Methodology

The Zacks Rank is a proprietary stock-rating model that uses trends in earnings estimate revisions and earnings-per-share (EPS) surprises to classify stocks into five groups: #1 (Strong Buy), #2 (Buy), #3 (Hold), #4 (Sell) and #5 (Strong Sell). The Zacks Rank is calculated through four primary factors related to earnings estimates: analysts' consensus on earnings estimate revisions, the magnitude of revision change, the upside potential and estimate surprise (or the degree in which earnings per share deviated from the previous quarter).

Zacks builds the data from 3,000 analysts at over 150 different brokerage firms. The average yearly gain for Zacks Rank #1 (Strong Buy) stocks is +23.62% per year from January, 1988, through June 2, 2025.

Selections for Best Quantum Computing Stocks are based on the current top ranking stocks based on Zacks Indicator Score. For this list, only companies that have average daily trading volumes of 100,000 shares or more were considered. All information is current as of market open, Feb. 25, 2026.

Introduction to Quantum Computing Stocks

What Are Quantum Computing Stocks?

Quantum computing stocks are publicly traded companies that develop quantum hardware, quantum software, or platforms that allow customers to access quantum systems. These firms range from early-stage, pure-play quantum companies to tech giants that treat quantum computing as part of a broader innovation portfolio.

Quantum computing companies fall into several distinct categories. Understanding these groups—and which stocks belong to each—helps investors target the level of risk and exposure they want.

1. Pure-Play Quantum Hardware Companies

These companies focus almost entirely on building quantum computers and related systems. They generate most of their revenue from quantum technology rather than broader tech operations.

Examples:

- IonQ (IONQ) – Specializes in trapped-ion quantum computers with cloud access via AWS, Azure, and Google Cloud.

- Rigetti Computing (RGTI) – Builds superconducting quantum processors and hybrid quantum–classical platforms.

- D-Wave Quantum (QBTS) – Develops quantum annealing systems optimized for real-time optimization tasks.

These companies offer the highest direct exposure to quantum technology, but also carry the most risk and volatility.

2. Quantum Software & Algorithm Developers

These firms build software tools, algorithms, and operating environments that run on quantum hardware, often partnering with multiple hardware providers.

Examples:

- Quantum Computing Inc. (QUBT) – Develops photonic-based systems and reservoir computing models along with software tools for quantum applications.

- Horizon Quantum Computing (Private) – Works on compiling classical code into quantum-ready programs.

- Zapata AI (Private, formerly Zapata Computing) – Focuses on quantum-inspired optimization and machine-learning software.

Though many quantum software leaders are still private, companies like QUBT give public investors access to this segment.

3. Hybrid or Quantum-Adjacent Computing Companies

These firms don’t build full quantum computers but develop technologies that support or complement quantum computing, such as photonics, cryogenics, advanced sensors, or quantum communication systems.

Examples:

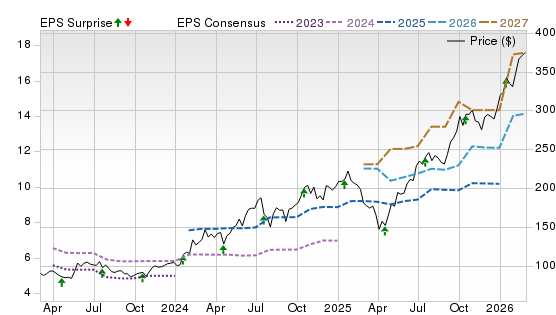

- Nvidia (NVDA) – Provides GPU platforms that power quantum simulations and hybrid quantum–classical workflows.

- Adtran (ADTN) – Develops quantum-safe networking solutions.

- Hamamatsu Photonics (HPHTF) – Manufactures detectors and lasers used in quantum research.

- Arqit Quantum (ARQQ) – Specializes in quantum encryption and quantum-safe security.

These stocks offer exposure to the broader quantum ecosystem with lower technological risk.

4. Large-Cap Technology Companies With Quantum Divisions

These tech giants invest heavily in quantum computing R&D as part of their broader innovation strategy. Their quantum operations are small relative to total revenue, but their resources make them long-term contenders.

Examples:

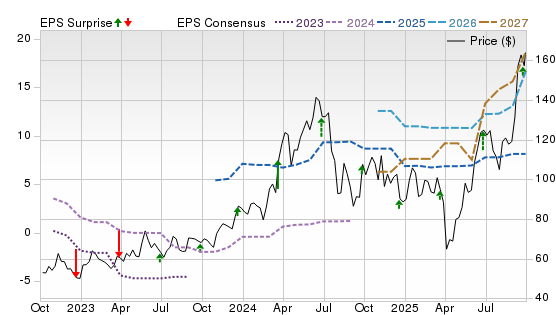

- Alphabet (GOOGL) – Google Quantum AI leads in superconducting qubit research and error correction breakthroughs.

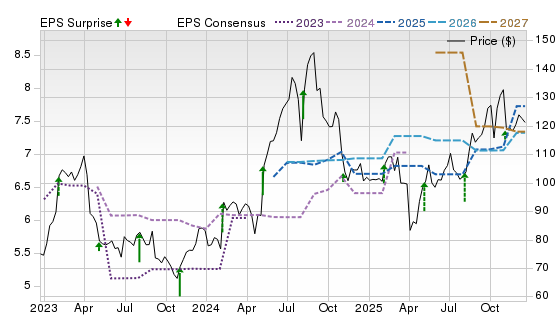

- IBM (IBM) – Operates one of the world’s largest quantum ecosystems with IBM Quantum and a multi-year quantum development roadmap.

- Microsoft (MSFT) – Develops topological qubits and runs the Azure Quantum cloud platform.

- Amazon (AMZN) – Provides quantum access through AWS Braket and invests in multiple quantum hardware startups.

These companies offer the safest quantum exposure because their success does not depend solely on quantum breakthroughs.

Practical Use Cases and Near-Future Applications

Quantum computing is expected to disrupt industries that depend on immense computational power. While fully fault-tolerant systems may still be years away, several near-term applications are starting to emerge:

- Optimization problems (logistics, supply chain, routing).

- Drug discovery & materials science.

- Financial modeling, risk analysis & portfolio optimization.

- AI acceleration via quantum-enhanced machine learning.

- Cybersecurity & post-quantum cryptography.

Hybrid quantum-classical systems — already accessible via cloud platforms — are likely to be the earliest source of commercial value.

Is It Too Early to Invest in Quantum Computing Stocks Now?

Quantum computing is still in its infancy. For many investors, this raises a fair question: Is now the right time—or too soon—to buy quantum stocks?

Why It Might Be Too Early

- Many quantum companies are unprofitable and years from commercial-scale revenue.

- Stock prices tend to swing sharply on small news events.

- Quantum hardware still faces challenges like error correction and qubit stability.

Why Some Investors Are Buying Now

- Governments and corporations are investing heavily, accelerating progress.

- Several quantum companies now have real customers and recurring revenue.

- Major breakthroughs could significantly revalue early-stage players.

- Wall Street analysts are increasingly bullish on select names.

Bottom line: Quantum stocks are a high-risk, long-term bet — similar to early semiconductor or AI companies decades ago. Investors with patience and risk tolerance may see significant upside.

Pros and Cons of Investing in Quantum Computing Stocks

Benefits of Buying Quantum Computing Stocks

- Potential for exponential long-term returns

- Exposure to a transformative next-generation technology

- Early participation in a market that could rival today’s semiconductor or AI industries

- Increasing institutional interest and government funding

Risks of Buying Quantum Computing Stocks

- Many companies have uncertain business models

- High volatility and frequent price spikes/drops

- Long timelines for commercial viability

- Unproven technologies may never reach scale

- Cash burn and capital-raising risks

Are Quantum Computing Stocks a Good Long-Term Investment?

Quantum stocks can be an excellent long-term play if you:

- Can tolerate long periods of volatility

- Want exposure to frontier technologies

- Have a multi-year investment horizon

- Understand that profitability may be far off

For conservative investors, a diversified tech name like Alphabet offers safer quantum exposure.

Market Timing and Future Outlook

When Will Quantum Computing Be Commercially Viable?

Most experts predict:

- Early commercial applications: Within 2–5 years.

- Broader enterprise deployment: Within 5–10 years.

- Fully fault-tolerant quantum systems: Likely 10+ years away.

Progress is accelerating, but meaningful revenue at industrial scale may take time.

Key Technological Breakthroughs to Watch

- Improvements in quantum error correction.

- Advances in qubit stability and coherence.

- Achieving quantum advantage in real-world tasks.

- Expansion of quantum cloud services.

- Launch of commercial-grade next-generation quantum processors.

- Cross-industry partnerships in AI, pharmaceuticals, and logistics.

Strong Buy

Strong Buy

Hold

Hold