5 Best Pharma Stocks to Buy Today

| Company (Ticker) | 12 Week Price Change | Forward PE | Price | Proj EPS Growth (1 Year) | Projected Sales Growth (1Y) |

|---|---|---|---|---|---|

| Harrow, Inc. (HROW) | 20.66% | 29.28 | $44.22 | 1,991.89% | 42.42% |

| Harmony Biosciences (HRMY) | 27.20% | 9.19 | $37.15 | 26.65% | 17.15% |

| ANI Pharmaceuticals (ANIP) | -7.11% | 10.49 | $83.77 | 7.87% | 7.76% |

| Phibro Animal Health (PAHC) | -0.60% | 15.06 | $39.12 | 32.18% | 13.13% |

| Amneal Pharmaceuticals (AMRX) | 35.80% | 14.19 | $13.40 | 21.10% | 6.30% |

*Updated on January 23, 2026.

Harrow, Inc. (HROW)

$44.22 USD -1.10 (-2.43%)

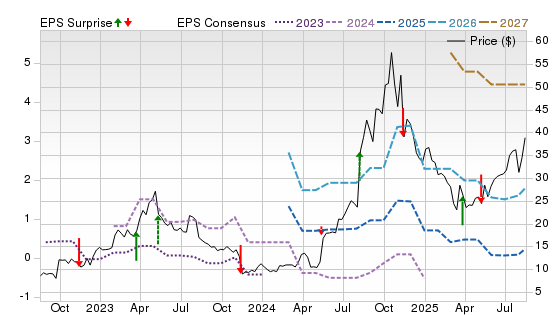

3-Year Stock Price Performance

Premium Research for HROW

- Zacks Rank

Strong Buy 1

Strong Buy 1

- Style Scores

D Value A Growth D Momentum B VGM

- Market Cap:$1.75 B (Small Cap)

- Projected EPS Growth:117.95%

- Last Quarter EPS Growth:37.50%

- Last EPS Surprise:50.00%

- Next EPS Report date:March 26, 2026

Our Take:

Harrow is a North American eyecare pharmaceutical company marketing branded ophthalmic drugs, including VEVYE for dry eye and IHEEZO for ocular anesthesia, alongside a growing retina and procedure-room portfolio. The acquisition of Melt Pharmaceuticals adds non-IV, non-opioid sedation candidates.

The investment case leans on expanding market access and product breadth. VEVYE has secured broad coverage across Medicare Part D, Medicaid, and major commercial plans, with a recent Tier-1 win at CVS’s PBM that should support sustained prescription growth. The relaunch of TRIESENCE adds another durable retina asset, de-risking the revenue mix.

A Zacks Rank #1 (Strong Buy) signals positive estimate revisions. The A Growth Score aligns with strengthening demand and operating leverage, while a D for Value and Momentum acknowledge a richer multiple and choppy trading. On the Price, Consensus & EPS Surprise chart, the stock’s steady uptrend mirrors rising 2026–2027 EPS lines, with brief earnings-related pullbacks that have reset higher over time.

See more from Zacks Research for This Ticker

Normally $25 each - click below to receive one report FREE:

Harmony Biosciences (HRMY)

$37.15 USD +0.39 (1.06%)

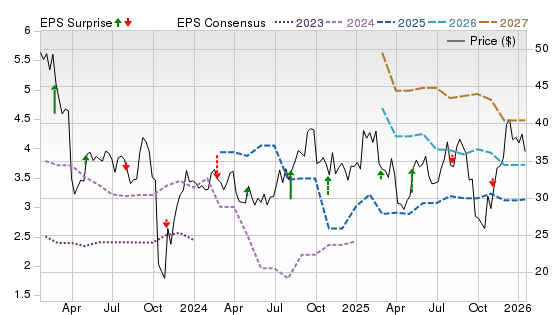

3-Year Stock Price Performance

Premium Research for HRMY

- Zacks Rank

Strong Buy 1

Strong Buy 1

- Style Scores

A Value B Growth C Momentum A VGM

- Market Cap:$2.11 B (Mid Cap)

- Projected EPS Growth:24.70%

- Last Quarter EPS Growth:27.94%

- Last EPS Surprise:-5.43%

- Next EPS Report date:Feb. 24, 2026

Our Take:

Harmony Biosciences is a CNS-focused pharmaceutical company anchored by WAKIX (pitolisant) for the treatment of narcolepsy, including a pediatric label, and a pipeline aimed at broadening its sleep-wake franchise.

The appeal today is durable category leadership with line-extension momentum. Management projects WAKIX revenue to exceed $1 billion in 2026 as the brand penetrates further and next-generation pitolisant formulations advance, including a gastro-resistant version that met bioequivalence and a high-dose program intended to strengthen efficacy at the upper end of dosing. An in-house orexin-2 receptor agonist has entered human studies, adding a potential best-in-class asset.

With a Zacks Rank #1 and Style Score of A for Value and B for Growth, estimate momentum and valuation look favorable, while the C Momentum Score cautions that shares can stall between catalysts. On the chart, price generally trends higher alongside rising 2026–2027 consensus lines, punctuated by brief drawdowns around regulatory headlines that later stabilize as estimates reset.

See more from Zacks Research for This Ticker

Normally $25 each - click below to receive one report FREE:

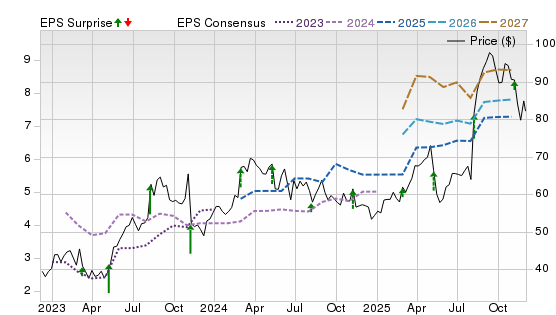

ANI Pharmaceuticals (ANIP)

$83.77 USD -1.62 (-1.90%)

3-Year Stock Price Performance

Premium Research for ANIP

- Zacks Rank

Buy 2

Buy 2

- Style Scores

B Value A Growth B Momentum A VGM

- Market Cap:$1.92 B (Small Cap)

- Projected EPS Growth:45.19%

- Last Quarter EPS Growth:18.84%

- Last EPS Surprise:17.24%

- Next EPS Report date:Feb. 27, 2026

Our Take:

ANI Pharmaceuticals is a diversified specialty drug maker whose rare-disease franchise is anchored by Purified Cortrophin Gel, complemented by branded ophthalmology, generics, and CDMO platforms. Management’s 2026 outlook targets $1.055–$1.115 billion in sales, including $540–$575 million from Cortrophin, highlighting a shift toward higher-margin specialty care backed by an expanded rare-disease sales force and solid liquidity.

The appeal here is a steadily broadening prescriber footprint in neurology, rheumatology, and nephrology, disciplined pricing and mix, and ongoing integration of retina and generics capabilities, an operating model that reduces single-asset risk while compounding cash flow.

A Zacks Rank #2 (Buy) reflects constructive estimate revisions. The A Growth and B Value Scores fit a company transitioning to faster, higher-quality earnings, while a B Momentum Score signals improving but uneven follow-through. On the chart, shares trend higher in step with rising 2026–2027 EPS lines, with occasional pullbacks around updates, consistent with execution rather than hype.

See more from Zacks Research for This Ticker

Normally $25 each - click below to receive one report FREE:

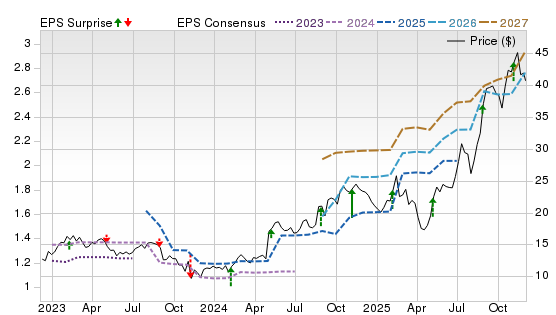

Phibro Animal Health (PAHC)

$39.12 USD -2.49 (-5.98%)

3-Year Stock Price Performance

Premium Research for PAHC

- Zacks Rank

Buy 2

Buy 2

- Style Scores

A Value A Growth F Momentum B VGM

- Market Cap:$1.69 B (Small Cap)

- Projected EPS Growth: 32.06%

- Last Quarter EPS Growth: 28.07%

- Last EPS Surprise: 23.73%

- Next EPS Report date: Feb. 4, 2026

Our Take:

Phibro Animal Health develops and markets animal-health products across medicated feed additives, vaccines, and nutritional specialties, supported by a smaller performance-chemicals unit. The portfolio spans livestock and companion animals and sells globally through direct and distributor channels.

The strategic swing factor is the integration of the medicated-feed-additive portfolio acquired from Zoetis, which materially expands MFAs, adds manufacturing scale and international reach, and is expected to lift margins and earnings power. Management has paired that step-up with a focus on vaccines and nutritionals, raising guidance and highlighting Animal Health as the growth engine.

A Zacks Rank #2 captures positive estimate revisions while tempering expectations. A scores for Value and Growth align with improving earnings quality at a reasonable multiple, while an F for Momentum reflects a choppier tape. On the chart, shares have transitioned from a base into a persistent uptrend as 2026–2027 EPS lines step higher, an accumulation pattern consistent with strengthening fundamentals despite periodic volatility.

See more from Zacks Research for This Ticker

Normally $25 each - click below to receive one report FREE:

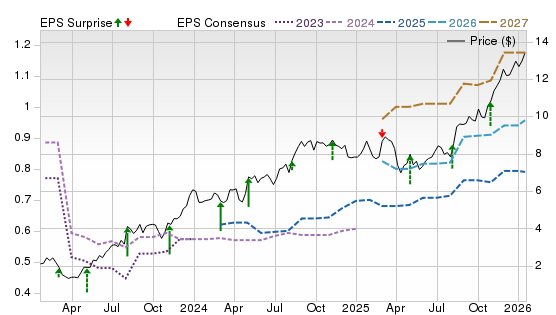

Amneal Pharmaceuticals (AMRX)

$13.40 USD -0.18 (-1.33%)

3-Year Stock Price Performance

Premium Research for AMRX

- Zacks Rank

Buy 2

Buy 2

- Style Scores

A Value A Growth B Momentum A VGM

- Market Cap:$4.27 B (Mid Cap)

- Projected EPS Growth:36.21%

- Last Quarter EPS Growth:-34.78%

- Last EPS Surprise:30.77%

- Next EPS Report date:Feb. 27, 2026

Our Take:

Amneal operates across generics, injectables, and specialty brands, with growth led by Parkinson’s therapy Crexont and new specialty launches, while complex generics and injectables add steady cash flow. Management’s recent updates reaffirm a multi-year shift toward higher-margin branded and complex products and a healthy revenue/EBITDA outlook.

This balance, durable generics cash generation plus branded catalysts, supports reinvestment and de-risked growth relative to single-asset biopharma peers. Competition and pricing remain structural headwinds, but the pipeline and launch cadence offer offsets and visibility.

A Zacks Rank #2 indicates constructive estimate revisions. Style Scores of A for Value and Growth suggest attractive earnings power at a reasonable multiple, while a B for Momentum reflects constructive, but not runaway, trading. On the chart, shares show a persistent uptrend from prior lows, with 2026–2027 EPS lines stepping higher and the 2027 line rising further. The pattern points to improving fundamentals alongside typical mid-cap pharma volatility.

See more from Zacks Research for This Ticker

Normally $25 each - click below to receive one report FREE:

Methodology

The Zacks Rank is a proprietary stock-rating model that uses trends in earnings estimate revisions and earnings-per-share (EPS) surprises to classify stocks into five groups: #1 (Strong Buy), #2 (Buy), #3 (Hold), #4 (Sell) and #5 (Strong Sell). The Zacks Rank is calculated through four primary factors related to earnings estimates: analysts' consensus on earnings estimate revisions, the magnitude of revision change, the upside potential and estimate surprise (or the degree in which earnings per share deviated from the previous quarter).

Zacks builds the data from 3,000 analysts at over 150 different brokerage firms. The average yearly gain for Zacks Rank #1 (Strong Buy) stocks is +23.62% per year from January, 1988, through June 2, 2025.

Selections for Best Pharmaceutical Stocks are based on the current top ranking stocks based on Zacks Indicator Score and other factors. For this list, only companies that have average daily trading volumes of 100,000 shares or more are considered. All information is current as of market open, Jan. 23, 2026.

Learn More about Pharmaceutical Stocks

What are Pharmaceutical Stocks?

“Pharmaceutical stocks” refer to publicly traded companies engaged primarily in the discovery, development, manufacturing, and sale of drugs — including brand-name medicines, biologics, vaccines and sometimes generics.

Types of Pharmaceutical Stocks

Large-cap, established pharmaceutical companies – These are the global leaders with diverse drug portfolios, steady revenue streams, and long histories of paying dividends. Examples include Pfizer (PFE), Merck (MRK), Johnson & Johnson (JNJ), AbbVie (ABBV), Bristol-Myers Squibb (BMY) and Novartis (NVS). These companies tend to have well-funded pipelines and wide geographic reach, making them popular with conservative investors.

Specialty-drug and focused biopharma firms – These companies concentrate on specific therapeutic areas such as rare diseases, oncology, immunology, or metabolic conditions. They can deliver strong growth if a breakthrough therapy succeeds. Examples include Vertex Pharmaceuticals (VRTX) in genetic diseases, Regeneron (REGN) in immunology and ophthalmology, Incyte (INCY) in oncology and Horizon Therapeutics (HZNP) in autoimmune disorders.

Pipeline-driven or R&D-intensive pharmaceutical developers – These companies may have fewer commercialized drugs but invest heavily in research, clinical trials, and next-generation treatments. Revenue may be uneven, but the upside can be significant if major approvals come through. Notable examples include Moderna (MRNA) in mRNA therapeutics, BioNTech (BNTX) in immuno-oncology, Alnylam Pharmaceuticals (ALNY) in RNA interference drugs and Sarepta Therapeutics (SRPT) in genetic therapies.

Pros of Pharmaceutical Stocks

- Consistent demand for medicines: Healthcare needs remain steady regardless of economic cycles, helping companies like Merck, Eli Lilly (LLY), or AstraZeneca (AZN) maintain dependable revenue.

- Attractive dividends: Many large pharmaceutical companies, such as Pfizer, AbbVie, and Johnson & Johnson, are known for long-standing dividend programs and high payout reliability.

- Potential for major upside from drug launches: A successful approval or breakthrough therapy—such as Eli Lilly’s diabetes/obesity drugs or Regeneron’s eye-disease treatments—can significantly boost a company’s valuation.

- Diversification within healthcare: Pharma stocks often behave differently from technology, consumer, or financial sectors, providing balance to an investment portfolio.

Cons of Pharmaceutical Stocks

- Regulatory hurdles: Failure to secure FDA approval, clinical-trial setbacks, or safety concerns can sharply impact valuations when trials don’t meet expectations.

- Patent cliffs and generic competition: Once exclusivity ends, branded drugs can face rapid erosion from generics or biosimilars. For instance, AbbVie’s Humira — once the world’s top-selling drug — saw sales drop after biosimilar competition entered the market.

- Competitive pressures: New drugs from rivals can displace existing blockbusters. For example, Novo Nordisk (NVO) and Eli Lilly (LLY) dominate the obesity/diabetes segment, squeezing competitors.

- High research costs and uncertainties: Pharma R&D is expensive and unpredictable. Firms like Moderna, Alnylam, or Sarepta often experience stock volatility tied directly to clinical-trial outcomes or scientific feasibility.

Best Pharmaceutical Stocks vs. Biotechnology Stocks: Which Is Better?

Pharmaceutical companies (large-cap pharma)

These firms—such as Merck, Pfizer, AbbVie, and Novartis—tend to be more stable due to established product lines and recurring revenue. They typically appeal to income-focused investors because they often pay strong and consistent dividends.

Biotechnology companies

Biotech firms like Regeneron, Vertex, Moderna, and BioNTech often target cutting-edge scientific approaches with high growth potential. Their revenues can surge when a breakthrough therapy succeeds, but they face much greater volatility and dependency on research outcomes.

>>Learn more: Best Biotech Stocks to Buy Today

Which is better?

- If you prefer steady dividends and lower volatility, large U.S. and international pharma names are generally a better fit.

- If you’re seeking high potential returns and can handle larger price swings, biotech and R&D-intensive drug developers may offer superior upside.

- Many investors blend both categories to balance income with innovation-driven growth.

Risks and Safety

How do FDA approvals impact stock prices?

Securing FDA approval for a new drug can be a major catalyst: positive news can dramatically boost stock price. Conversely, delays, negative trial results, or regulatory setbacks can result in sharp declines. That’s why even solid firms factor in “uncertainty rating” — because much hinges on regulatory success.

How do patent expirations affect pharmaceutical stocks?

When a drug’s patent expires, generics may enter, often severely reducing sales for the original drug — which can lead to revenue decline unless the company successfully replaces the lost revenue with new drugs or therapies.

What are the biggest risks when investing in drug companies?

- R&D failure and sunk costs.

- Regulatory hurdles and unpredictable approval processes.

- Competition (generics, biosimilars, newer therapies).

- Litigation, pricing pressure, changes in healthcare policy and regulation.

- Concentration risk if a company relies heavily on a few blockbuster drugs.

Pharmaceutical Stocks Trends

Which pharmaceutical stock benefits the most from aging population trends?

Large-cap companies with broad portfolios — especially those offering treatments for chronic diseases (e.g., cardiovascular, cancer, auto-immune, diabetes) — tend to benefit from demographic trends. Firms like Merck, AbbVie, and others with diversified pipelines may be especially well positioned.

How have pharmaceutical stocks performed in the last 5 years?

Many large-cap pharma stocks have offered attractive dividend yields and moderate growth, often outperforming more cyclical sectors, especially in volatile markets. Their relative resilience and dividends have appealed to investors seeking stability.

Are pharma stocks recession-proof?

Not entirely — but compared with consumer discretionary or cyclical sectors, pharma tends to be more resilient. Demand for essential medicines tends to remain stable even during economic downturns, giving pharma a defensive characteristic.

How to Invest in Pharmaceutical Stocks

Should beginners invest in pharma ETFs instead of single stocks?

Yes — for many retail investors, pharma-focused ETFs (or broader healthcare ETFs) offer diversified exposure, reducing the risk of overconcentration in a single company. This mitigates risks like regulatory failure or drug-specific setbacks.

Is it better to invest in global or U.S. pharmaceutical companies?

Both have advantages. U.S. firms often lead in innovation, R&D, and large-scale global distribution. International companies may offer exposure to different markets, drug pipelines, and potentially attractive valuations. A mix of both can provide balanced diversification.