Prudential Financial (PRU)

(Delayed Data from NYSE)

$110.50 USD

-0.68 (-0.61%)

Updated Apr 26, 2024 04:00 PM ET

After-Market: $110.52 +0.02 (0.02%) 7:58 PM ET

3-Hold of 5 3

A Value F Growth F Momentum D VGM

Company Summary

Headquartered in Newark, NJ, Prudential Financial Inc. was founded in 1875. Through its subsidiaries and affiliates, this a financial services leader offers an array of financial products and services including life insurance, annuities, retirement-related services, mutual funds, investment management and real estate services. These are offered to individual and institutional customers across United States, Asia, Europe and Latin America.

Prudential’s principal operations are comprised of four divisions, which together encompass seven segments, and Corporate and Other operations.

U.S. Businesses (62% of 2023 Revenues) provides a wide array of of products and solutions ...

Company Summary

Headquartered in Newark, NJ, Prudential Financial Inc. was founded in 1875. Through its subsidiaries and affiliates, this a financial services leader offers an array of financial products and services including life insurance, annuities, retirement-related services, mutual funds, investment management and real estate services. These are offered to individual and institutional customers across United States, Asia, Europe and Latin America.

Prudential’s principal operations are comprised of four divisions, which together encompass seven segments, and Corporate and Other operations.

U.S. Businesses (62% of 2023 Revenues) provides a wide array of of products and solutions that cater to protection, retirement, savings, income and investment needs. It comprises U.S. Workplace Solutions, U.S. Individual Solutions, and Assurance IQ divisions. Through the U.S. Workplace Solutions division, Prudential extends retirement investment and income products and services along with a full range of group life, long-term and short-term group disability, and group corporate-, bank- and trust-owned life insurance in the United States. While the U.S. Individual Solutions division devises and distributes individual variable and fixed annuity products as well as term life, variable life and universal life insurance products, the Assurance IQ division utilizes data science and technology to distribute third-party products.

International Businesses (32.2%) consists of International Insurance segment, and the Closed Block division consists of Closed Block segment. International Insurance develops and distributes life insurance, retirement products and certain accident and health products with fixed benefits.

PGIM (5.8%) provides investment management services related to public and private fixed income, public equity and real estate, commercial mortgage origination and servicing, and mutual funds and other retail services.

Corporate and Other operations include corporate items and initiatives that are not allocated to business segments and businesses that have been or will be divested or placed in run-off.

General Information

Prudential Financial, Inc

751 BROAD ST

NEWARK, NJ 07102

Phone: 973-802-6000

Fax: 973-802-7277

Web: http://www.prudential.com

Email: investor.relations@prudential.com

| Industry | Insurance - Multi line |

| Sector | Finance |

| Fiscal Year End | December |

| Last Reported Quarter | 3/31/2024 |

| Earnings Date | 4/30/2024 |

EPS Information

| Current Quarter EPS Consensus Estimate | 3.16 |

| Current Year EPS Consensus Estimate | 13.38 |

| Estimated Long-Term EPS Growth Rate | 11.00 |

| Earnings Date | 4/30/2024 |

Price and Volume Information

| Zacks Rank | |

| Yesterday's Close | 111.18 |

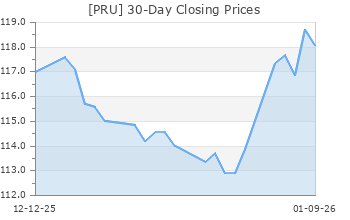

| 52 Week High | 118.69 |

| 52 Week Low | 77.22 |

| Beta | 1.37 |

| 20 Day Moving Average | 1,226,729.50 |

| Target Price Consensus | 113.25 |

| 4 Week | -5.30 |

| 12 Week | 8.27 |

| YTD | 7.20 |

| 4 Week | -1.44 |

| 12 Week | 5.22 |

| YTD | 1.29 |

| Shares Outstanding (millions) | 359.00 |

| Market Capitalization (millions) | 39,913.62 |

| Short Ratio | NA |

| Last Split Date | NA |

| Dividend Yield | 4.68% |

| Annual Dividend | $5.20 |

| Payout Ratio | 0.43 |

| Change in Payout Ratio | 0.03 |

| Last Dividend Payout / Amount | 2/16/2024 / $1.30 |

Fundamental Ratios

| P/E (F1) | 8.31 |

| Trailing 12 Months | 9.57 |

| PEG Ratio | 0.75 |

| vs. Previous Year | 6.61% |

| vs. Previous Quarter | -25.00% |

| vs. Previous Year | 2.93% |

| vs. Previous Quarter | 28.58% |

| Price/Book | 1.37 |

| Price/Cash Flow | 9.14 |

| Price / Sales | 0.78 |

| 3/31/24 | NA |

| 12/31/23 | 14.52 |

| 9/30/23 | 14.12 |

| 3/31/24 | NA |

| 12/31/23 | 0.61 |

| 9/30/23 | 0.61 |

| 3/31/24 | NA |

| 12/31/23 | 0.13 |

| 9/30/23 | 0.07 |

| 3/31/24 | NA |

| 12/31/23 | 0.13 |

| 9/30/23 | 0.07 |

| 3/31/24 | NA |

| 12/31/23 | 8.42 |

| 9/30/23 | 8.41 |

| 3/31/24 | NA |

| 12/31/23 | 4.89 |

| 9/30/23 | 1.21 |

| 3/31/24 | NA |

| 12/31/23 | 5.69 |

| 9/30/23 | 2.71 |

| 3/31/24 | NA |

| 12/31/23 | 81.06 |

| 9/30/23 | 74.23 |

| 3/31/24 | NA |

| 12/31/23 | NA |

| 9/30/23 | NA |

| 3/31/24 | NA |

| 12/31/23 | 0.65 |

| 9/30/23 | 0.70 |

| 3/31/24 | NA |

| 12/31/23 | 39.87 |

| 9/30/23 | 41.19 |