5 Best Oil Stocks to Buy Today

| Company (Ticker) | 12 Week Price Change | Forward PE | Price | Proj EPS Growth (1 Year) | Projected Sales Growth (1Y) |

|---|---|---|---|---|---|

| Centrus Energy (LEU) | -17.87% | 72.93 | $311.48 | -17.05% | 8.34% |

| Oceaneering International (OII) | 20.41% | 15.64 | $30.99 | -7.46% | -5.83% |

| TechnipFMC (FTI) | 29.76% | 19.95 | $55.27 | 20.79% | 6.70% |

| Innovex International, Inc. (INVX) | 25.61% | 16.23 | $25.96 | 22.48% | 6.04% |

| Halliburton (HAL) | 25.68% | 15.14 | $33.98 | -6.75% | -2.37% |

*Updated on January 27, 2026.

Centrus Energy (LEU)

$311.48 USD +29.78 (10.57%)

3-Year Stock Price Performance

Premium Research for LEU

- Zacks Rank

Strong Buy 1

Strong Buy 1

- Style Scores

F Value D Growth A Momentum F VGM

- Market Cap:$5.39 B (Mid Cap)

- Projected EPS Growth:4.25%

- Last Quarter EPS Growth:-88.05%

- Last EPS Surprise:-5.00%

- Next EPS Report date:Feb. 5, 2026

Our Take:

Centrus is the leading U.S.-owned uranium enrichment provider, serving commercial nuclear operators with low-enriched uranium while also developing high-assay low-enriched uranium (HALEU) for next-generation reactors.

Recent developments underscore the firm’s emphasis on operational progress and future capacity. By the end of September 2025, Centrus had assembled a $3.9 billion order backlog, roughly $3 billion tied to long-term LEU agreements, supported by $1.6 billion in unrestricted cash, alongside continued execution of DOE-supported HALEU work.

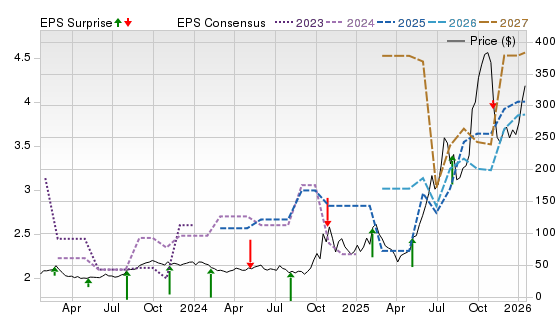

A Zacks Rank #1 (Strong Buy) signals positive estimate revisions. The A Momentum score fits the stock’s strong relative strength, while D Growth and F Value remind investors that near-term fundamentals and valuation can be sensitive to contract timing and mix. On the Price, Consensus & EPS Surprise chart, price has trended sharply higher alongside rising 2026–2027 EPS lines, with occasional volatility around updates, suggesting the market is discounting capacity build-out and policy support.

See more from Zacks Research for This Ticker

Normally $25 each - click below to receive one report FREE:

Oceaneering International (OII)

$30.99 USD +1.90 (6.53%)

3-Year Stock Price Performance

Premium Research for OII

- Zacks Rank

Strong Buy 1

Strong Buy 1

- Style Scores

B Value B Growth C Momentum A VGM

- Market Cap:$2.91 B (Mid Cap)

- Projected EPS Growth:76.32%

- Last Quarter EPS Growth:12.24%

- Last EPS Surprise:30.95%

- Next EPS Report date:Feb. 18, 2026

Our Take:

Oceaneering is a global technology-driven services company with deep expertise in offshore project execution, manufactured products, and digital integrity solutions.

The company stands out for its highly reliable underwater robots that operate successfully 99% of the time, a proven ability to consistently generate cash, and growing business opportunities across energy, industrial and defense sectors. With $506 million in cash as of Sep. 30, 2025, plus unused credit capacity, the balance sheet supports growth, investments, and ongoing share repurchases while maintaining financial flexibility.

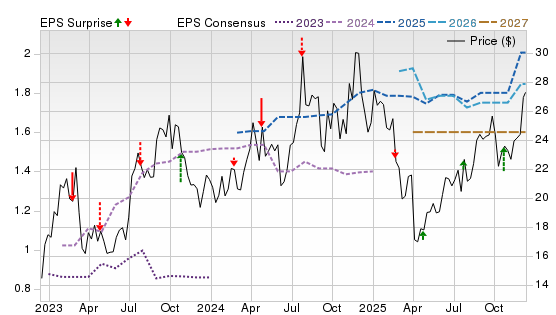

A Zacks Rank #1 captures upward estimate revisions, while B scores for Value and Growth suggest a balanced profile at this stage of the upcycle. The D Momentum score cautions that shares may pause after a run. On the chart, price has rebounded from midyear lows as 2026–2027 EPS estimates stabilize after earlier trims, a pattern consistent with improving execution and visibility in backlog-driven offshore work.

See more from Zacks Research for This Ticker

Normally $25 each - click below to receive one report FREE:

TechnipFMC (FTI)

$55.27 USD +0.64 (1.17%)

3-Year Stock Price Performance

Premium Research for FTI

- Zacks Rank

Buy 2

Buy 2

- Style Scores

B Value A Growth B Momentum A VGM

- Market Cap:$21.95 B (Large Cap)

- Projected EPS Growth:24.73%

- Last Quarter EPS Growth:10.29%

- Last EPS Surprise:15.38%

- Next EPS Report date:Feb. 19, 2026

Our Take:

TechnipFMC is a global integrated solutions provider in the oil and gas industry. Most of its revenue is generated internationally, with a strong focus on subsea activities.

In Q3 2025, TechnipFMC delivered solid execution and cash generation, driven by sustained subsea activity. Inbound orders totaled $2.6 billion, including $2.4 billion from subsea awards, while the board expanded the buyback authorization by $2 billion. The company also raised full-year 2025 free cash flow guidance to $1.3 to 1.45 billion and introduced initial Subsea guidance for 2026.

A Zacks Rank #2 reflects positive, but moderating, estimate momentum. An A Growth score fits accelerating earnings and backlog conversion, while B Value and C Momentum point to a reasonable entry after a strong year. The chart shows shares trending higher with 2026–2027 EPS lines edging up, and brief pullbacks around quarterly prints that have been followed by estimate resets in the company’s favor.

See more from Zacks Research for This Ticker

Normally $25 each - click below to receive one report FREE:

Innovex International, Inc. (INVX)

$25.96 USD +0.31 (1.21%)

3-Year Stock Price Performance

Premium Research for INVX

- Zacks Rank

Buy 2

Buy 2

- Style Scores

B Value A Growth C Momentum A VGM

- Market Cap:$1.74 B (Small Cap)

- Projected EPS Growth:-4.44%

- Last Quarter EPS Growth:-35.71%

- Last EPS Surprise:-33.33%

- Next EPS Report date:Feb. 24, 2026

Our Take:

Innovex International provides mission-critical products and services for well construction and completion markets, operating through a curated portfolio of complementary offerings.

During the third quarter of 2025, Innovex reported revenue of $240 million with sequential growth, while adjusted EBITDA totaled $44 million, representing an 18% margin. The quarter reflected continued integration progress, early revenue synergies, and cost actions supporting margin expansion, alongside benefits from product cross-selling and operational streamlining following the $90 million Eldridge facility divestiture, which strengthened liquidity.

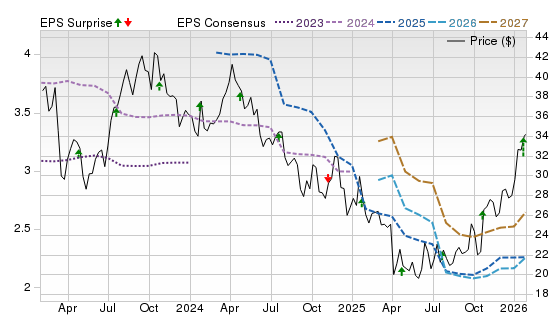

A Zacks Rank #2 indicates constructive estimate revisions. The A Growth score and B Value suggest profits are improving while the stock still trades at relatively attractive valuations, while C Momentum implies the stock may be consolidating after a strong run-up. On the chart, 2026–2027 EPS lines have risen sharply post-listing and the stock has tracked those upgrades higher, albeit with volatility normal for newly listed oilfield service providers.

See more from Zacks Research for This Ticker

Normally $25 each - click below to receive one report FREE:

Halliburton (HAL)

$33.98 USD -0.18 (-0.53%)

3-Year Stock Price Performance

Premium Research for HAL

- Zacks Rank

Buy 2

Buy 2

- Style Scores

B Value B Growth A Momentum A VGM

- Market Cap:$28.57 B (Large Cap)

- Projected EPS Growth:-9.50%

- Last Quarter EPS Growth:18.97%

- Last EPS Surprise:27.78%

- Next EPS Report date:April 28, 2026

Our Take:

Halliburton is a leading oilfield services provider focused on well construction, completion and production enhancement for global E&Ps.

Financial performance improved sequentially, with operating income rising and free cash flow reaching $875 million in Q4 2025. International revenue growth helped offset weaker North America trends. The company emphasized strong shareholder returns, including an 85% free cash flow payout and $1 billion in buybacks, while highlighting its ability to deliver leading returns and capitalize on future growth opportunities as market conditions evolve.

A Zacks Rank #2 captures recent estimate upward revisions. Balanced B scores on Value and Growth and an A Momentum score fit a cyclical upturn off 2025 lows. On the chart front, shares have turned higher as 2027 EPS lines tick up after flattening in 2025–2026, signaling improved sentiment around international spending and potential upside as North America is expected to respond first when macro fundamentals improve.

See more from Zacks Research for This Ticker

Normally $25 each - click below to receive one report FREE:

Methodology

The Zacks Rank is a proprietary stock-rating model that uses trends in earnings estimate revisions and earnings-per-share (EPS) surprises to classify stocks into five groups: #1 (Strong Buy), #2 (Buy), #3 (Hold), #4 (Sell) and #5 (Strong Sell). The Zacks Rank is calculated through four primary factors related to earnings estimates: analysts' consensus on earnings estimate revisions, the magnitude of revision change, the upside potential and estimate surprise (or the degree in which earnings per share deviated from the previous quarter).

Zacks builds the data from 3,000 analysts at over 150 different brokerage firms. The average yearly gain for Zacks Rank #1 (Strong Buy) stocks is +23.62% per year from January, 1988, through June 2, 2025.

Selections for Best Biotech Stocks are based on the current top ranking stocks based on Zacks Indicator Score, Style Scores and fundamentals. For this list, only companies that have average daily trading volumes of 100,000 shares or more of 95 energy companies listed on the New York Stock Exchange or Nasdaq. All information is current as of market open, Jan. 27, 2026.

General Questions About Energy Stocks

Types of energy stocks

Energy equities are diverse, spanning traditional oil and gas functions to electrification and renewable power. Below are the major categories with representative companies to help you understand where stocks fit in the broader sector.

Integrated producers

These are large energy companies involved in the full value chain—from finding and producing oil and gas (upstream), transporting it (midstream), refining it into fuels (downstream), and often selling it at retail. This breadth can help smooth earnings when one segment underperforms.

Examples:

- Exxon Mobil (XOM): One of the world’s largest integrated oil majors with operations across exploration, refining, petrochemicals and emerging low-carbon solutions.

- Chevron (CVX): Another U.S. supermajor with a globally diversified portfolio of upstream and downstream assets.

- BP plc (BP): UK-based integrated energy company with oil/gas and growing renewable investments.

- Shell plc (SHEL): Major European integrated producer also building out renewables and LNG infrastructure.

Exploration & Production (E&P)

Companies in this group focus chiefly on finding and drilling for crude oil and natural gas. Their earnings often move in step with commodity prices because they sell raw energy products.

Examples:

- ConocoPhillips (COP): A large independent producer with strong positions in U.S. shale and global fields.

- EQT Corporation (EQT): One of the biggest natural gas producers in the U.S., with deep Marcellus Basin exposure.

- Diamondback Energy (FANG): Focused on shale oil production in the Permian Basin.

- Civitas Resources (CIVI), Chord Energy (CHRD), Vista Energy (VIST): Examples of smaller/mid-cap E&Ps with exploration upside.

Midstream Pipelines

Midstream firms own and operate the infrastructure that moves and stores oil, natural gas, and related products. Their earnings tend to come from fee-based contracts rather than commodity prices, offering stability.

Examples:

- Enbridge Inc. (ENB): A Canadian giant operating one of North America’s largest pipeline networks for crude and natural gas.

- Kinder Morgan (KMI): Major U.S. pipeline owner transporting hydrocarbons and refined products.

- Enterprise Products Partners (EPD): One of the largest midstream master limited partnerships (MLPs) with thousands of miles of pipelines.

- MPLX (MPLX): A high-yield midstream MLP spun out of Marathon Petroleum.

- ONEOK (OKE): Midstream operator handling natural gas liquids and pipelines across the U.S.

Refiners

Refining companies take crude oil and transform it into usable products like gasoline, diesel, jet fuel, and petrochemicals. These stocks often do well when refining margins (crack spreads) are wide

Examples:

- Phillips 66 (PSX): A leading U.S. refiner also expanding into midstream infrastructure.

- Valero Energy (VLO): One of the largest independent refiners with global footprint.

- Marathon Petroleum (MPC): Large U.S. refiner with affiliated midstream operations.

Utilities

Utilities generate and deliver electricity or natural gas to consumers and businesses. These firms are typically more regulated and less volatile than pure commodity plays. Many are also transitioning to cleaner energy sources.

Examples:

- NextEra Energy (NEE): Largest U.S. utility with a major renewable generation portfolio.

- Duke Energy (DUK): Large diversified utility serving millions of customers.

- Southern Company (SO): Major southeastern U.S. utility investing in grid modernization and cleaner power.

- Portland General Electric (POR): Regional utility with a growing renewable footprint.

- Constellation Energy (CEG): Nuclear-focused power generator with natural gas and geothermal exposure.

Renewables

These stocks focus on energy generation from sustainable sources like wind, solar, hydro, geothermal, and emerging technologies such as hydrogen and wave power. They may also include service providers in the clean-energy infrastructure space.

Examples:

- Brookfield Renewable Partners (BEP): Operates an extensive portfolio of wind, solar, and hydro assets globally.

- Ormat Technologies (ORA): Specialized in geothermal and solar power projects.

- SolarEdge (SEDG), First Solar (FSLR), Canadian Solar (CSIQ): Growing names in solar generation and component manufacturing.

- Eco Wave Power (WAVE): Early-stage wave energy technology company with high growth potential.

- Quanta Services (PWR): Not a pure renewable but a key player in building and maintaining power grids and clean infrastructure.

Quick takeaway for Energy Stock Investing:

- Traditional energy investors often favor integrated producers and E&Ps for commodity exposure and dividends.

- Income-oriented investors may like midstream pipelines and utilities.

- Growth-focused strategies commonly target renewable energy and infrastructure names.

What are the benefits of buying energy stocks?

- High dividend yields relative to the broader market.

- Strong correlation to inflation and commodity cycles.

- Global demand for oil, natural gas, and power remains durable.

- Capital-return programs (buybacks, dividends) have strengthened in recent years.

What are the risks of buying energy stocks?

- Volatile crude and natural-gas prices.

- Political/regulatory risk.

- High capital requirements.

- Demand destruction during recessions.

- Technological disruption from clean-energy alternatives.

Energy Stocks vs. Energy ETFs

- Stocks offer targeted exposure and potential for outsized gains if you pick winners.

- ETFs provide diversification across subsectors, reducing company-specific risk.

Top Energy ETFs to Invest In

ETFs provide diversified exposure across oil producers, refiners, pipelines, and renewable-energy companies. Popular examples include:

- Energy Select Sector SPDR Fund (XLE) — Tracks major S&P 500 energy giants.

- Vanguard Energy ETF (VDE) — Broader basket of U.S. energy stocks.

- iShares Global Clean Energy ETF (ICLN) — Focused on solar, wind, and green-tech names.

- Alerian MLP ETF (AMLP) — Concentrates on income-heavy pipeline operators.

Investment Strategy & Suitability

Are dividend-paying energy stocks a good investment?

Yes—many investors favor energy companies for their historically strong dividends, supported by robust free-cash-flow generation and capital discipline.

Are energy stocks a good hedge against inflation?

Often. Oil and gas prices typically rise when inflation climbs, and producers can benefit from commodity-linked revenues.

How do energy stocks perform during a recession?

They tend to soften as fuel demand falls, though stable-cash-flow midstream operators and utilities often hold up better.

What energy stocks should I hold long-term?

Integrated majors, high-quality pipelines, regulated utilities, and established renewable developers tend to offer durable long-term returns.

Should I invest in traditional or renewable energy?

A balanced approach works for many investors: traditional companies provide cash stability, while renewables offer long-term growth potential.

How to Select Energy Stocks

When evaluating energy names, consider:

- Balance-sheet strength: Favor companies with low debt, strong cash flow, and solid liquidity to withstand commodity volatility.

- Capital-allocation strategy: Look for disciplined spending, smart investment priorities, and a clear plan for shareholder returns.

- Dividend sustainability: Choose firms with stable cash generation, reasonable payout ratios, and reliable long-term dividend policies.

- Exposure to favorable regions: Companies operating in high-productivity, low-cost areas (e.g., Permian Basin, LNG export hubs) often deliver stronger margins.

- Production cost per barrel: Low-cost producers are more resilient when oil and gas prices fall and typically outperform over time.

- Growth pipeline: Evaluate upcoming projects—such as renewable buildouts, LNG expansions, or refinery upgrades—that support future earnings.

- Historical returns on capital: Consistently strong ROIC signals efficient management and durable value creation.

Energy Stock Trends and Market Factors

How are energy stocks affected by oil prices?

Oil prices remain the most influential variable. Producers benefit from rising crude, while refiners perform best when input costs are low and demand is strong.

What’s the forecast for the energy sector?

Analysts expect continued capital discipline, stable dividends, and a multi-year growth cycle in LNG exports. Renewables should gain momentum as financing conditions improve and global clean-energy spending rises.

How do rising interest rates impact energy stocks?

Higher rates increase borrowing costs, which can slow renewable-energy development. For oil producers, the impact is milder due to strong cash positions.

What are analysts saying about the energy market?

Most major research firms see a balanced oil market, steady global demand growth, and favorable long-term trends for both LNG and low-carbon technologies. Volatility may remain elevated, but the sector’s valuation and cash-return profile remain attractive relative to the S&P 500.