments, but investors should look for similar, larger groups with high rankings to confirm the positive momentum.

How Are Industry Groups Determined

Zacks uses a proprietary industry classification system that groups companies together according to their business models. Expanded industry groups are used for calculating industry rank though companies can also be classified by sector or medium industry groups. Mapping of sector and industry group classifications.